Adjusting an Options Position - The TLT Edition

In this article on 6/28, I wrote about a contrarian (at the time) bullish play using options on ticker TLT. In this piece, I want to discuss "adjusting" an open options position.

Once you buy a stock or ETF, you have three basic choices - hold it, sell some of it, or sell all of it. With options, there is any number of ways to modify, or adjust, an existing position.

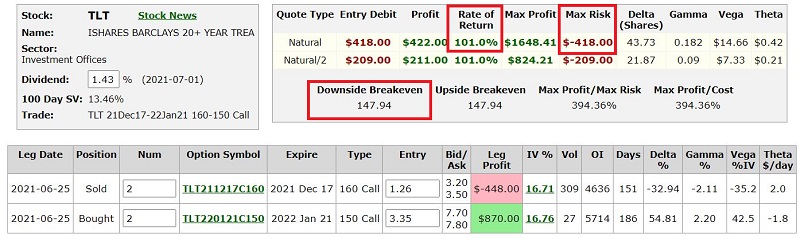

ORIGINAL CALENDAR SPREAD EXAMPLE

The original TLT example trade involved a strategy known as a "diagonal call calendar spread." This strategy involves:

- Buying a longer-term call option with a lower strike price

- Selling a shorter-term call option with a higher strike price

The particulars of the original example trade appear in Figures 1 and 2 below (all figures below are courtesy of http://www.Optionsanalysis.com).

The purpose of this calendar spread trade was to:

- Gain bullish exposure to the long-term treasury market

- Commit and risk a great deal less capital ($418) versus buying 100 shares of TLT ($14,201)

- Allow time decay to work in our favor (by selling a shorter-term option)

- Possibly benefit from an increase in option implied volatility

Since 6/25 ticker (as this is written), TLT has rallied from $142.01 a share to $151.61, a gain of 6.8%. At the same time, the calendar spread has gained +$422, or +101% on capital invested.

So, let's assume that a trader now has a desire to:

- Lock in some profit

- Reduce and/or eliminate the risk of loss

- Still hold the potential for more gains

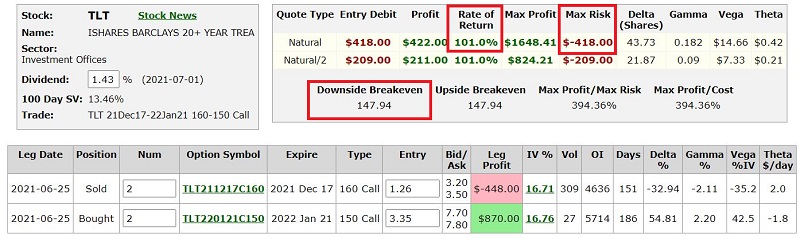

ONE EXAMPLE ADJUSTMENT

When the original trade was entered, we traded a 2-lot - buying 2 of the Jan2022 150 calls and selling 2 of the Dec2021 160 calls. Now let's see what happens if we exit half of our position. To do this, we simply:

- Sell 1 Jan2022 150 call @ 7.75

- Buy 1 Dec2021 160 call @ $3.35

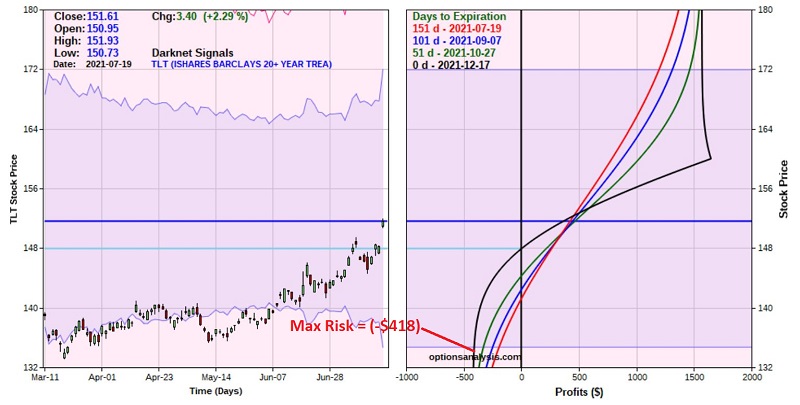

The resulting position appears in the screenshots below.

If TLT declines from here:

- This trade now has a locked-in profit (even if TLT falls apart, the worst-case now is a gain off +$22) regardless of how far TLT might fall

- On the downside, time decay won't materially affect the P/L until at least after the first week of September

If TLT rises from here:

- The trade still enjoys roughly another $600 in additional profit potential

- About the current price, time decay will work in our favor (note in the risk curve chart above how the blue, green, and black lines show successively higher profitability. This is because the December 160 call that we are short will lose its time premium much more quickly than the January 150 call that we are long)

- On the negative side, for eliminating the risk of loss, we also give up about $600 of profit potential versus the original position

IMPORTANT: Choosing when to prioritize risk reduction versus profit maximization is entirely up to the individual trader. This example adjustment is not telling you what you SHOULD do, only what you CAN do in this given instance IF you decide to take advantage of the pop-up in the price of TLT to reduce (or, in this case, eliminate the risk of loss).