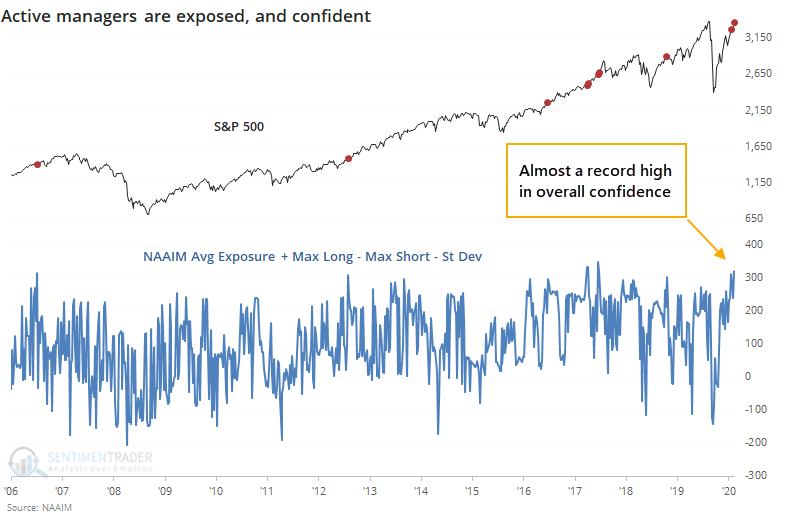

Active managers have rarely been so confident about stocks

One indicator getting some attention in recent days is the NAAIM survey of active investment managers. We've been following this since I consulted with former NAAIM president Will Hepburn on its construction back in 2008. It can be a useful indicator to follow, though like most surveys, it tends to be most useful from a contrarian point of view when managers quickly panic.

The most recent week shows not only a high average exposure to stocks, but also maximum exposure of 200%, the least bullish manager is 50% exposed, and there is a massive amount of group-think with a low standard deviation among responses. Taken all together, these managers are among the most confident they've ever been.

The problem with assuming that this is a contrary indicator is that it doesn't work. When these trend-following managers have become supremely confident, the S&P has tended to keep going.

But...it has paid to become a bit more defensive on some of the higher-beta stocks after these jumps in optimism when looking at the ratio of the highest-beta stocks in the S&P 500 to the index itself.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A more in-depth look at the current market environment

- Tables showing all instances when NAAIM managers were this confident, and what happened afterward