Absolute & Relative Trend Update

The goal of today's note is to provide you with some insight into what I am seeing with my absolute and relative trend following indicators for domestic and international ETFs.

Data as of 5/28/21 close. All relative comparisons are versus the S&P 500 ETF (SPY). For absolute and relative indicator definitions, please scroll down to the end of the note.

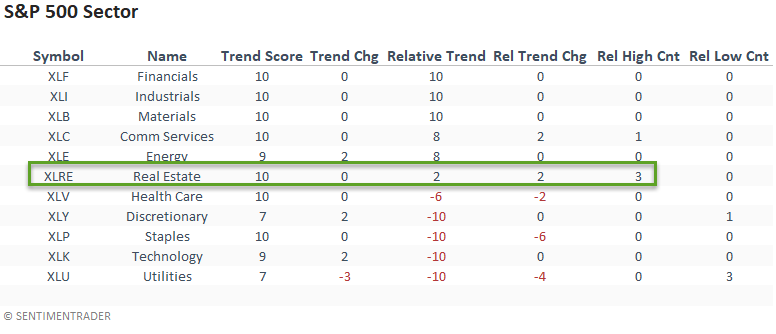

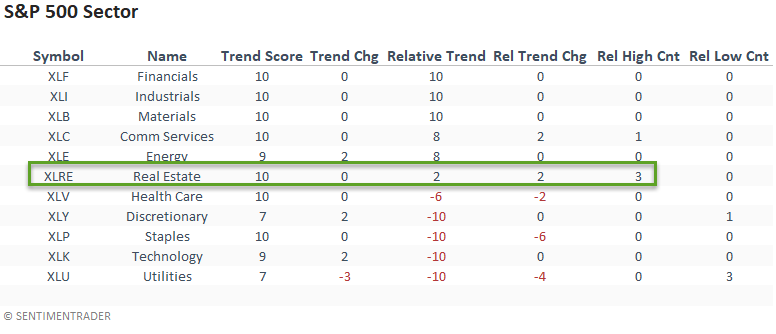

ABSOLUTE & RELATIVE TRENDS - SECTOR ETFS

The market continues to favor a value/cyclical tilt. After a modest increase last week, the relative trend scores for defensive sectors deteriorated, with utilities registering a relative low on 3/5 days. Technology and consumer discretionary remain weak. Interestingly, real estate recorded a new relative high on 3/5 days. In a note last week, Jay highlighted real estate as a sector that performs well in June.

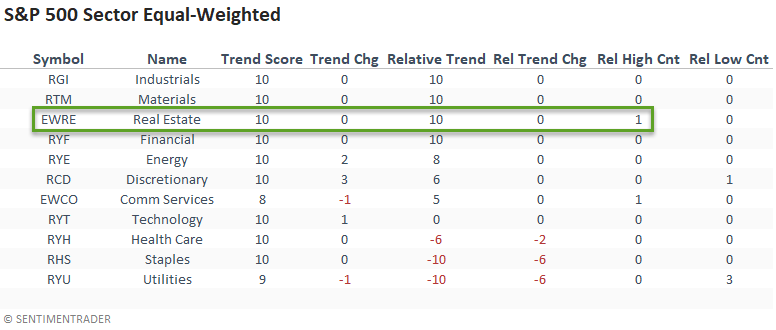

The equal-weighted sectors confirm the cap-weighted data with solid absolute and relative trend scores from the value/cyclical sectors and weak defensive groups. I would also note that the equal-weighted real estate sector looks better than the cap-weighted version.

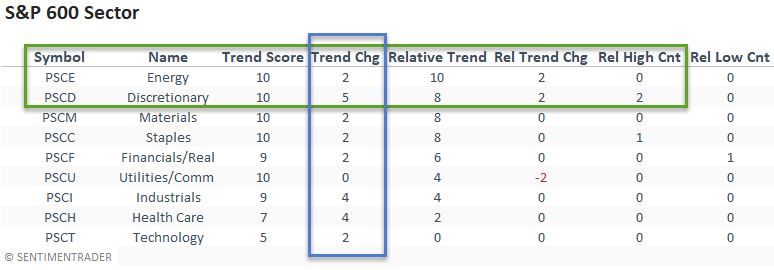

The decline in absolute trend scores highlighted in the previous week reversed course, with several sectors showing improvement. Energy and consumer discretionary look solid, which is not a surprise as they tend to perform well in year two after a bear market.

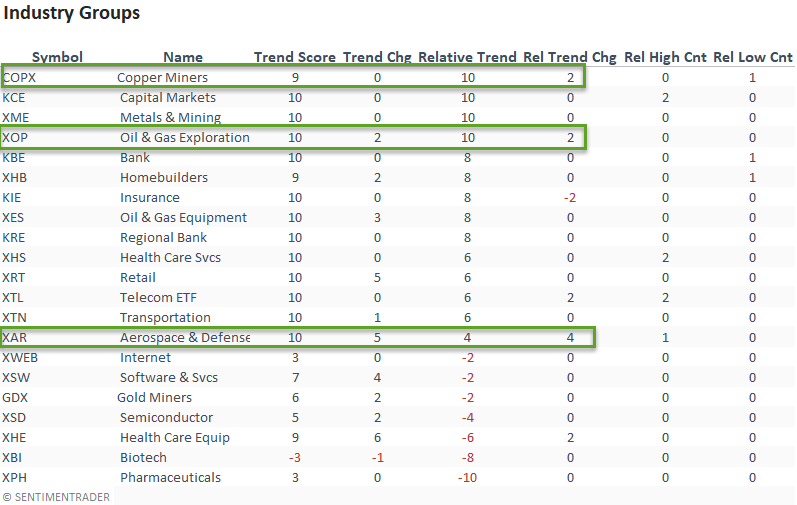

ABSOLUTE & RELATIVE TRENDS - INDUSTRIES

Industry trends continue to favor value/cyclical groups. Copper miners and oil & gas exploration had a solid week. Aerospace and defense stocks are worth mentioning as the absolute and relative trend scores had the best w/w increase.

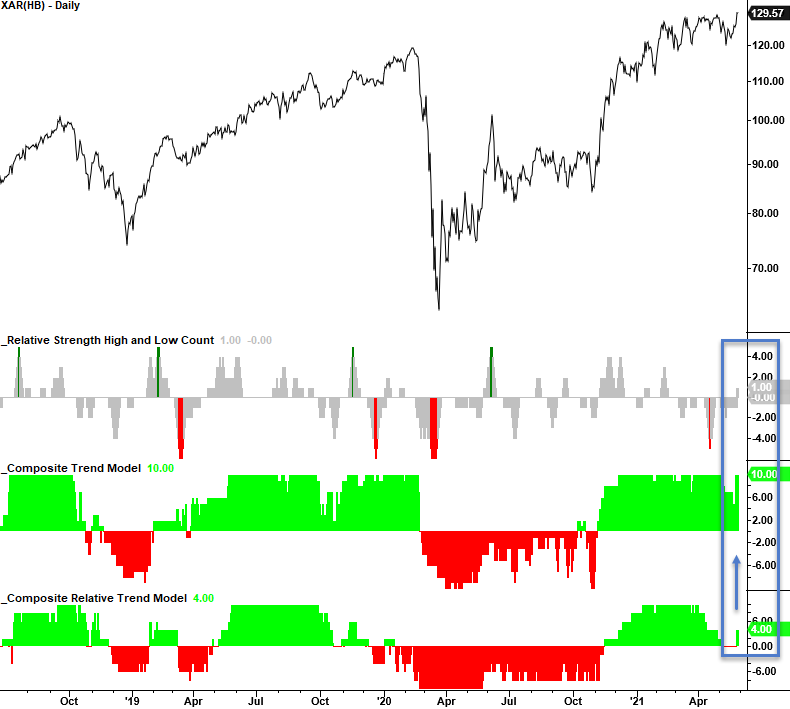

CHART IN FOCUS - AEROSPACE & DEFENSE

I'm highlighting the Aerospace and Defense ETF this week because I like the setup. After a multi-month consolidation, the ETF broke out last week and registered a new absolute and relative high with a jump in both trend scores.

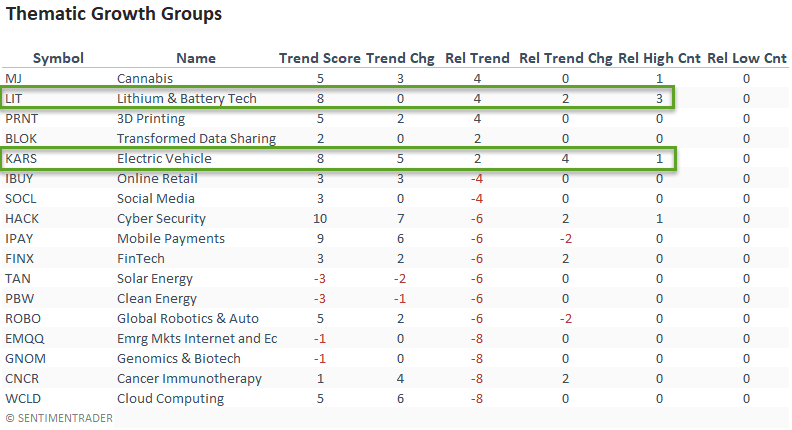

ABSOLUTE & RELATIVE TRENDS - THEMATIC ETFS

The Lithium & Battery Technology ETF broke out from a multi-month consolidation and registered a new relative high on 3/5 days last week. I would also note the improvement in the electric vehicle ETF.

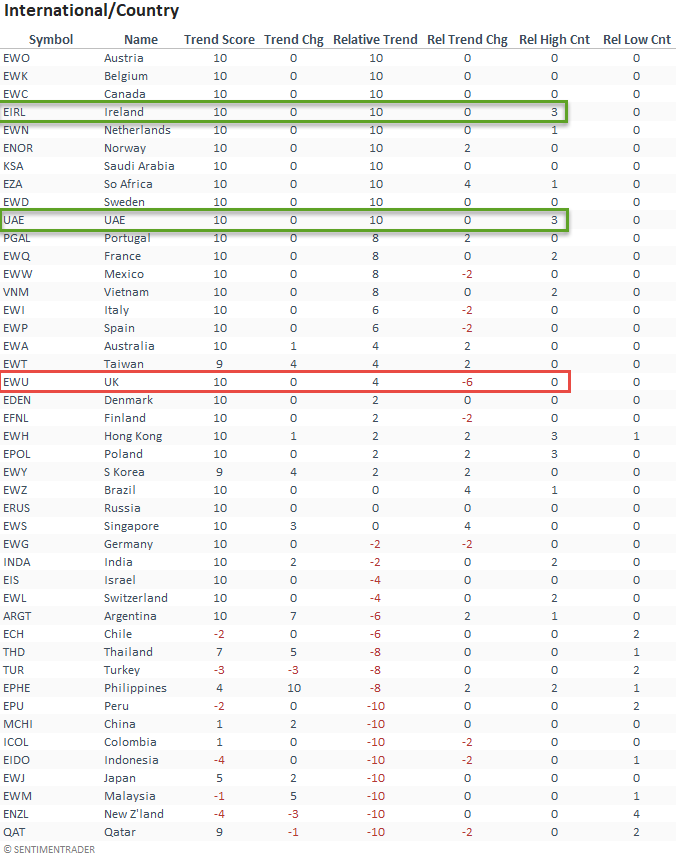

ABSOLUTE & RELATIVE TRENDS - COUNTRIES

Ireland and the United Arab Emirates look solid, with the respective ETFs registering a new relative high on 3/5 days. The relative trend score for the United Kingdom had a significant contraction after the improvement in the prior week.

CHART IN FOCUS - EMERGING MARKET RELATIVE TRENDS

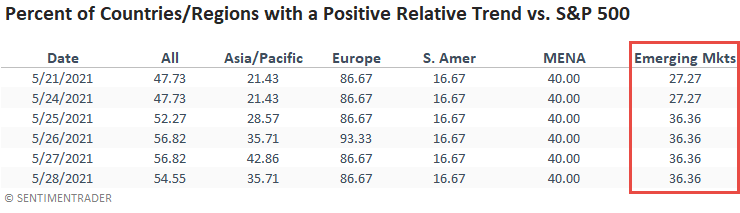

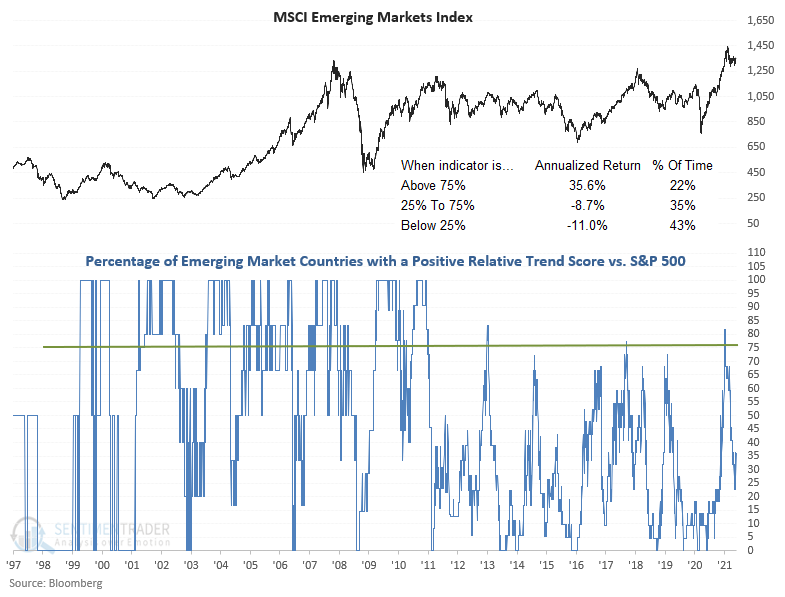

Emerging markets continue to perform poorly on a relative basis when compared to the S&P 500. As the table below shows, only 36% of the EM Countries are outperforming the S&P, a level that is unattractive for a broad-based allocation.

ABSOLUTE AND RELATIVE TREND COLUMN DEFINITIONS

- Absolute Trend Count Score - The absolute trend model contains ten indicators to assess absolute trends across several durations.

- Absolute Trend 5-Day Change - This indicator measures the 5-day net change in the absolute trend model.

- Relative Trend Count Score - The relative trend model contains ten indicators to assess relative trends vs. the S&P across durations.

- Relative Trend 5-Day Change - This indicator measures the 5-day net change in the relative trend model.

- Relative High Count - This indicator measures the number of 21-day relative highs vs. the S&P 500 in the last 5 days.

- Relative Low Count - This indicator measures the number of 21-day relative lows vs. the S&P 500 in the last 5 days.

- Absolute and Relative Trend Scores range from 10 (Best) to -10 (Worst)