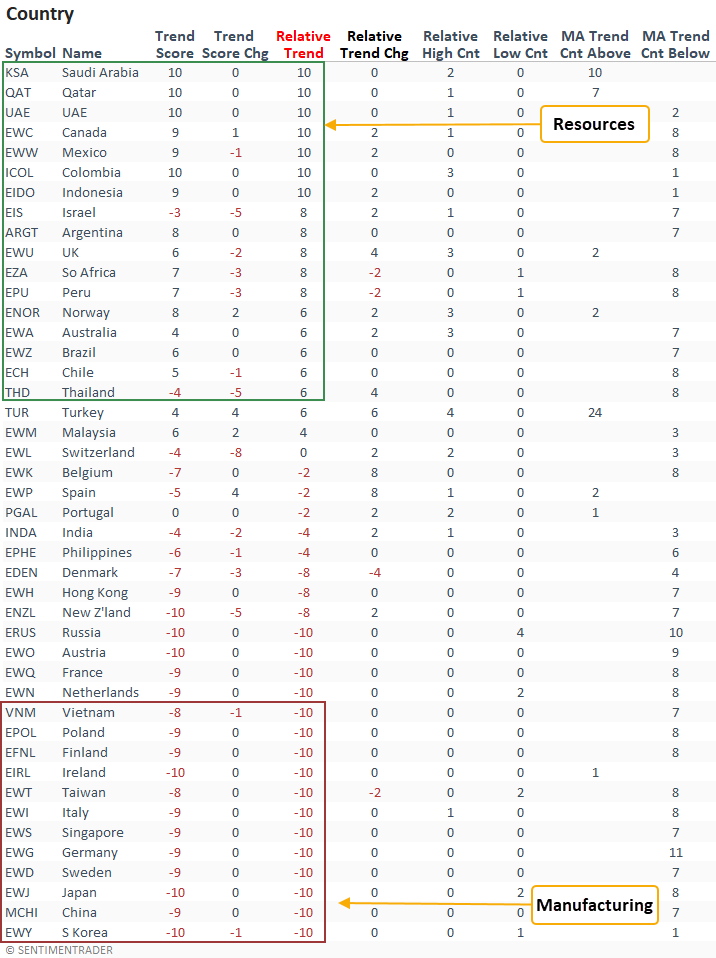

Absolute and relative trends continue to favor resource-based stocks

Key points:

- Natural resource-based countries show positive absolute and relative trends

- At the same time, the manufacturing-based Asia-Pacific region looks unfavorable

- A basket of commodities maintains a bullish intermediate-term trend backdrop

- Domestic industry trends confirm the bullish global market message for natural resource stocks

Natural resource-based countries dominate manufacturing-based countries

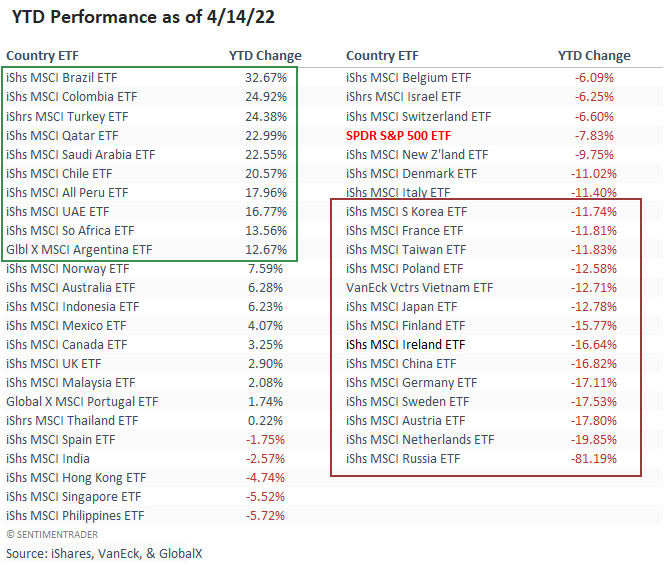

Suppose I sort the Country table by the relative trend score change column. In that case, it shows a significant number of global ETFs with a high natural resource stock weighting with positive relative trend scores versus the S&P 500. South American and Middle Eastern countries dominate the bullish trend rankings. In contrast, the global ETFs with negative relative trend scores show a bias toward countries with a significant manufacturing/export presence, especially in the Asia-Pacific region. China, Japan, and South Korea are a few noteworthy ones that look unfavorable.

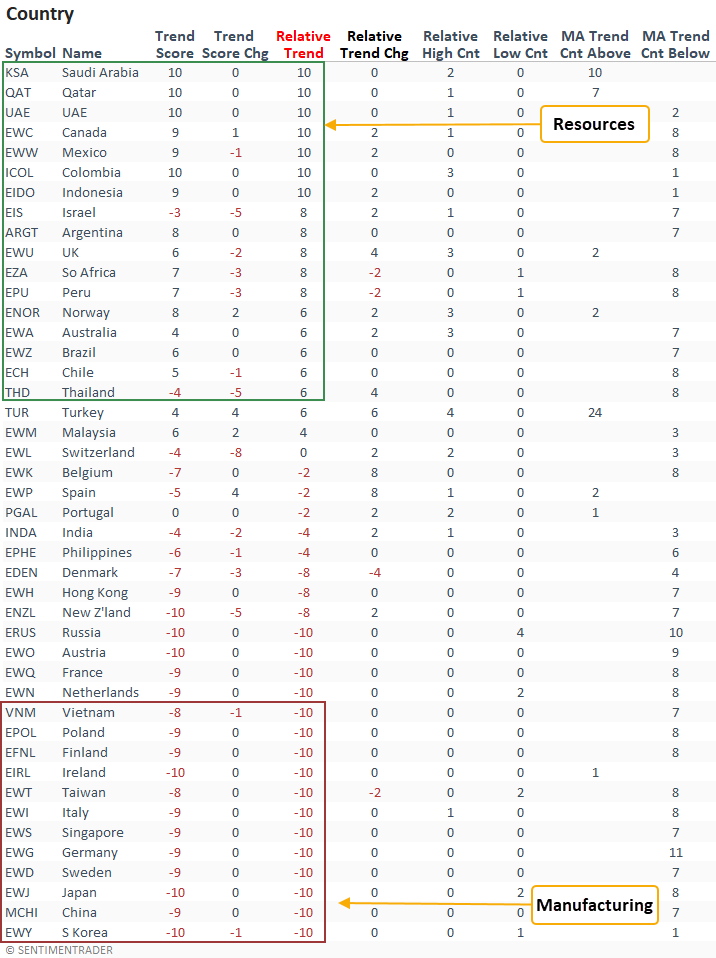

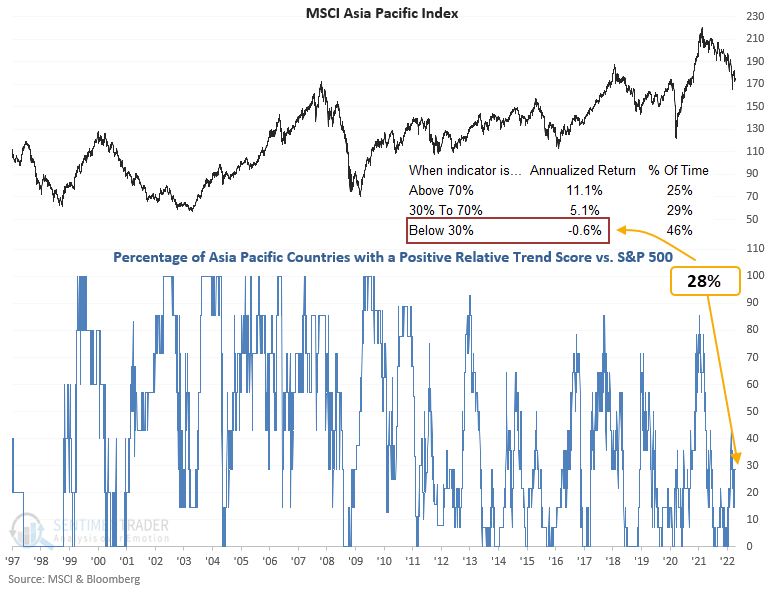

A natural resource-heavy region looks favorable

For the first time in more than a year, Latin American countries with a positive relative trend score versus the S&P 500 increased to 100%. When 80% or more of the ETFs show a positive relative trend score, annualized returns look better.

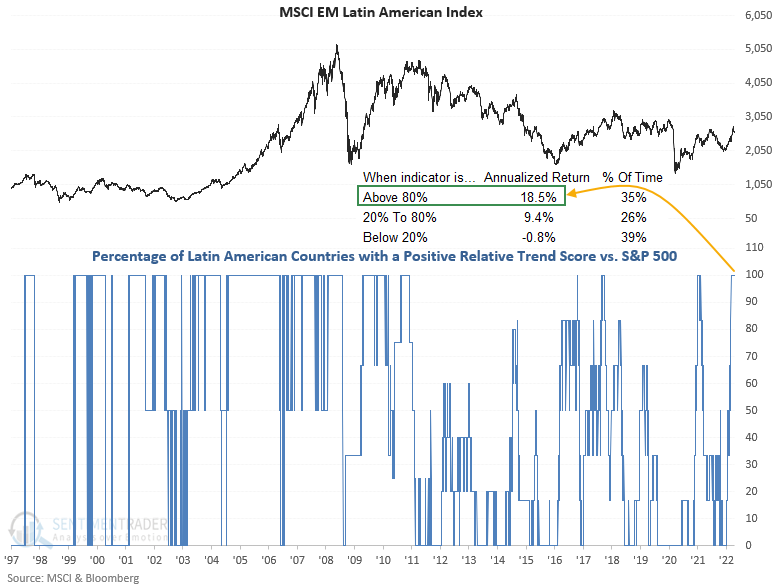

A manufacturing-heavy region looks unfavorable

When I assess the relative trend scores for Asia-Pacific countries, it shows an unfavorable level of ETFs in the manufacturing-heavy region with a positive relative trend score.

YTD performance shows the same trend - resources over manufacturing

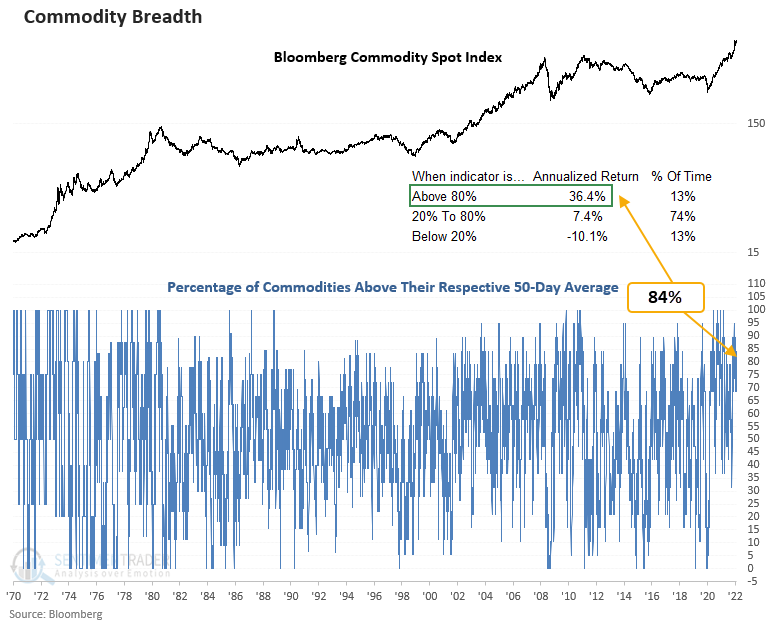

What do commodities suggest about the outlook for natural resource-based countries

When I assess intermediate-term trends for a basket of commodities, it shows 84% of components trading above their 50-day average, suggesting strong annualized returns for a commodity index. So, with commodities in a favorable position, we could expect natural resources-based country ETFs to continue to outperform.

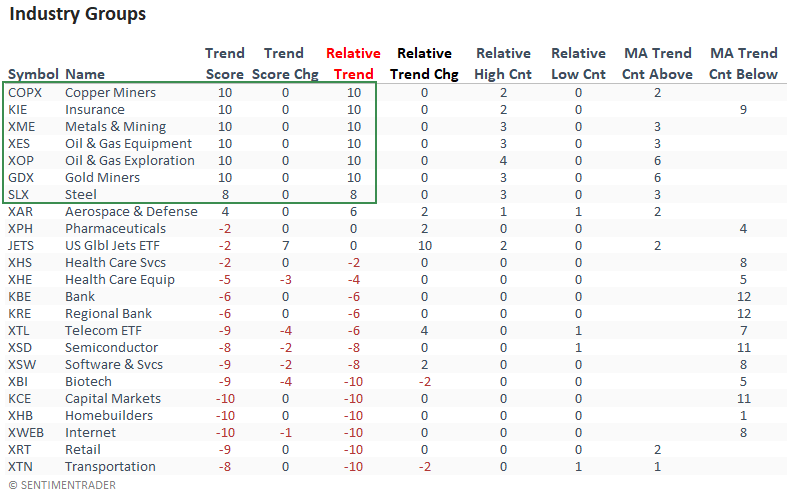

Domestic industries confirm the global trends for natural-resource based stocks

What the research tells us...

Country ETFs exhibiting the strongest absolute and relative trends maintain heavier weightings toward natural resource-based stocks. While natural resource countries look favorable, we can't say the same for the manufacturing-heavy Asia-Pacific region. When I review trends for commodities or domestic industries, the message is the same. Stay the course with natural resource stocks.