Absolute and Relative Trend Update

The goal of today's note is to provide you with some insight into what I am seeing with my absolute and relative trend following indicators for domestic and international ETFs.

Data as of 10/8/21 close. All relative comparisons are versus the S&P 500 ETF (SPY). For absolute and relative indicator definitions, please scroll down to the end of the note.

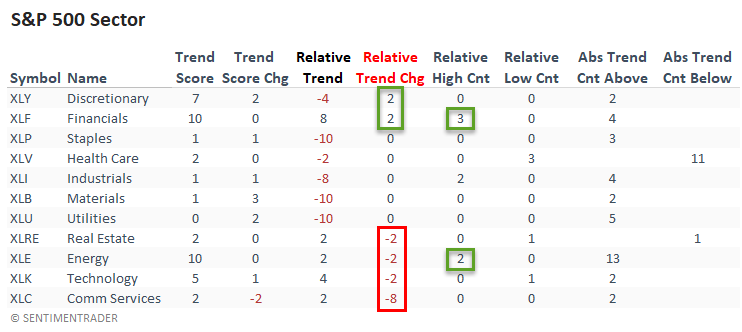

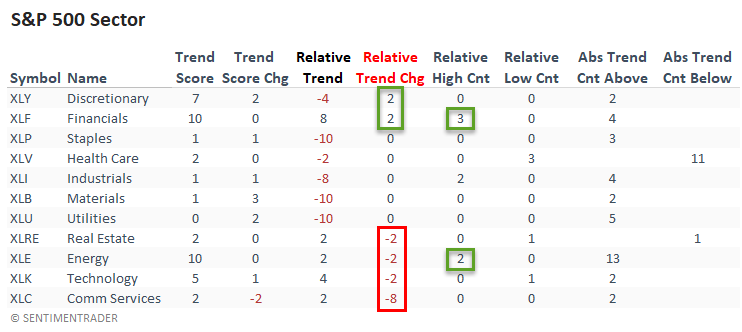

ABSOLUTE & RELATIVE TRENDS - SECTOR ETFS

The financials maintain the best absolute and relative trend score combination of any group. And, I would note that the sector registered new relative highs on 3/5 days last week.

While the relative trend score for energy declined slightly, the absolute score remains strong at a ten. The group registered multiple relative highs on the week.

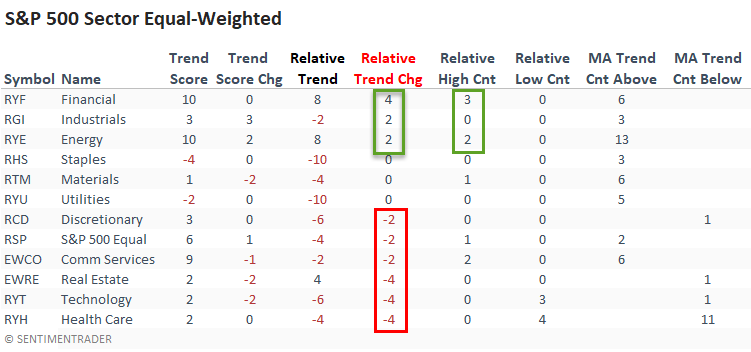

The equal-weighted sector data shows a clear distinction between cyclical/value groups and growth-oriented ones. Financials, Industrials, and energy improved, while technology and health care deteriorated.

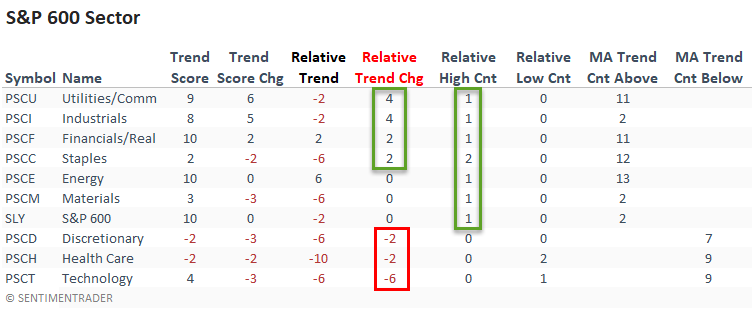

Small-cap stocks improved and showed similar trends to the equal-weighted large-cap data with better value/cyclical group results.

I would monitor small-cap stocks closely as the economically sensitive group could provide a spark for a fourth-quarter rally.

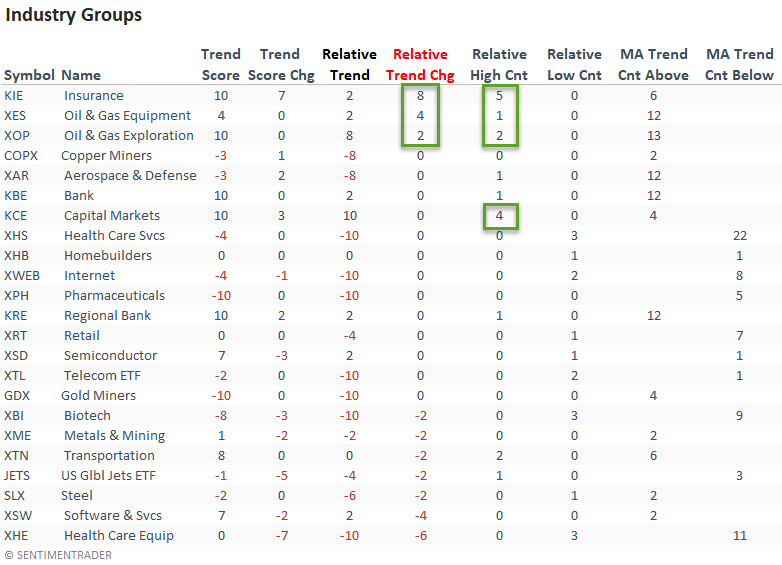

ABSOLUTE & RELATIVE TRENDS - INDUSTRIES

Suppose you sort the industry table according to the relative trend change. In that case, we see the improvement within the financial sector came from the insurance and capital markets industries and not from banks. I would also note that insurance and capital markets registered several new relative highs.

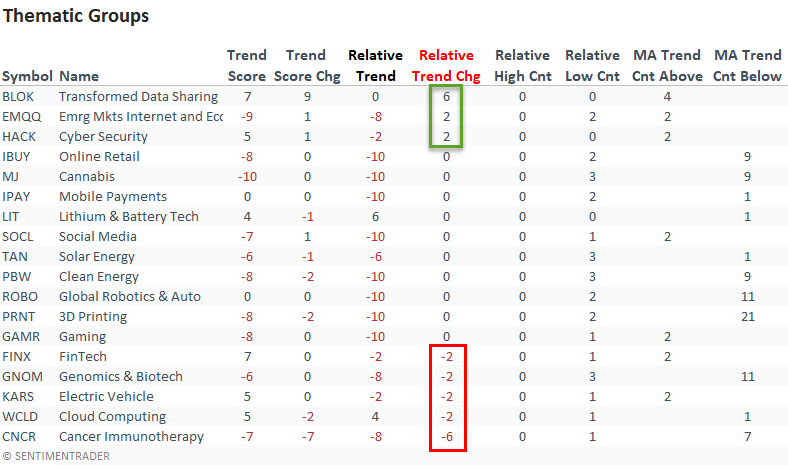

ABSOLUTE & RELATIVE TRENDS - THEMATIC ETFS

Suppose you sort the thematic ETF table according to the relative trend change column. In that case, we see more groups with a deterioration in their respective trend score versus an improvement. And, the table shows that several ETFs registered new relative lows on the week without a single relative high.

The BLOK ETF showed a noticeable increase in its absolute and relative trend score on the back of a big jump in Bitcoin.

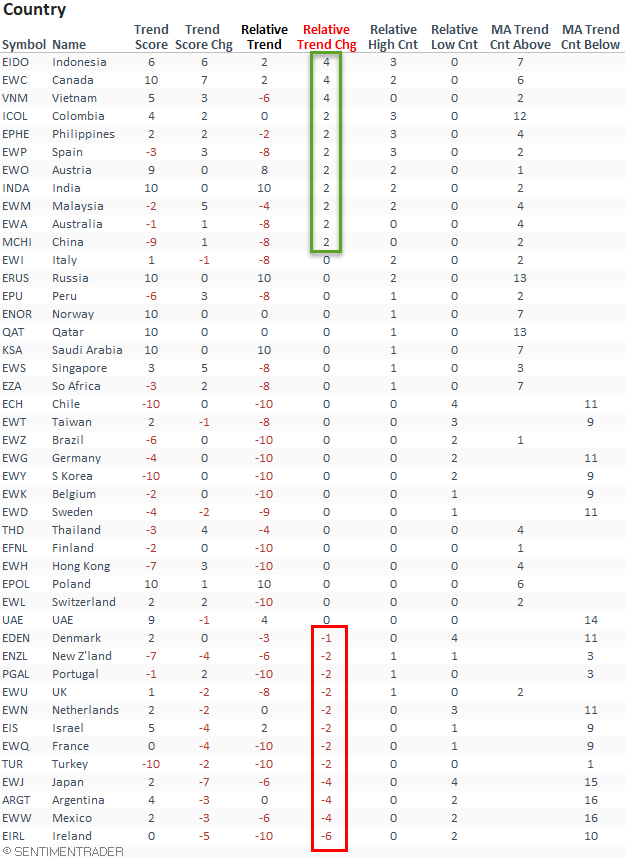

ABSOLUTE & RELATIVE TRENDS - COUNTRIES

Suppose I sort the Country table by the relative trend score change column. In that case, it shows the improvement in some of the Asia Pacific countries like Indonesia, Vietnam, Malaysia, Australia, and China.

I would note that India returned to a perfect relative trend score of 10 for the first time since March.

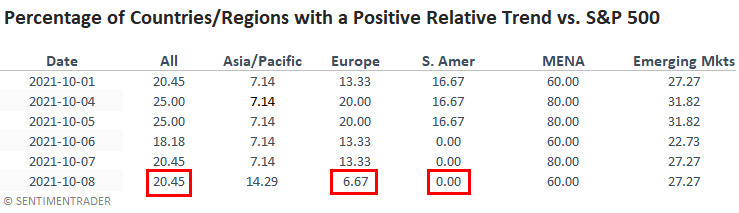

GLOBAL RELATIVE TRENDS

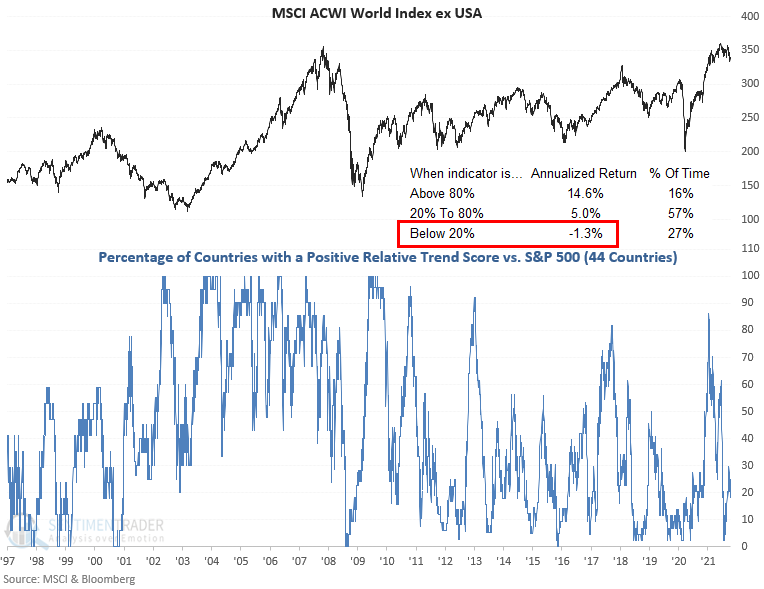

The percentage of countries with a positive relative trend score versus the S&P 500 held steady on a w/w basis. Europe and South America deteriorated while the Asia Pacific region improved. The current level continues to suggest an unfavorable environment for the MSCI ACWI World Index ex USA.

ALL COUNTRY RELATIVE TREND CHART

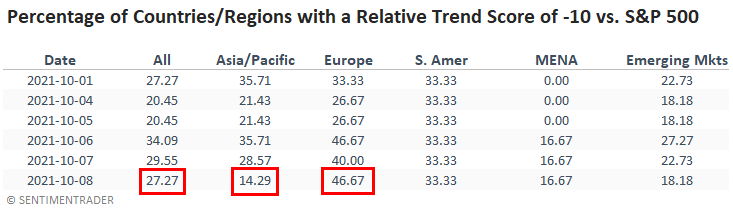

The percentage of countries with a relative trend score of -10 versus the S&P 500 was unchanged on a w/w basis. The Asia Pacific region improved while Europe deteriorated.

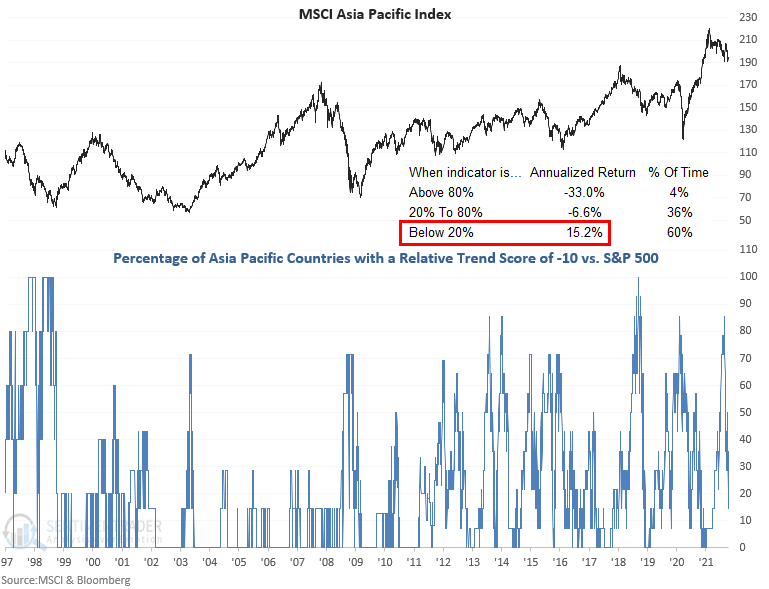

The percentage of countries in the Asia Pacific region with a relative trend score of -10 decreased on a w/w basis and now resides at the lowest level since April. I think this is a must-watch indicator on a go-forward basis as the supply chain and shipping bottlenecks are impacting the region.

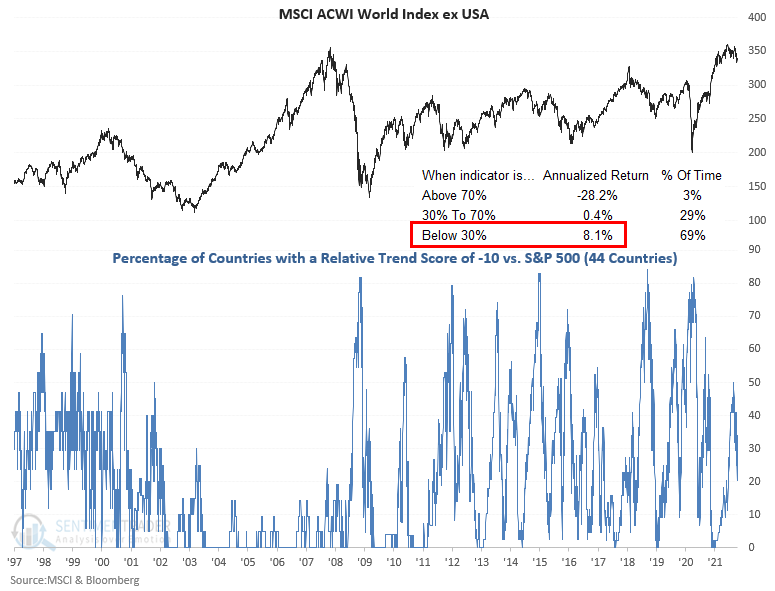

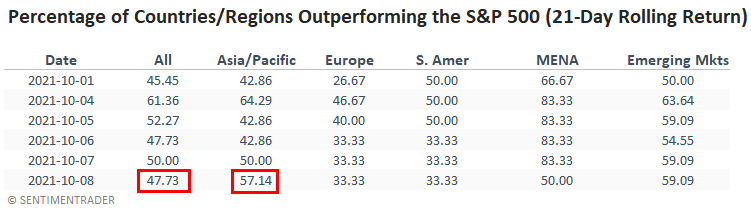

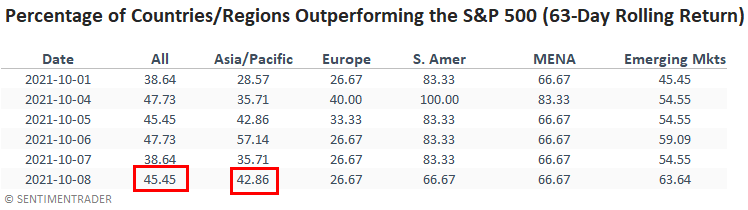

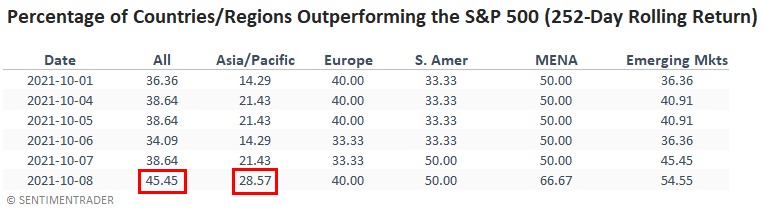

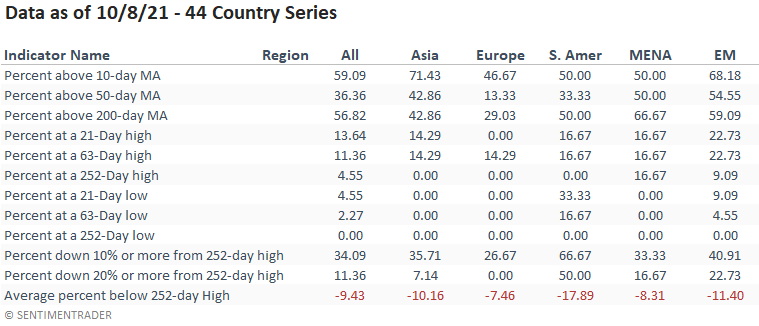

In a note on 7/7/21, I shared a study that assessed the forward return outlook for stocks when the percentage of countries outperforming the S&P 500 on a rolling 21-day basis falls to a low level. I've included a snapshot of the indicator from the original study and two additional tables with different rolling periods.

GLOBAL BREADTH

ABSOLUTE AND RELATIVE TREND COLUMN DEFINITIONS

- Absolute Trend Count Score - The absolute trend model contains ten indicators to assess absolute trends across several durations.

- Absolute Trend 5-Day Change - This indicator measures the 5-day net change in the absolute trend model.

- Relative Trend Count Score - The relative trend model contains ten indicators to assess relative trends vs. the S&P across durations.

- Relative Trend 5-Day Change - This indicator measures the 5-day net change in the relative trend model.

- Relative High Count - This indicator measures the number of 21-day relative highs vs. the S&P 500 in the last 5 days.

- Relative Low Count - This indicator measures the number of 21-day relative lows vs. the S&P 500 in the last 5 days.

- Absolute and Relative Trend Scores range from 10 (Best) to -10 (Worst)

- MA Trend Cnt Above - This indicator counts the number of consecutive days above the 10-day moving average.

- MA Trend Cnt Below - This indicator counts the number of consecutive days below the 10-day moving average.

Please click here for a note with details on the construction of the composite trend model.