AAII survey is a case study in saying vs doing

Investors are saying one thing, and doing another. What to believe?

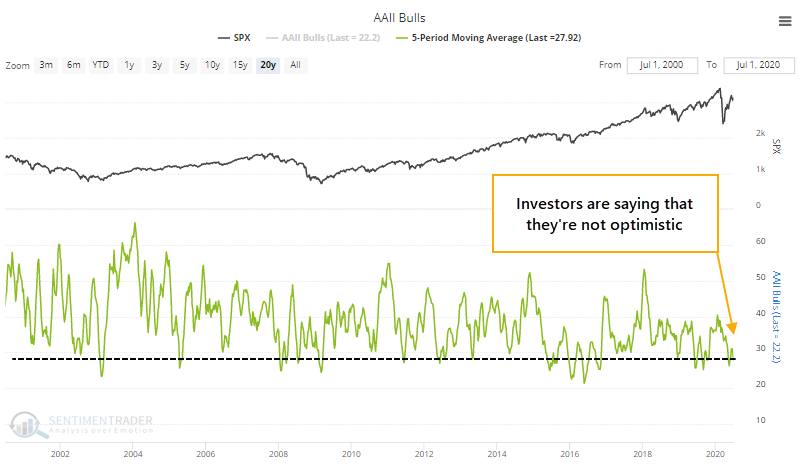

The latest survey from AAII showed that investors are still apathetic about this rally. Or at least, that's what they're saying. The 5-week average of bullish respondents is among the lowest in 20 years.

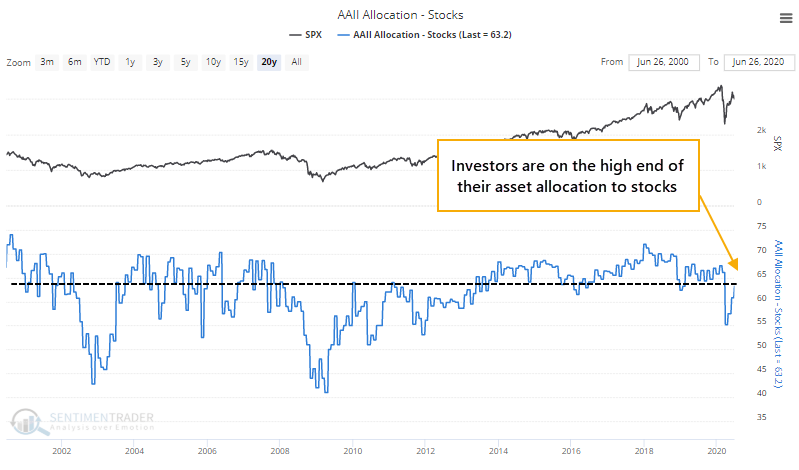

And yet, many of these same investors have increased their allocation to stocks. At 63% of their portfolios, stocks are on the high end of allocations over the past 20 years.

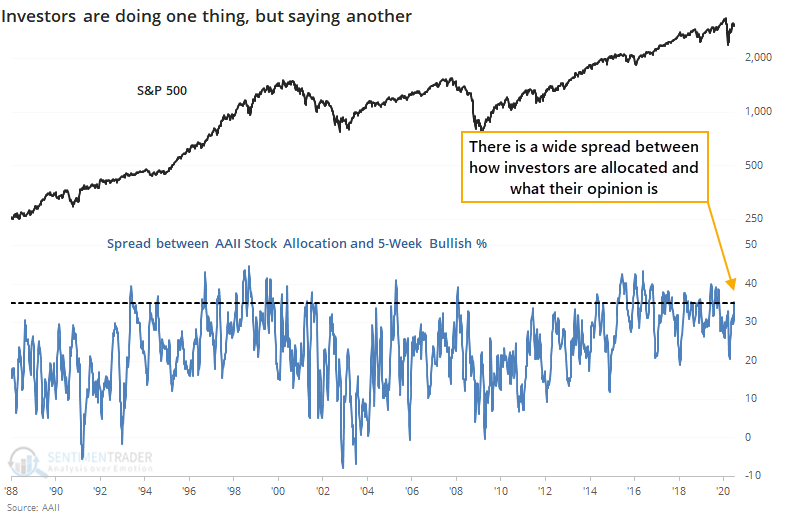

That divergence between saying vs doing has led to one of the widest spreads in the survey's history.

We pay more attention to real-money gauges than we do surveys, though the latter do have their uses. This is one of those cases where the survey was a better contrary guide than was the actual allocation.

Below, we can see every time in more than 30 years when investors in the AAII poll were at least 35% more allocated to stocks than they said they were. Theoretically, this should be a negative for future returns, but there was no evidence of that.

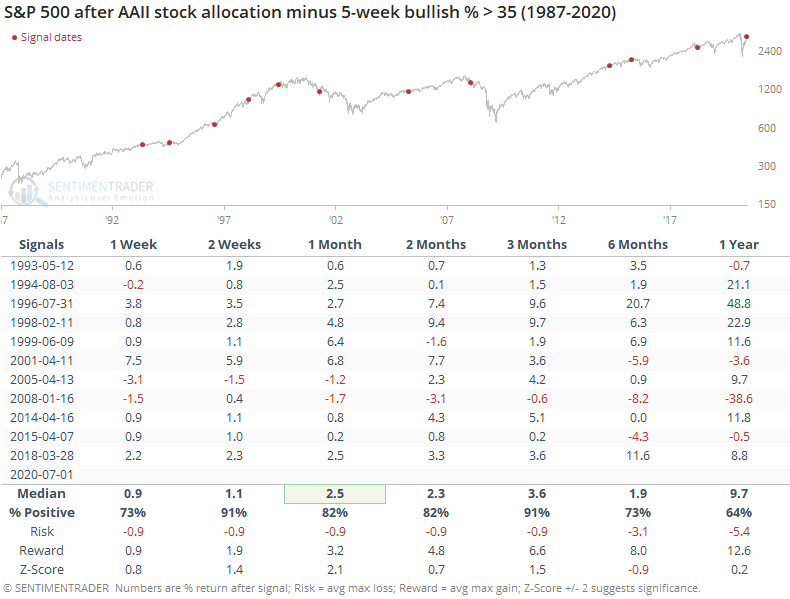

Over the next 1-3 months, it was hard to find a negative return, and impossible to find a big loss. When investors were much more invested than they said they were, apparently they found the money somewhere, because stocks kept rallying.

It's not like these were buy-and-forget signals, though. Stocks ran into trouble soon enough in 1998, 2000, 2002, 2008, and 2015.

Investors' allocation to stocks is not yet high enough to be a big worry, and their opinion is low enough that it has historically been a modest positive, so net-net this particular survey looks to be more of a tailwind for stocks.