AAII aye aye

Yesterday, Dean showed that a drop in optimism among newsletter writers is a good thing. Except when it occurs near a high. And especially when sentiment is still elevated. Then it's not a good thing.

Context is important, and markets don't accommodate knee-jerk contrarianism very well, which is why we test things. The overall idea is that bull markets need increasing optimism to survive. The whole "wall of worry" cliche is complete bunk.

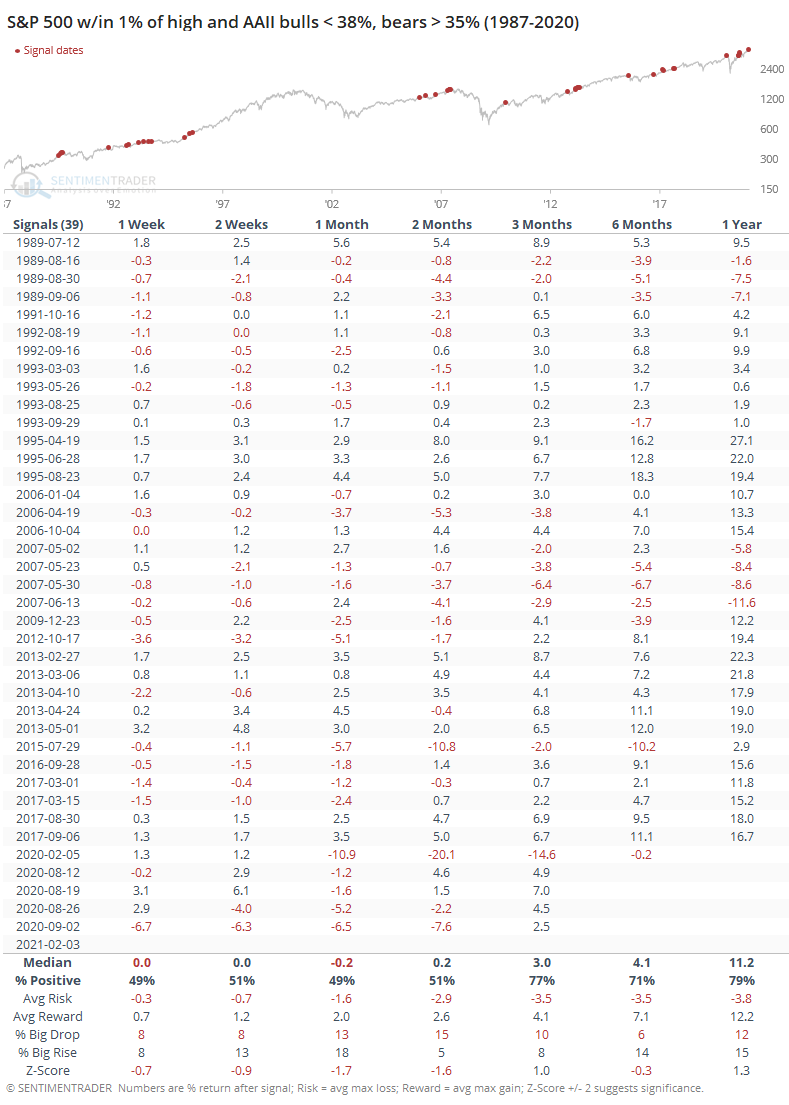

There's been some hoopla celebrating the fact that investor sentiment is quite low despite stocks tickling their highs. In this case, "sentiment" is the AAII survey, a flawed measure of sentiment if ever there was one.

So...let's test it.

Not much of a reason to celebrate. We very often see these folks turn more cautious after an initial bout of optimism, and that's not often a good thing for forward returns.

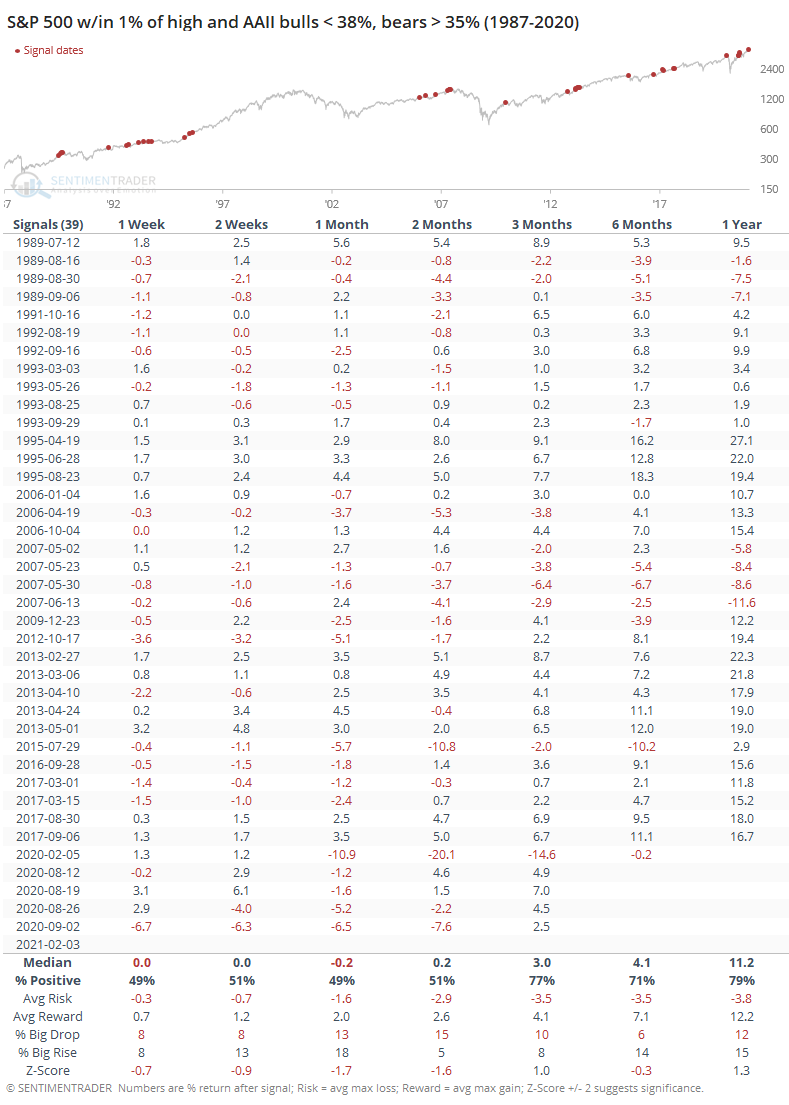

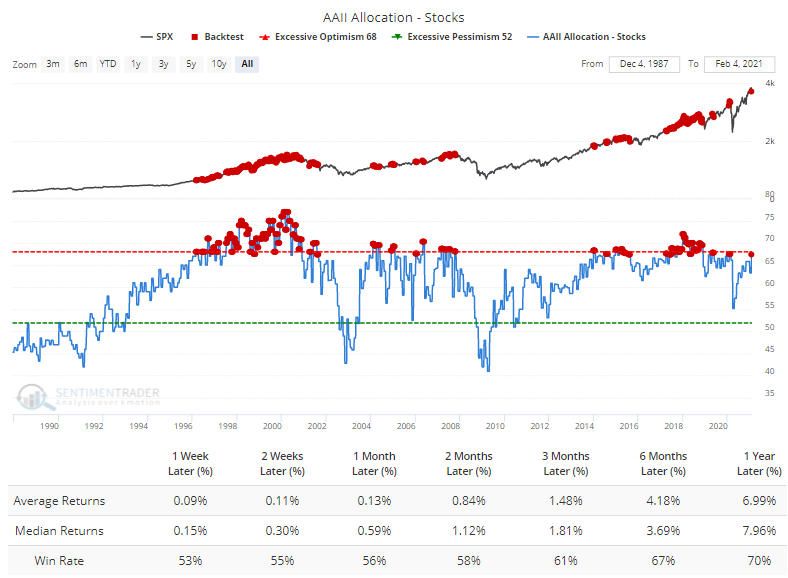

Also, despite not being very optimistic, they're still carrying a high exposure to stocks. The Backtest Engine shows muted returns in the S&P when exposure is this high.

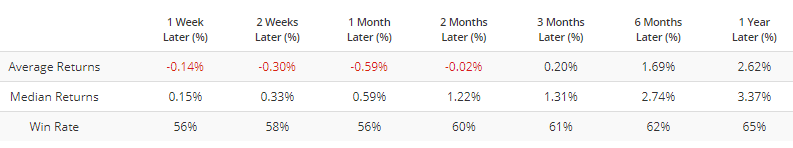

Returns have been especially muted over the past 15 years.

Again, not much of a reason for bulls to celebrate this measure of sentiment.