A Yen for the Yen

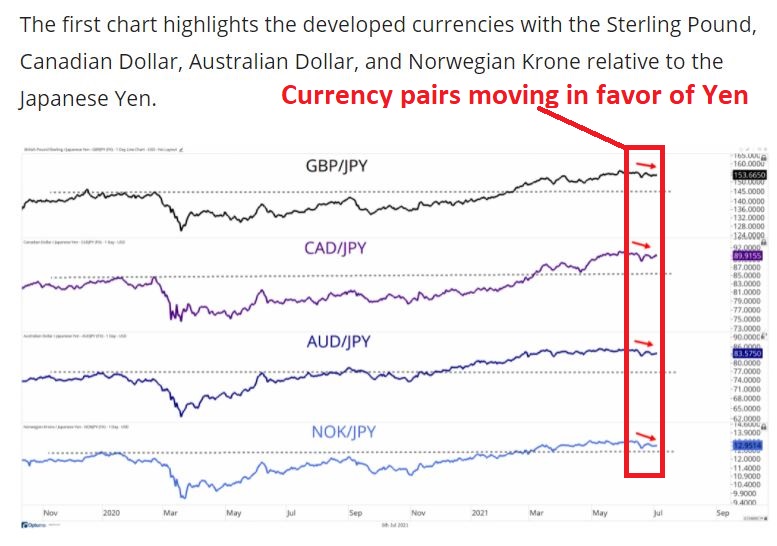

I recently came across the charts below displaying the currency cross between the Japanese Yen and various other currencies (charts are courtesy of www.AllStarCharts.com).

The primary thing that was pointed out was that the yen appeared to be strengthening against other currencies. This can happen in one of two ways:

- The yen goes up more than the other currencies

- The yen goes down less than the other currencies

Since I don't trade Forex or currency cross rates, I am more interested in the former - and in potentially taking a long position if the yen appears poised to advance.

PRICE ACTION

The chart below (courtesy of www.Stockcharts.com) displays a 5-year weekly bar chart of the Yen versus the US Dollar.

As with most charts, a trader can see pretty much whatever they want to see:

- One trader will see a market clearly in a downtrend (basically during all of 2021)

- One trader will see a market trapped in a large multi-year trading range (between 0.84 and 1.00)

- Another trader will see a market poised to reverse to the upside (based on potential support and an anticipated upside reversal in MACD)

Again, this is all firmly in the "eye of the beholder." So, let's look for another clue.

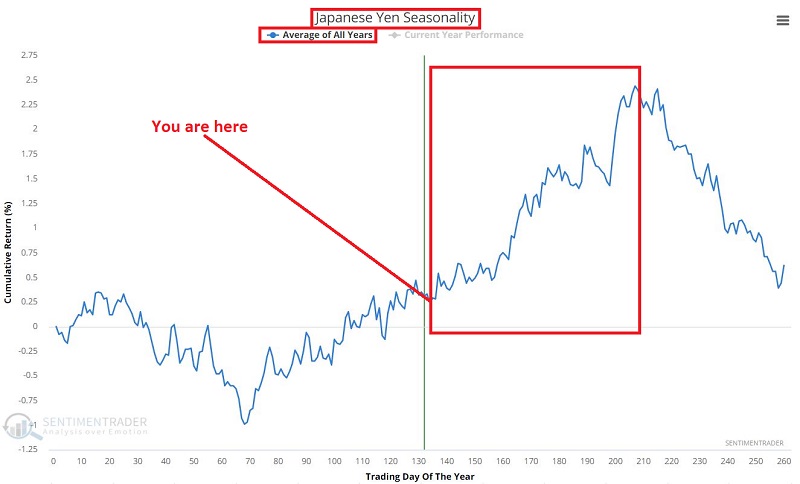

SEASONALITY

The chart below displays the Annual Seasonal Trend for the Japanese Yen.

As you can see, we are moving into what is generally a favorable time of year for the yen. Let's take a closer look at how this trend has played out in the past.

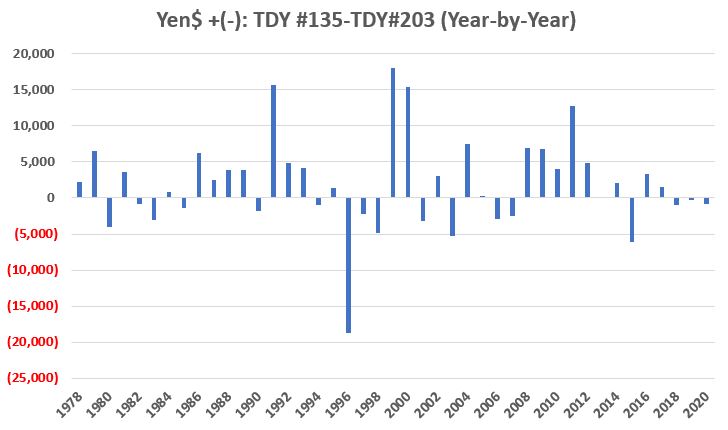

The chart below displays the year-by-year $ gain/loss for yen futures held long during our "favorable" period every year since 1976.

The huge loss in 1996 serves as our reminder that there are no sure things in trading and that managing risk is still the "Key to the Kingdom" regardless of the asset and method involved.

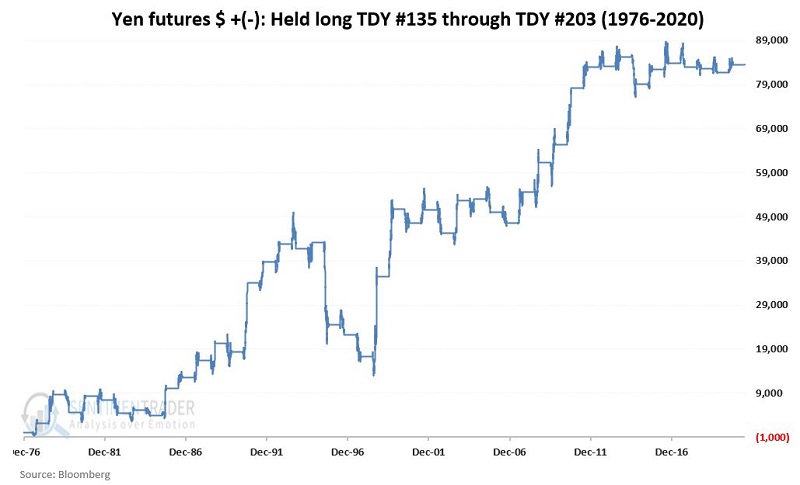

The chart below displays the cumulative results of the year-by-year results displayed above.

In sum:

- The yen showed a gain 26 times (60%)

- The yen showed a loss 17 times (40%)

- The average $ gain was +$5,462

- The average $ loss was (-$3,542)

- The median $ gain was +$3,931

- The average $ loss was (-$2,438)

THE NON-FUTURES AND NON-FOREX ALTERNATIVE

Non-futures traders can consider the ETF ticker FXY (Invesco CurrencyShares Japanese Yen Trust), which tracks Japanese Yen futures and can be bought and sold like shares of stock. Ticker FXY has support near $84 a share, and - like the futures - MACD is close to crossing over but has not yet done so.