A year like no other since 1932

In recent weeks, there has been a type of split in stocks, with the winners doing very well indeed, while the rest of the market just kind of limps along. It has exacerbated the trends seen during much of 2020.

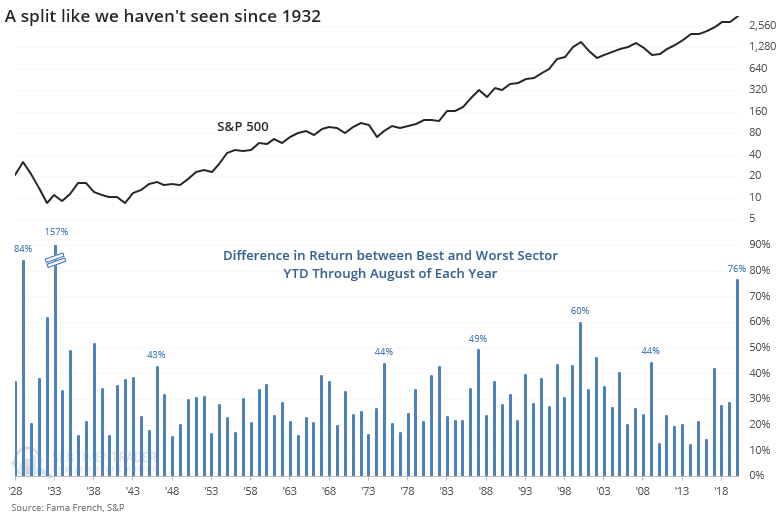

This year has highlighted the importance of being in the right sector more than any year since 1932. Through August, there hasn't been such a wide chasm between the best and worst sectors in nearly 90 years.

The only years in that span when the difference neared or exceeded 50% were 1987 and 2000.

This is thanks to the money pouring into the big tech stocks while neglecting left-for-dead sectors like energy. When we look at every year when there was a more than 40% difference through August between the best and worst sectors, we see that the ratio between those sectors had a strong tendency to mean-revert.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Charts showing the ratio between best and worst sectors dating to 1928

- If the Nasdaq peaks, it should fall hard, not see a bunch of back-and-forth

- The put/call ratio is finally rising

- Fear & Greed is starting to fall

- The VIX "fear gauge" fell along with stocks