A Worrisome - and Little Known - Inflationary Warning Sign

Last month the Producer Price Index (PPI) registered a 12-month rate-of-change of +17.25%, and the Consumer Price Index (CPI) registered a 12-month rate-of-change of +4.07%.

As the PPI is often thought to lead the CPI, this is a cause of concern for many.

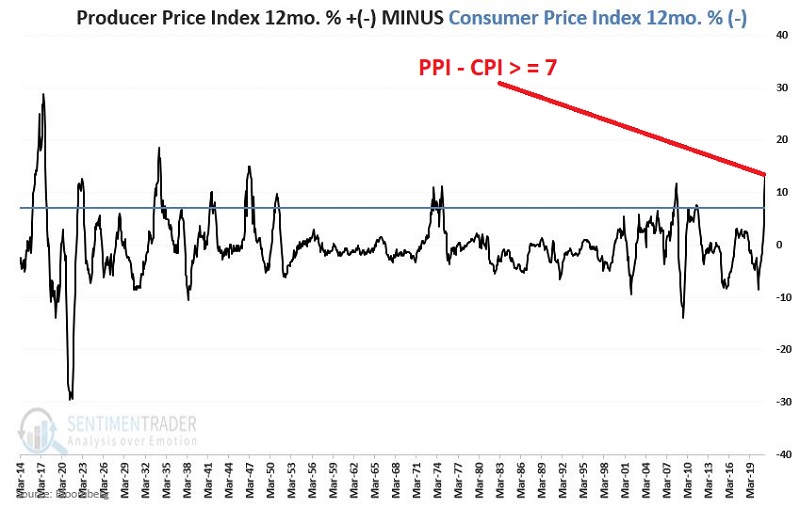

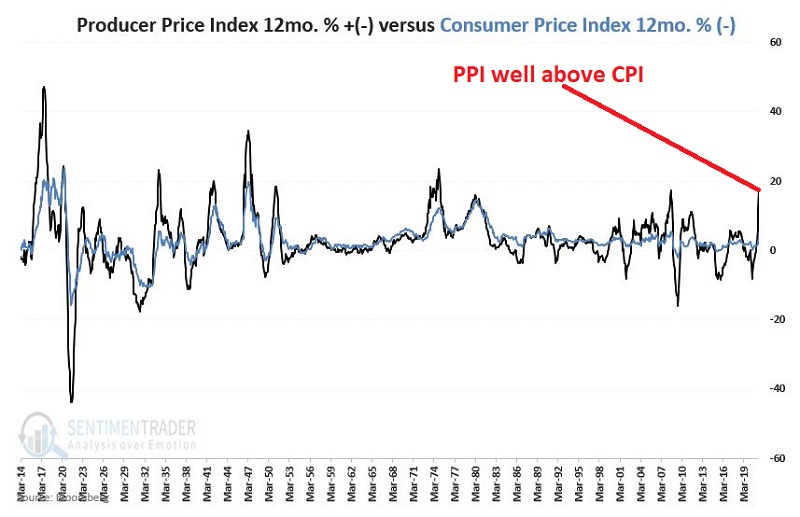

The chart below displays the 12-month % change in the PPI and CPI on one chart. As you can see, while the two indices typically trend in a similar direction, the PPI tends to be much more volatile than the CPI and will occasionally move significantly above or below the CPI.

One theory of concern is the notion that a spike in the PPI well above the CPI may signal an impending bout of significant inflation and that this might be negative for the stock market.

Is there anything to this theory? As it turns out, the answer - unfortunately - appears to be "Yes."

THE TEST

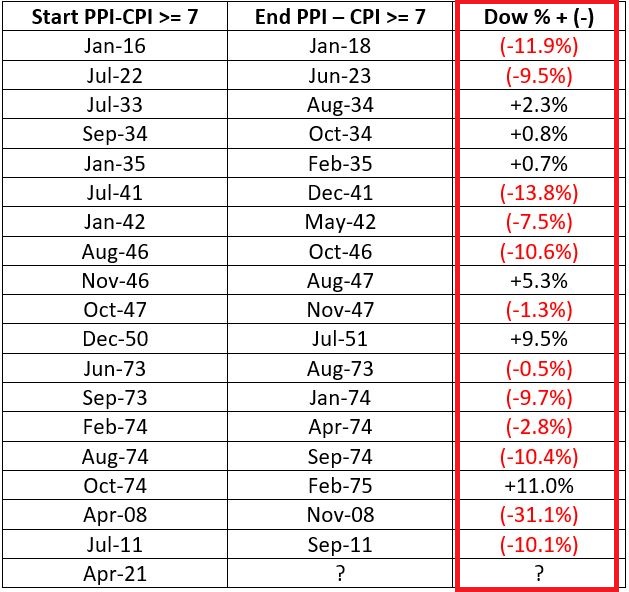

The chart below shows the monthly PPI 12-month change minus the CPI 12-month change, with a cutoff level of positive 7.

We want to identify those periods when the difference between PPI and CPI inflation is greater than 7 percentage points and look at the performance of the stock market during these periods.

For our test, we examine the state of PPI inflation and CPI inflation at the end of each month:

- If PPI - CPI is < 7, we consider this "normal" - and thus bullish for the stock market

- If PPI - CPI is >= 7, we consider this "abnormal" - and thus bearish for the stock market

The table below displays only those periods when PPI - CPI was >= 7 and the price performance of the Dow Jones Industrial Average during those periods.

Overall, the historical results have been extremely unfavorable for stocks. To wit:

- # of periods Dow UP = 6

- # of periods Dow DOWN = 12

- Median UP period Dow % = +3.8%

- Median DOWN period Dow % = (-9.9%)

- Cumulative Dow % +(-) = (-63.9%)

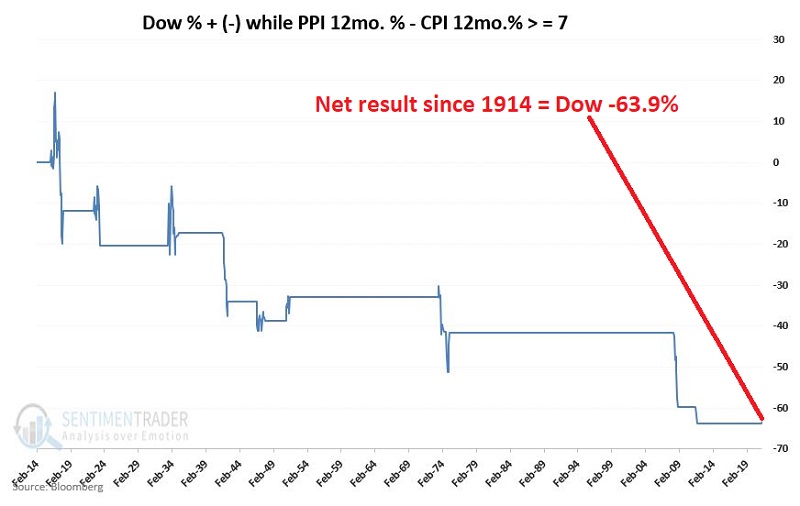

The chart below displays the cumulative % +(-) for the DOW only during those months when PPI - CPI >= 7. The results have been consistently negative for stocks.

THE CURRENT STATUS

- At the end of April, the PPI 12mo% change - CPI 12mo% change stood at a bearish +9.43

- At the end of May, this reading stood at +13.18

The good news is that the stock market shrugged off this piece of bad news in May and worked its way slightly higher. As with any indicator, there is no reason why the stock market must sell off just because some indicator value is beyond what some analyst deems bearish.

Nevertheless, it is worth keeping a close eye on these two inflation measures - and the stock market itself - in the days ahead. The longer the bearish inflation readings persist, the greater the likelihood that trouble may develop in the stock market.