A whole week with more than 90% of S&P members in short-term uptrends

Key points:

- Almost all S&P 500 members are trading above their 10-day moving averages

- More than 90% of stocks have held above that average for a week straight

- Similar thrusts and streaks preceded gains for the S&P over the next 6 months almost without exception

Yet another positive breadth thrust

In early December, buying interest across stocks was broad and urgent. More than 80% of volume on the NYSE flowed into advancing securities, triggering a rare breadth thrust.

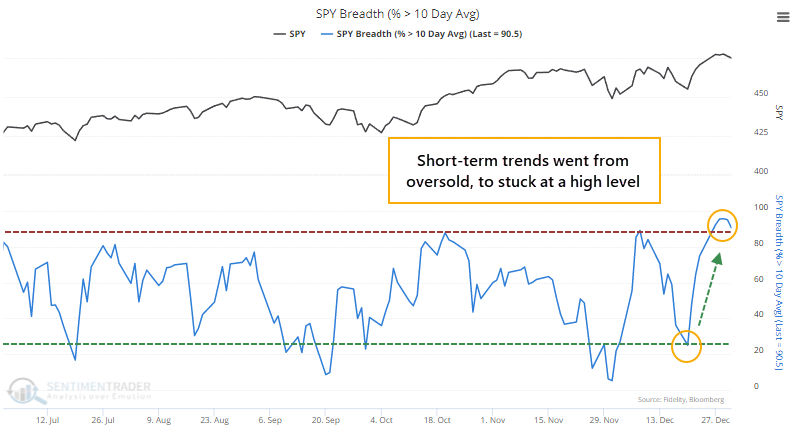

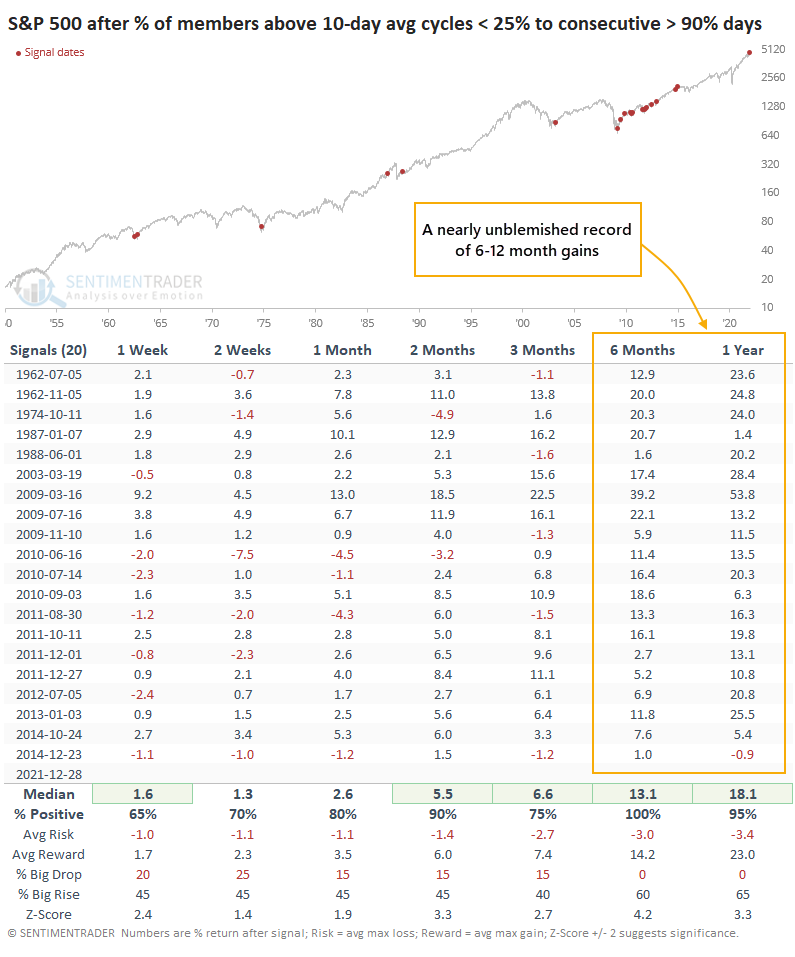

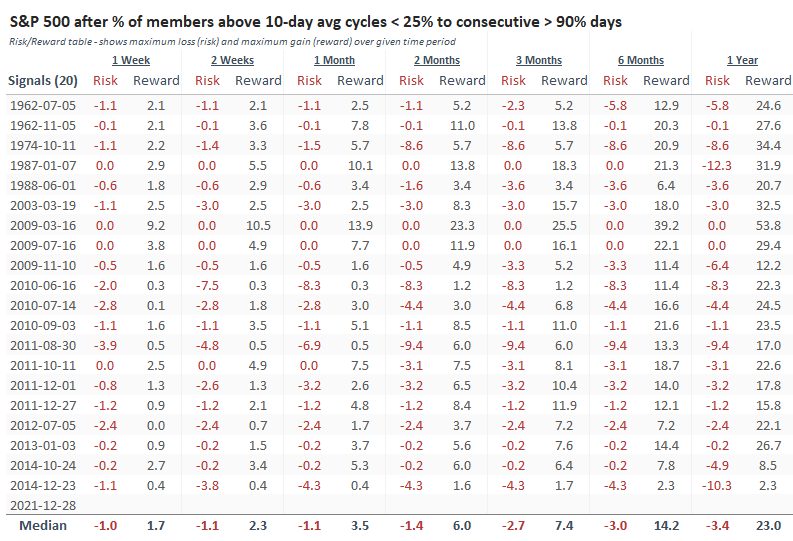

Within the most benchmarked index in the world, buying interest has been just as impressive. The percentage of S&P 500 member stocks trading above their 10-day moving averages cycled from only 25% on December 20 to more than 90% by last week.

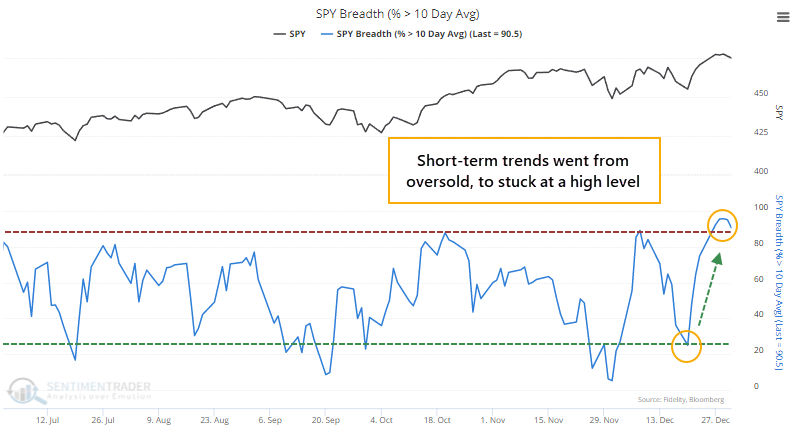

The Backtest Engine shows that since 1998, the S&P 500 performed well after more than 90% of its stocks traded above their 10-day averages, preceding a positive one-year return after 187 out of 193 signals.

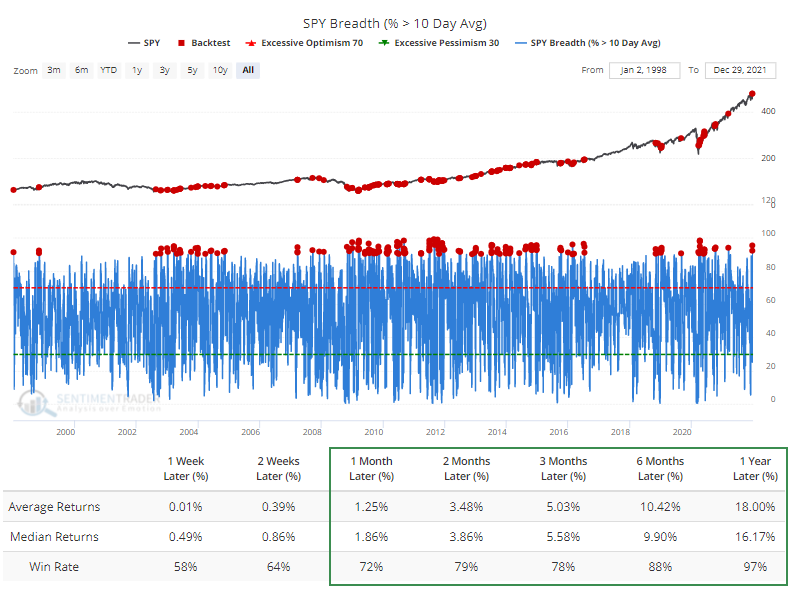

When these short-term trends cycled from below 25% (rounded) to above 90% on consecutive days, the S&P never lost ground over the next 6 months.

The Risk/Reward Table shows that over the next 6 months, there wasn't a single drawdown of more than -10% at any point after any of the signals. And 16 out of the 20 precedents showed a maximum gain of more than +10% during those 6 months.

A whole week of impressive trends

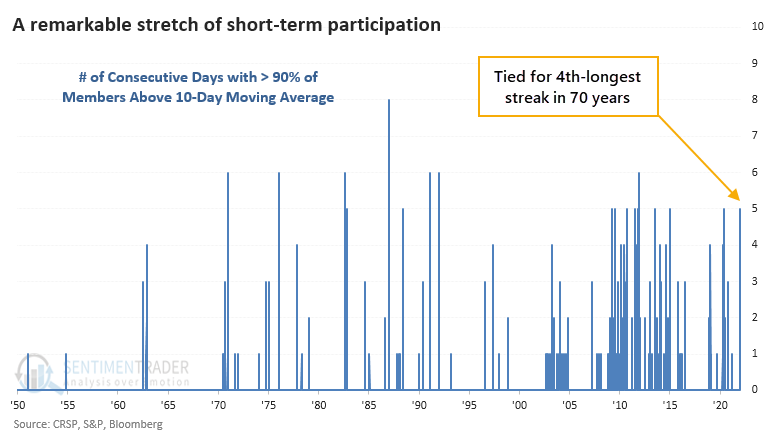

But it's even more impressive than that. By December 27, more than 90% of stocks were trading above their 10-day averages, and it hasn't dropped below 90% since then. This 5-day streak is tied for the 4th-longest since 1950.

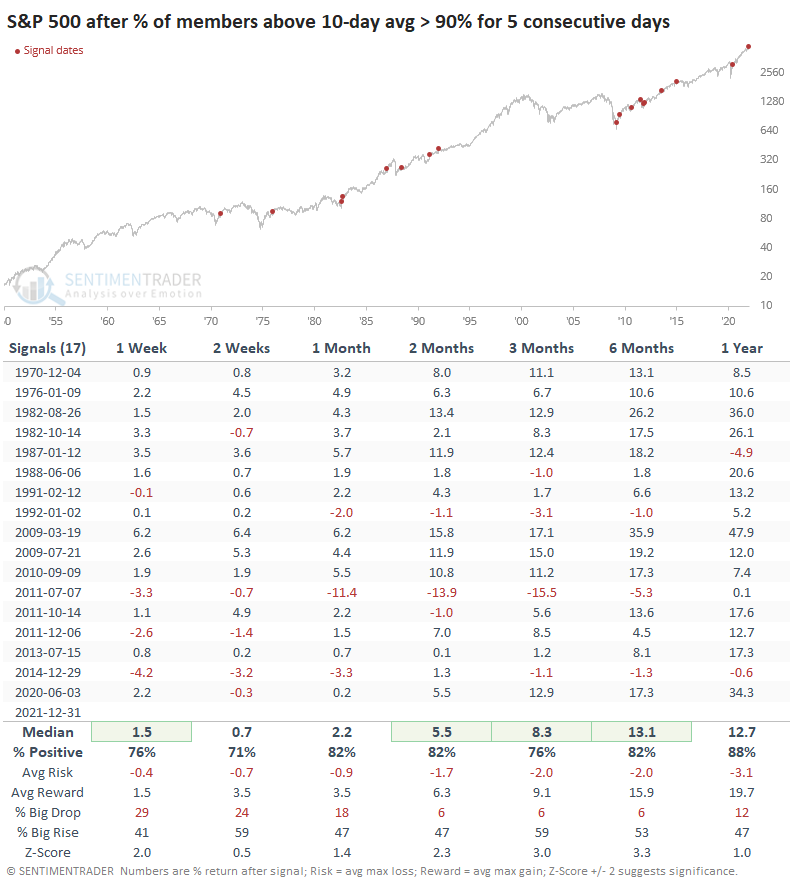

After other times when the S&P went 5 straight days with more than 90% of its members above their 10-day averages, the index continued to gain in the months ahead with few (and temporary) exceptions.

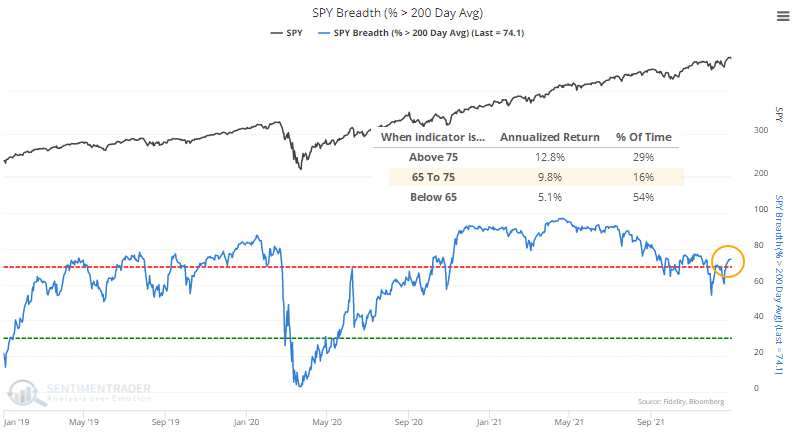

Longer-term participation is "just right"

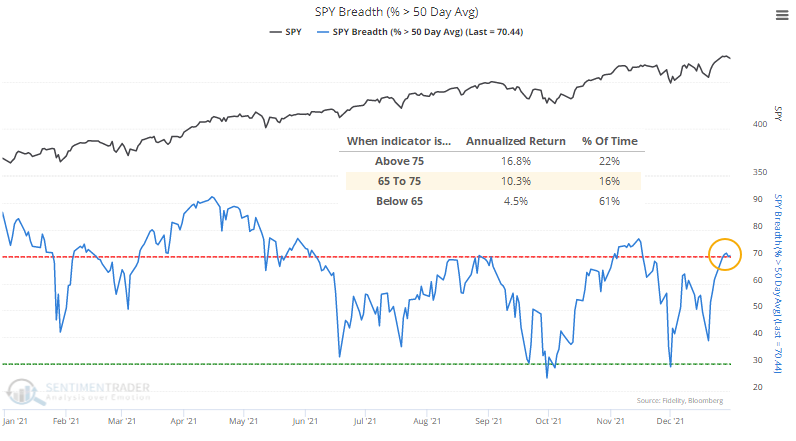

Looking at longer-term breadth metrics for the S&P 500, most of them are in the not-too-hot-not-too-cold zone. About 70% of stocks are trading above their 50-day averages, which since 1928 has given an annualized return of 10.3%.

Just less than 75% of them are trading above their 200-day averages, which has also preceded annualized returns of about 10%.

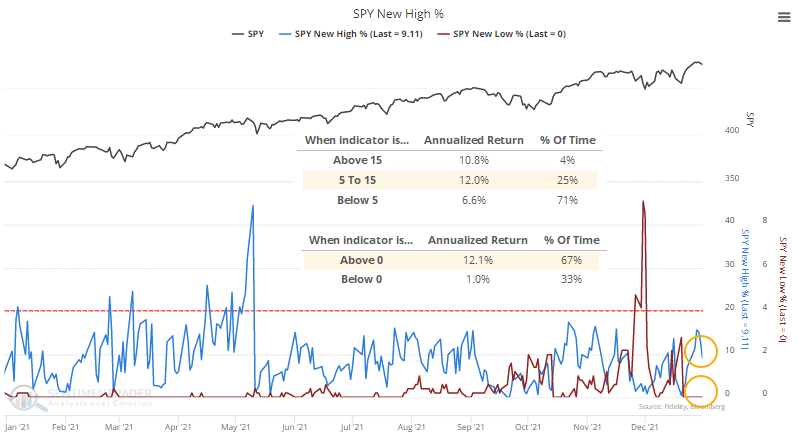

When the net percentage of stocks at 52-week highs minus 52-week lows is between 5% - 15%, as it is now, the index's annualized return bumped up to 12%. Actually, one of the most important aspects of this particular data set is simply whether there are more highs than lows. When lows dominate, the S&P's next-day return sinks dramatically, at least until there is a sudden surge that indicates capitulation.

What the research tells us...

There are definite concerns regarding valuations, bubble-like behavior in various assets, and a looming change in monetary policy. So far, equity investors don't seem to care, at least when it comes to blue-chip stocks. When we see sustained thrusts in short-term positive trends among members of the S&P 500, as we did at the end of December, it has preceded further gains almost without exception.