A Week Of Warnings As Transports Break Out

This is an abridged version of our Daily Report.

A week of warnings

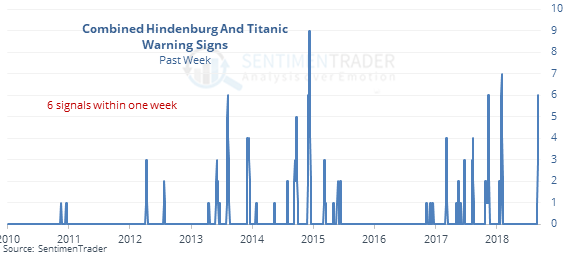

Every day last week triggered a Hindenburg Omen or Titanic Syndrome technical warning signal.

While they are much-maligned and not immune to failures, similar clusters of these warning signs preceded consistent weakness across stocks and sectors and were good for volatility.

A not so leading indicator

The Dow Transports broke out to a new high, exceeding its highs from August and January. At the same time, the Dow Industrials are lagging, more than 2.5% and 150 days from its own high. This has not been a positive leading indicator for the Industrials, with more large declines than rallies in the months ahead.

Pinned

After a tough day on Monday, the Invesco India fund, PIN, has the lowest Optimism Index out of the country ETFs we follow according to the Geo-Map.

Still speculative

Two weeks ago, we saw that there was a big jump in speculative options activity. That continued last week, as the Options Speculation Index declined only slightly, from 1.33 to 1.31.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |