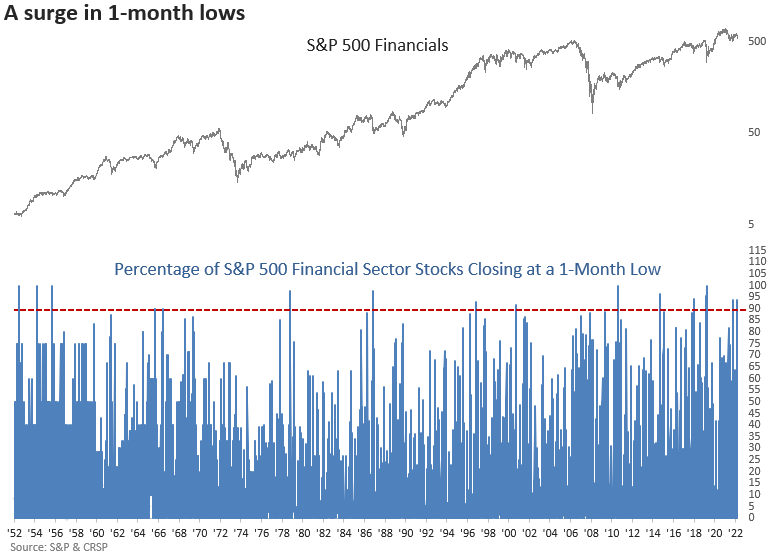

A vitally important sector sees a surge in new lows

Key points:

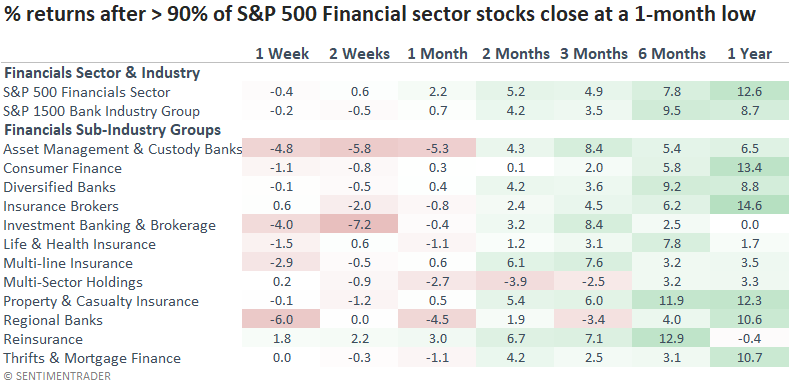

- More than 90% of S&P 500 Financial sector stocks closed at a 1-month low

- After similar conditions, the sector tended to show some downside follow-through before rebounding

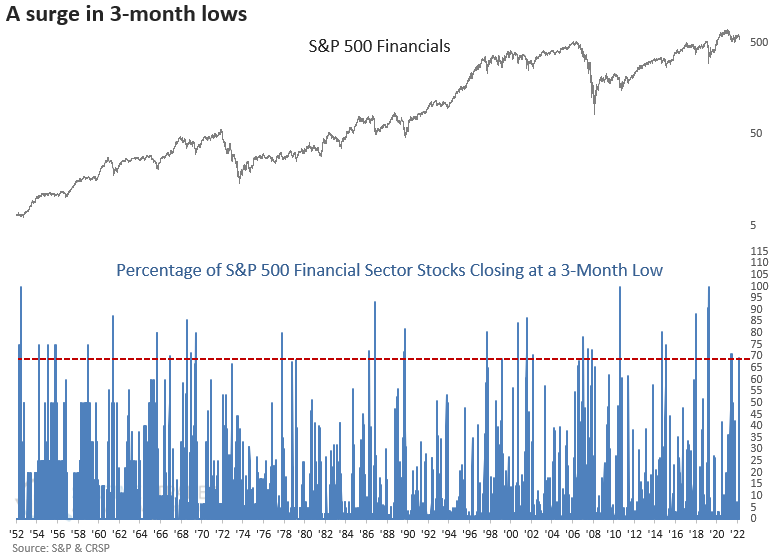

- Over 69% of S&P 500 Financial sector stocks closed at a 3-month low

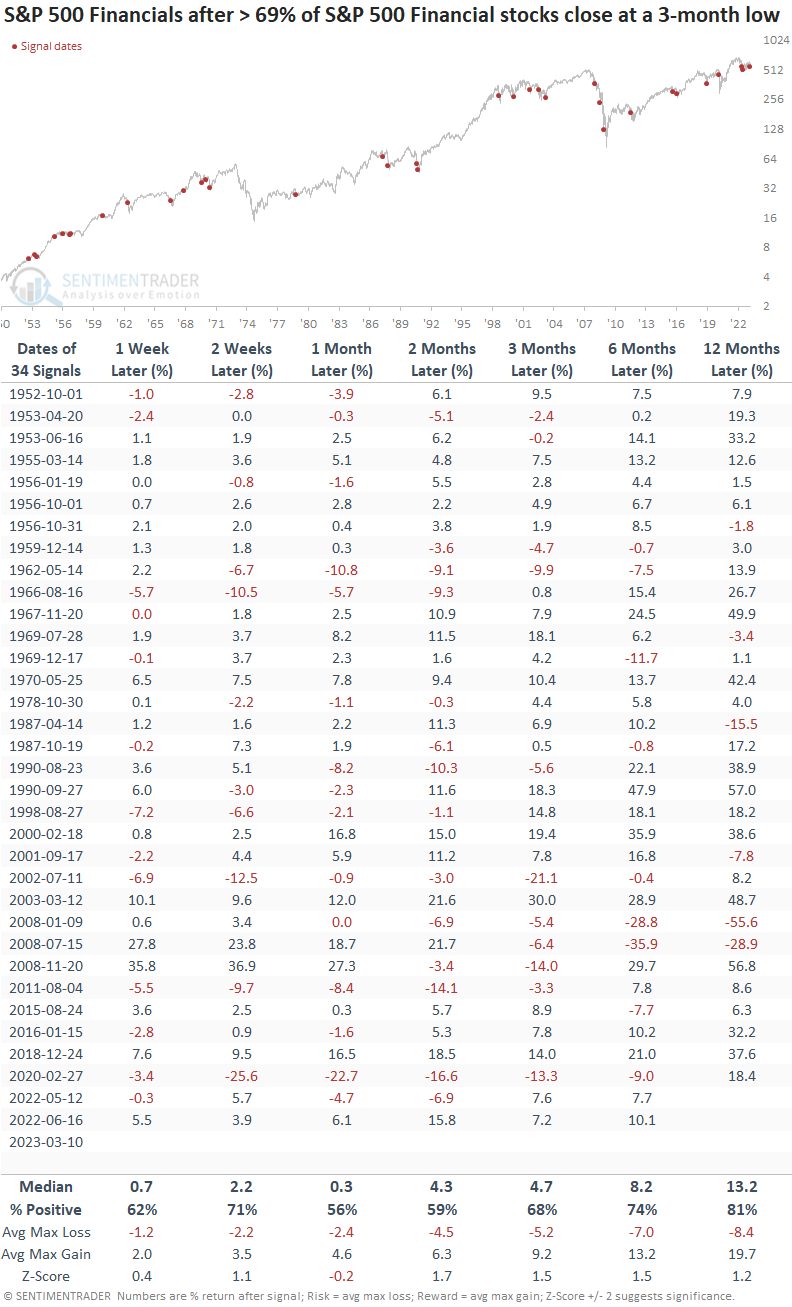

- After similar precedents, financials managed to bounce over the next few weeks

The Financials sector shows signs of short-term panic

The financials sector swooned on the back of the Silicon Valley Bank news late last week. While the global financial crisis occurred well over a decade ago, recency bias continues to plague investors on any sign of trouble in the vitally important sector, and this time was no different.

For only the 13th time in more than 70 years, over 90% of S&P 500 Financial sector stocks closed at a 1-month low. Typically, high readings like now are associated with a panic-driven event like the 1987 crash, 9/11, the 2011 debt downgrade, or the Covid crash.

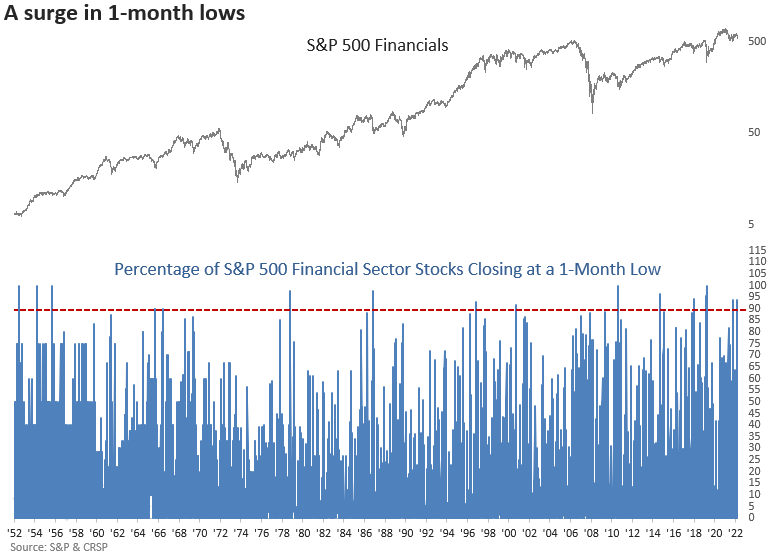

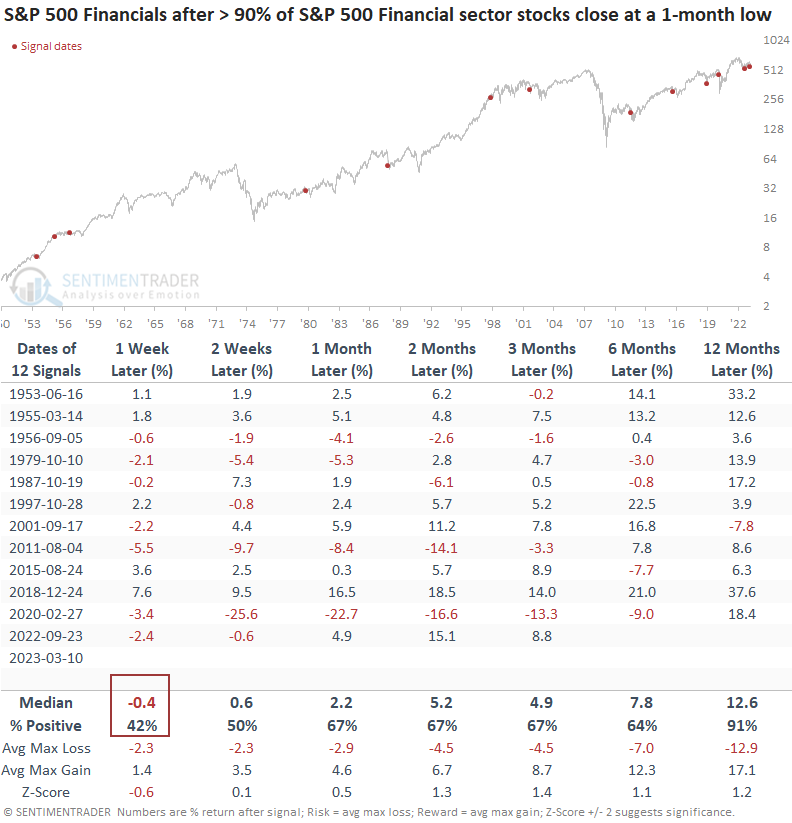

Be mindful of some downside follow-through in the next week

When greater than 90% of S&P 500 Financial sector stocks close at a 1-month low, the sector tends to see some near-term downside follow-through before rebounding over the next few months. A year later, the group was higher in all but one case.

Interestingly, the percentage of S&P 500 Financial sector stocks closing at a 21-day low never exceeded 90% in the global financial crisis. The max reading was 88%.

Suppose I apply the signals to a short-term outlook table. In that case, the next day shows the highest potential for further losses, which we see this morning with the financial sector down over 3%.

From a sub-industry perspective, most groups look significantly weaker than the S&P 500 financials sector over the next month. I suspect small and mid-cap companies, which are riskier, contribute to the weak all-cap sub-industry results.

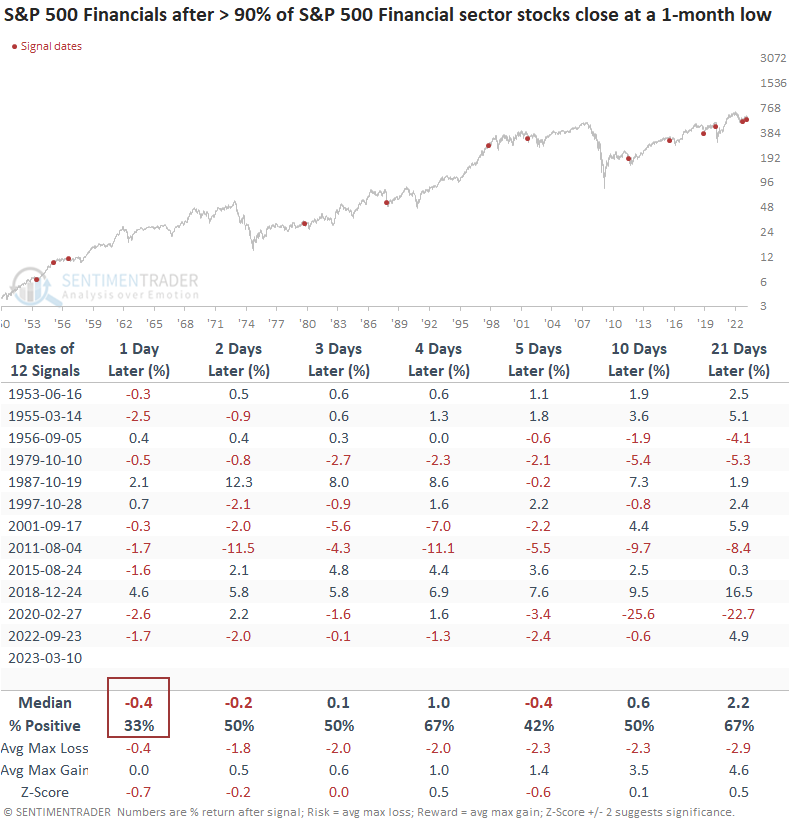

New lows over a longer time frame are increasing

The selling pressure late last week also pushed the percentage of 3-month lows above 69%.

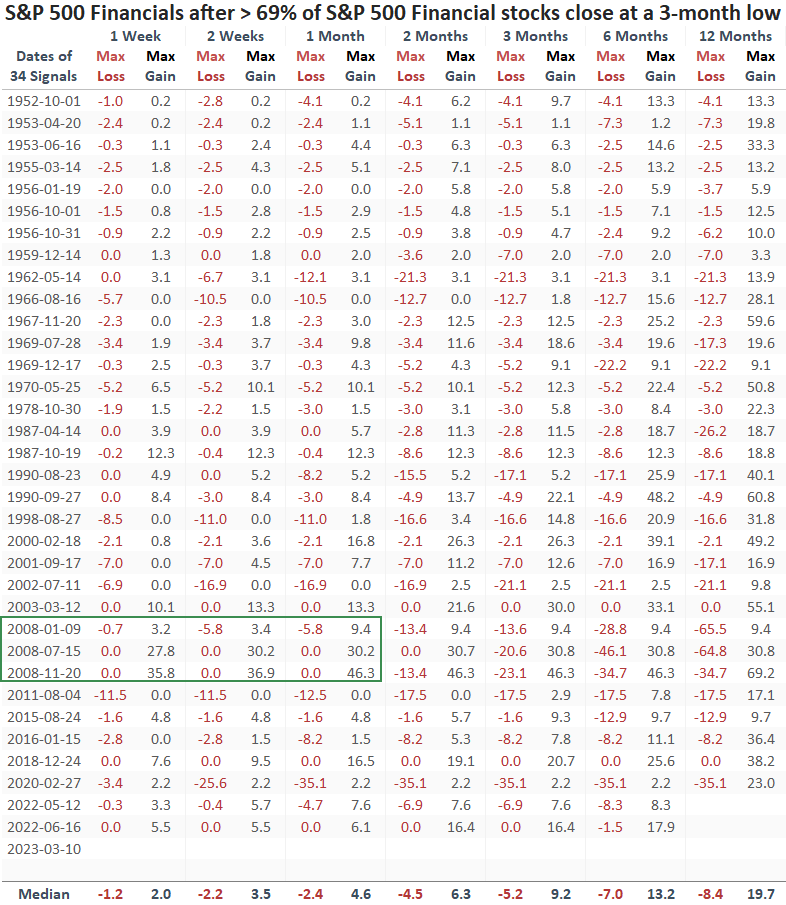

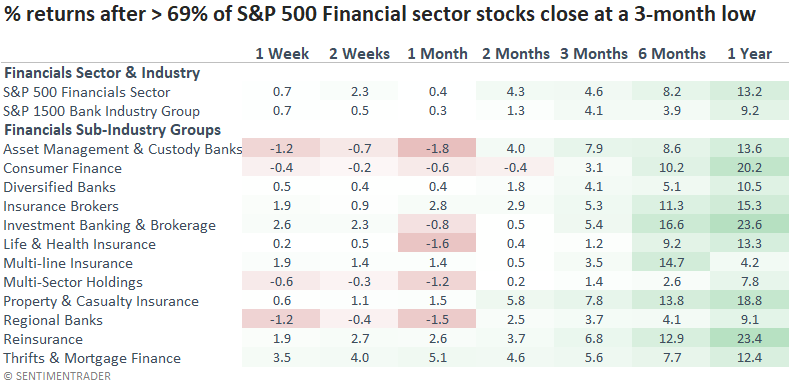

When greater than 69% of S&P 500 Financial sector stocks close at a 3-month low, the sector tends to bounce back in the next few weeks. However, the results a month later suggest some backing and filling could take place.

Except for 2008 and 2020, signals typically occurred near the end of a risk-off period.

With the global financial crisis at the forefront of investors' minds, it's important to remember that a spike in 3-month lows like now led to significant bear market rallies in 2008, which I highlighted in the table below.

Once again, sub-industry groups underperform relative to the S&P 500 Financials sector. Like the 1-month low study, Asset Management & Custody Banks and Regional Banks tend to show the weakest results.

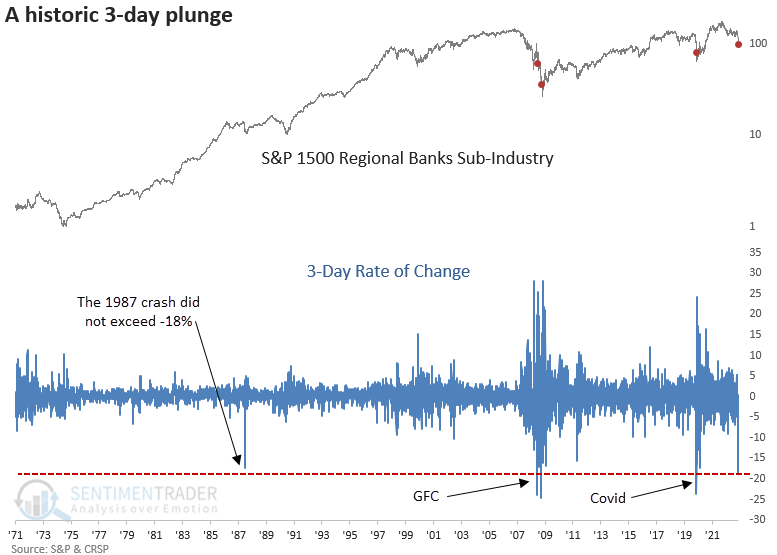

A historical perspective on regional banks

On an intraday basis, the S&P 1500 Regional Banks Sub-Industry group has declined by greater than 18% over three days. That's happened only three other times in history.

What the research tells us...

When the market gets volatile like now, it's important to remember the phrase in the Sentimentrader logo. An approach that emphasizes analysis over emotion will lead to better investing outcomes. With stocks in the financial sector falling at a breathtaking rate over the last few days, new lows on a one and three-month basis have reached a level that suggests a bounce could be coming. As always, there is no guarantee in investing. So, it's essential to manage risk.