A Trade-Related Gap

Stock futures are jumping this morning, with another trade-related headline. Per the WSJ:

That has sent S&P 500 futures more than 0.75% above yesterday's close. It's often questionable to assign movements in the futures to a single issue, but this one seems pretty clear.

Traders have been jerked around by rumors on this front for over a year, but this is an actual, sold headline that appears to be confirmed by both sides.

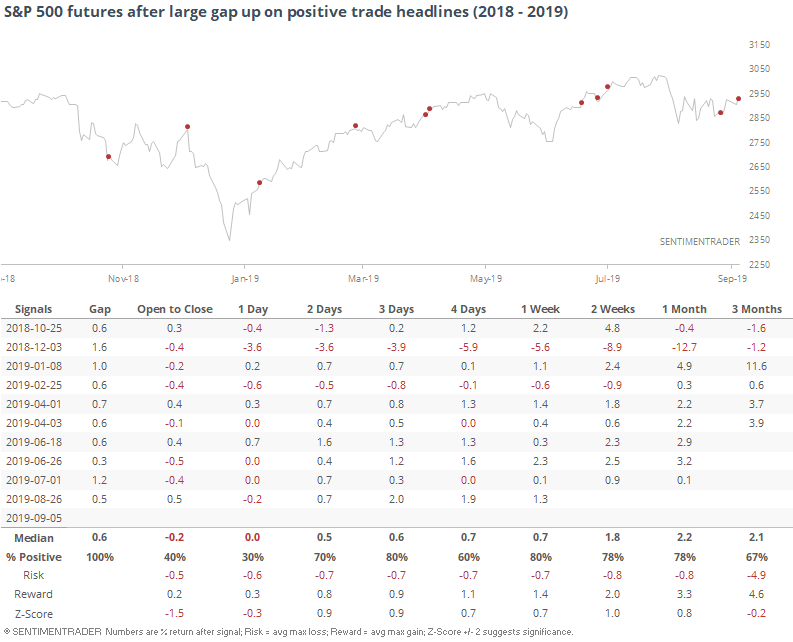

Using a trade timeline provided by China Briefing, we can see whether other big positive opening gaps, on days when there was a positive trade headline, ended up following through.

For the most part, no they didn't, at least in the very short-term. The futures followed through on the gap by adding to their gains over the next day only 3 times, while falling back 7 times.

The weakness was mostly confined to that very short-term, though. Most of them did show gains over the next 3-5 days, with only one showing a large loss when stocks collapsed into late December.

It's hard to rely on price action when it seems to be heavily influenced by the latest tweet, and this could be upended in a moment by an off-the-cuff post, but based on this admittedly shaky history, this ostensibly positive development should lead to further gains over the coming days.

It should be further helped along by the recent broad-based buying pressure, as Troy noted with yet another day showing big volume in advancing stocks yesterday.

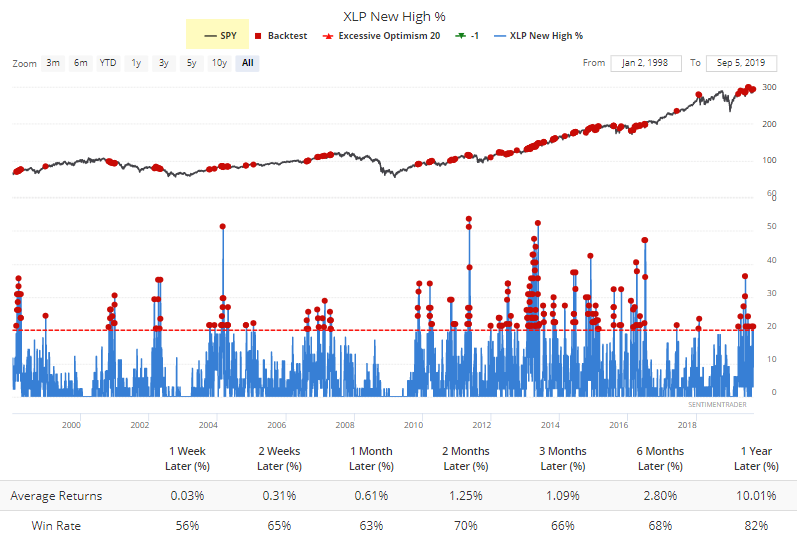

We've seen a lot of signs of abnormally heavy risk-aversion in recent weeks, even lately with a choppy recovery in stocks. Another sign of that has popped up over the past couple of days with a surge in 52-week highs among the most defensive sectors. Yesterday, more than 20% of staples hit a new high. Its forward returns were below average over the next couple of weeks, but more interesting is the return in SPY after this happens.

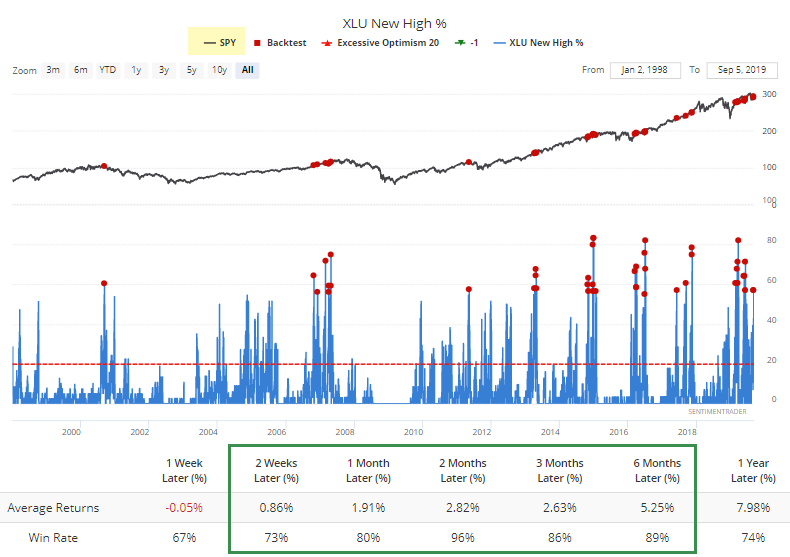

Even more notable, though, is the surge in 52-week highs among utilities. This has typically happened when investors were anxious about growth or rates, and has led to even more positive returns for the S&P 500. To run this test, just click this link then click the Run Backtest button and then the Multi-Timeframe Returns tab.

There have been 45 days when more than 55% of utility stocks hit a 52-week high, and the S&P 500 showed a positive return two months later after 43 of them.

It's been hard to chase breakouts because so many of them have failed, but given all of the pessimism lately, it seems like this one has a better chance than most of following through.