A tiny market with huge volume

There is a feeding frenzy out there, and the devouring horde is roaming toward more and more speculative outlets.

It started last June with a spike in options trading, specifically calls. It reached a fever peak in late August, pulled back in September as losses piled up, then spiked again in December and continues to this day. Over the past 5 days, U.S. options exchanges have executed an average of nearly 27 million call contracts, a record high. As a result, potential selling pressure from dealers has also spiked to a record.

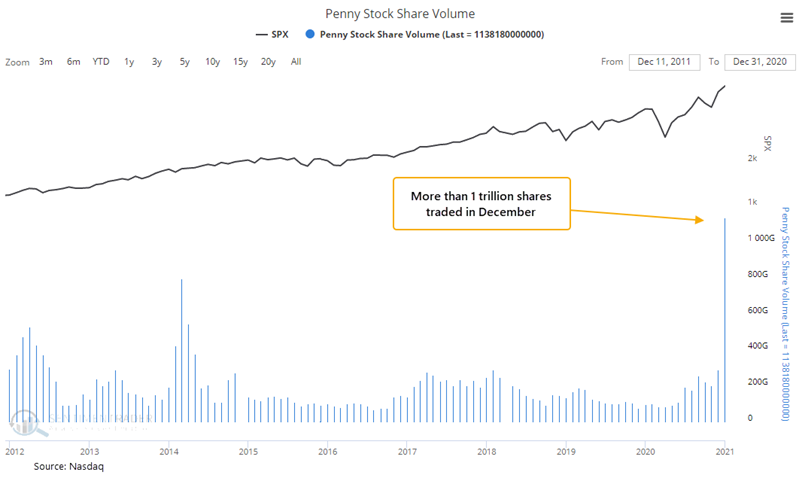

Even while the TikTok crowd still hasn't become bored with options, they've branched out to other avenues. That has been readily apparent over the past few weeks. As Bloomberg notes, that includes penny stocks. When January's figures are released, it's likely going to show near-record levels of volume in these lottery tickets

Even in December, this activity was starting to spike. For the first time in a decade, more than 1 trillion shares traded. Yeah, that's trillion with a "t."

For comparison's sake, that's nearly 50 times the volume traded among securities in the Nasdaq Composite index.

What else we're looking at

- What happens after other big spikes in penny stock share volume since 1995

- Looking at penny stock volume relative to total Nasdaq volume and $ amount traded

- There have been 2 other times call volume and Gamma Exposure both skyrocketed

- Think tech is in a bubble? We show a low-risk way to express that view with options on NFLX

- What it means when there is an internal surge among emerging market stocks

- Most small business owners now expect deteriorating conditions, but it doesn't mean what you think

For immediate access to all the research with no obligation, sign up for a 30-day free trial

| Stat Box On Tuesday, options traders executed over 800,000 put contracts on 10-year Treasury notes. That's only the 5th time in history that more than 800,000 bearish bets were traded on the same day. |

Sentiment from other perspectives

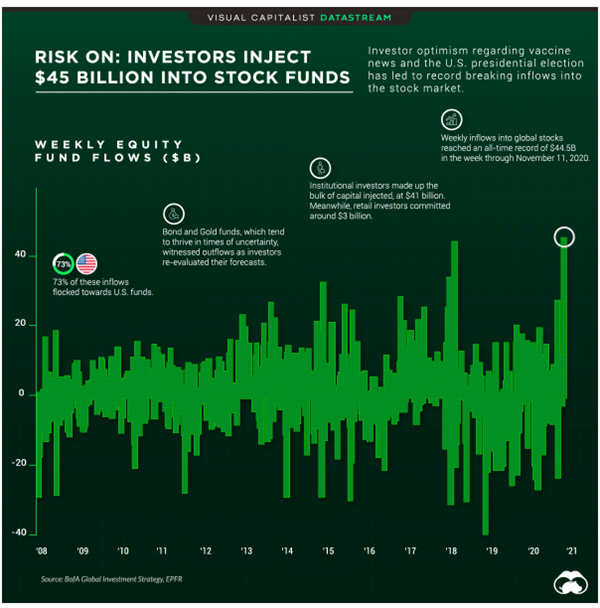

A levitating market has emboldened investors to push more than $44 billion into equity funds in a single week, setting an all-time record. Source: Visual Capitalist

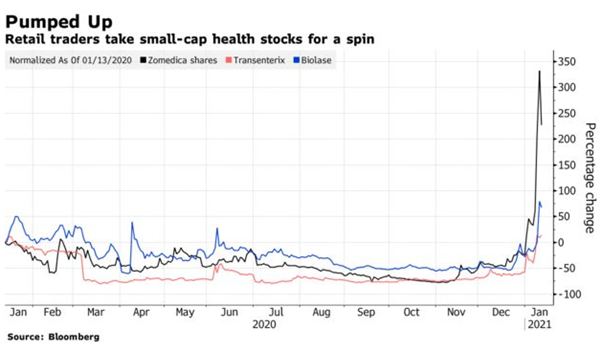

These fund flows are separate from the money moving into individual stocks. And many of those in recent weeks have been among the most speculative. Source: Bloomberg

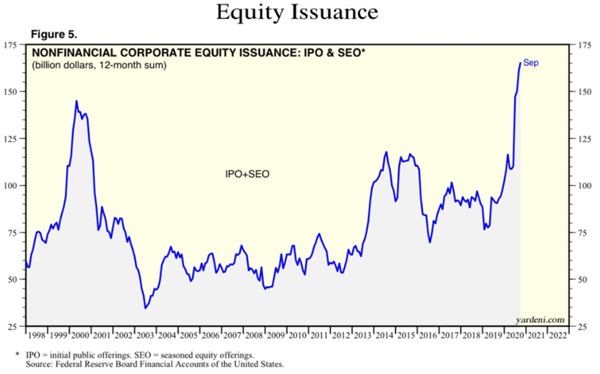

And what does Wall Street do when appetite is so voracious. Why, they feed the duck, of course. Source: Ed Yardeni via David Schawel