A Tepid Rally As Coffee And Sugar Sour

This is an abridged version of our Daily Report.

A really, really tepid rally

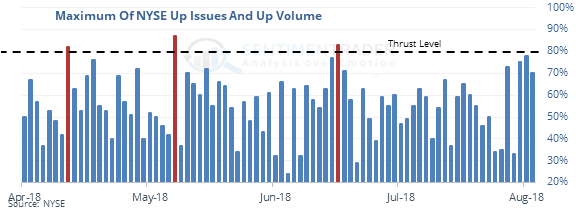

In the past 90 days, there have been only 3 breadth thrusts, a tepid run as the S&P 500 nears a new high.

Rallies with few thrusts did worse going forward than rallies with more of them, but even so the returns were still positive.

Coffee and sugar are the worst

Sentiment on coffee and sugar is among the worst it’s been in 30 years for both contracts. That has led to medium-term rebounds in the commodities…and it was good for Starbucks, too.

No letup

Coffee futures have declined for 9 straight sessions, tied for the 4th-longest streak since 1972. Its last streak went to 13 sessions at the end of October 2013. The only other one in the past 20 years was 10 straight losses.

Fix for skewed charts

Over the weekend, Eric added the option for logarithmic scales on the charts, for either the index or indicator (as long as it doesn’t have zero or negative values). Click here for a short post about why that can be useful.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |