A TCTM Risk Warning Model member triggers a risk-off signal

Key points:

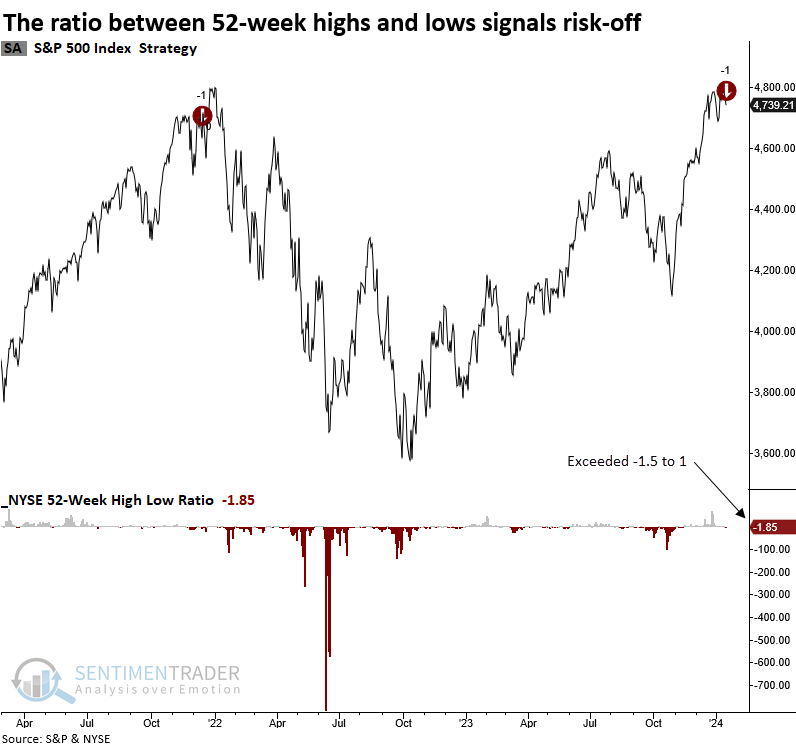

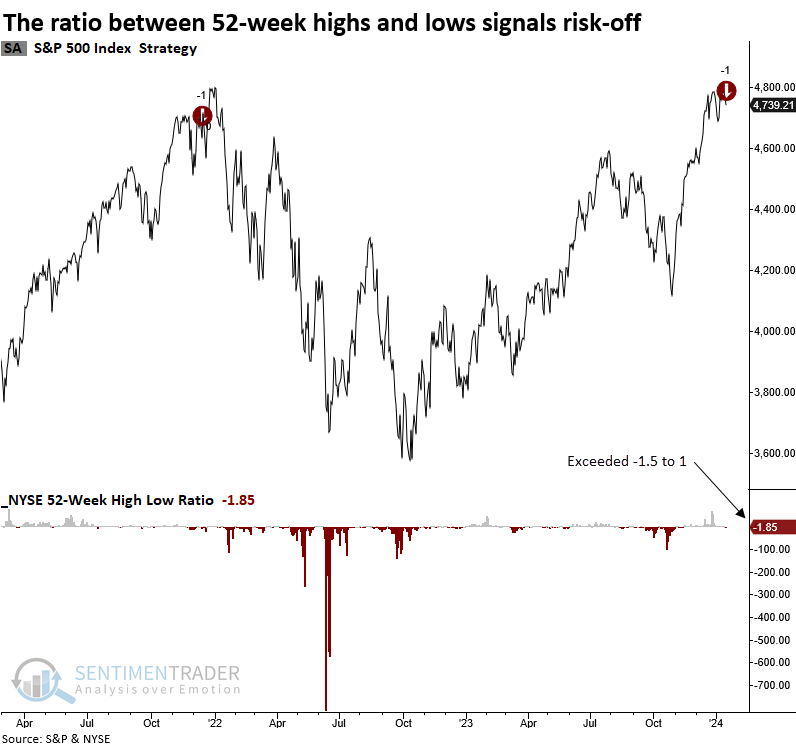

- The ratio between 52-week highs and lows on the NYSE exceeded -1.5 to 1, two sessions from a high

- Similar skews in highs versus lows preceded negative returns for the S&P 500 over the subsequent two months

- The TCTM Composite Risk Warning Model signal count increased to 10%

NYSE 52-week lows outpaced highs near an annual high

A model that monitors NYSE 52-week highs relative to lows exceeded a ratio of -1.5 to 1, with the S&P 500 only two days removed from an annual high, triggering a risk-off signal for a member in the TCTM Risk Warning Model.

The previous alert occurred in December 2021, three weeks before the peak in the S&P 500 on 2022-01-03. However, that signal was accompanied by several other risk-off signals from members in the Composite Risk Warning Model, culminating in a timely composite signal on 2022-01-13.

While this alert could be an isolated event, it raises a yellow flag regarding the sustainability of broad market participation that began last Autumn.

Comparable skews in 52-week highs versus lows preceded negative returns

If, within two days of hitting an annual high, the ratio of NYSE 52-week highs to lows exceeds -1.5 to 1, the world's most benchmarked index displayed negative returns and unfavorable win rates over the subsequent two months. While the S&P 500 eventually recovered, the outlook from three to twelve months later underperformed relative to historical trends.

A single arrow is easily broken, but not ten in a bundle - Japanese proverb

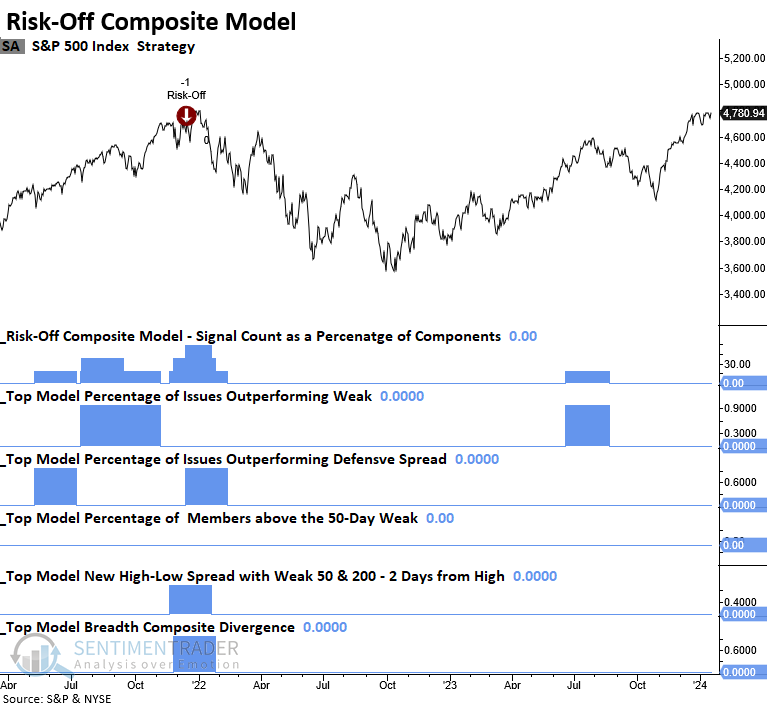

For a Composite Risk Warning Model alert to activate, the composite signal count must hit a minimum threshold of 50%, a currently unmet condition. In May 2023, the model reached 20%, as a brief consolidation within the overall context of a bottoming process underscored a subpar breadth environment.

It's common to see the signal count increase to levels below the trigger threshold. Typically, it denotes sector rotation.

A secondary risk-off composite

The Risk-Off Composite Model, which is not a TCTM component, can be found at the bottom of the TCTM Live page on the website. I use it as a secondary measure to manage risk.

This model currently shows a signal count of 0%, indicating an absence of breadth-based warnings.

What the research tells us...

Starting last Fall, we highlighted numerous breadth-based studies suggesting a broadening in market participation. Unfortunately, more and more signs, like the 52-week high-low ratio signal, indicate that the environment could be falling right back into the first half of the 2023 scenario, i.e., it's growth-oriented technology stocks working and not much else. While a participation problem is not ideal, there's always a bull market somewhere. Until the weight of the evidence suggests otherwise, stay the course with allocations to the strongest sectors, industries, and stocks.