A tactical trade opportunity in crude oil

Key points:

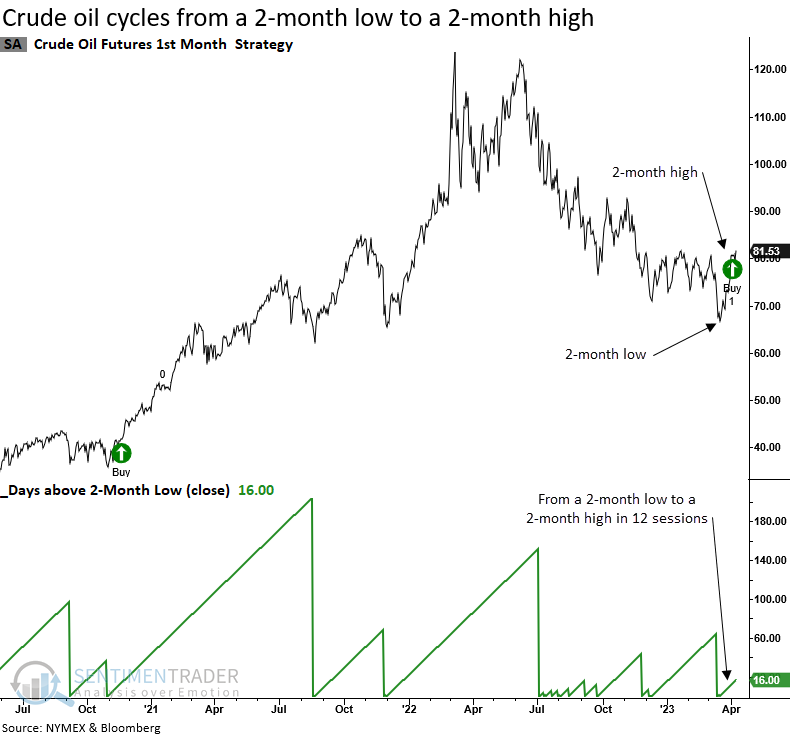

- Crude oil cycled from a 2-month low to a 2-month high in only 12 trading sessions

- After similar reversals, the commodity showed strong results over the next two months

- The Volatility Index for crude oil reversed from the upper end to the lower end of its recent range

- After similar volatility-based signals, oil was higher 90% of the time over the next three months

A reversal in price and volatility indicators suggests a tactical trade opportunity

Crude oil remains firmly in a long-term downtrend after declining 46% from its peak in March 2022 to the recent low in March 2023. Slowing economic growth and the strategic oil reserve drawdown have weighed on the commodity.

However, some new and interesting developments suggest the recent counter-trend rally in oil could continue.

A bullish reversal in the price of crude oil

For only the 19th time since 1984, crude oil futures (CL1) reversed from a 2-month low to a 2-month high in fewer than 20 trading sessions.

The previous signal in November 2020 led to a substantial rally.

Similar reversals in the price of crude oil suggest a tactical opportunity

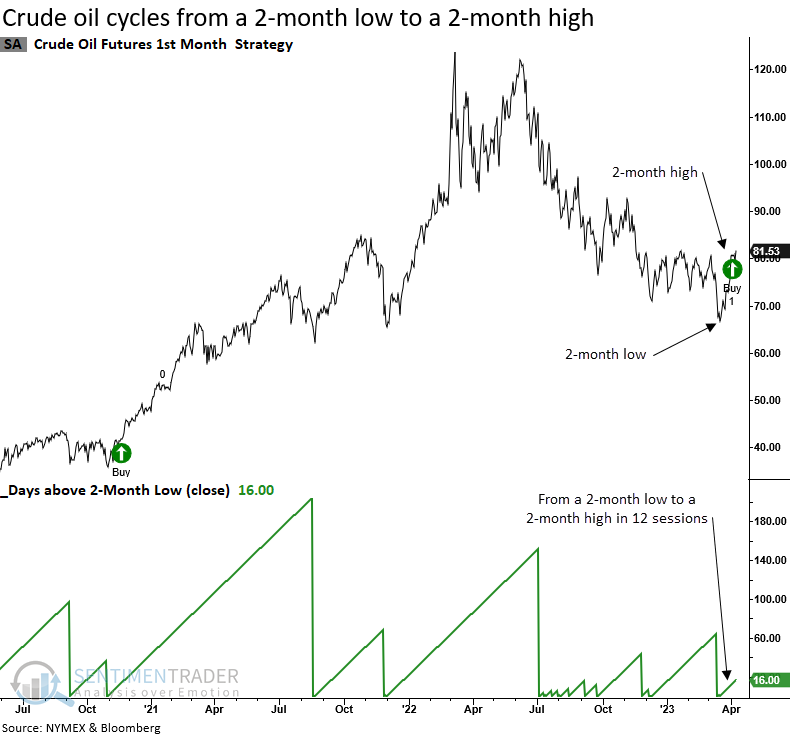

When oil cycles from a 2-month low to a 2-month high in 20 sessions or fewer, the commodity tends to consolidate the gains over the next few weeks. After the brief pause, the one and two-month time horizons show excellent returns, win rates, and z-scores.

Results look even more favorable when a signal occurs with crude oil down more than 30% from a 2-year high, which is the case now. Two months later, oil was higher 80% of the time, with a median gain of 16.9%.

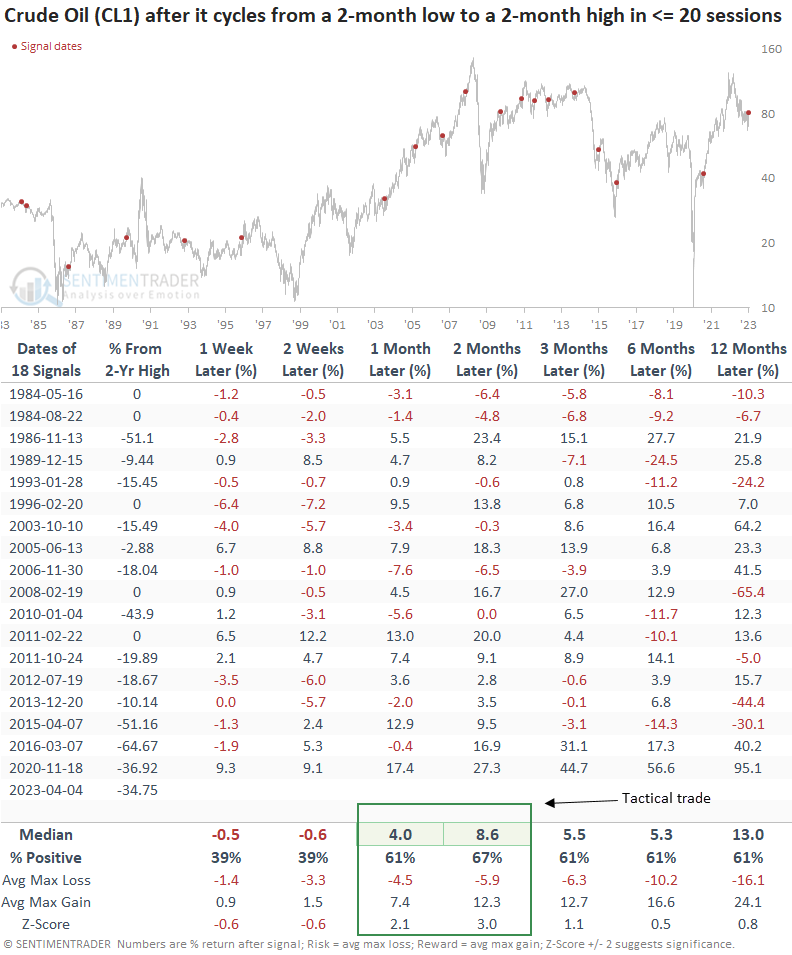

The reversal in oil hurts most sectors, including energy, over the next month. After the initial adjustment to higher energy costs, stocks resume an upward bias. The sweet spot for the energy sector comes in the three-month time frame.

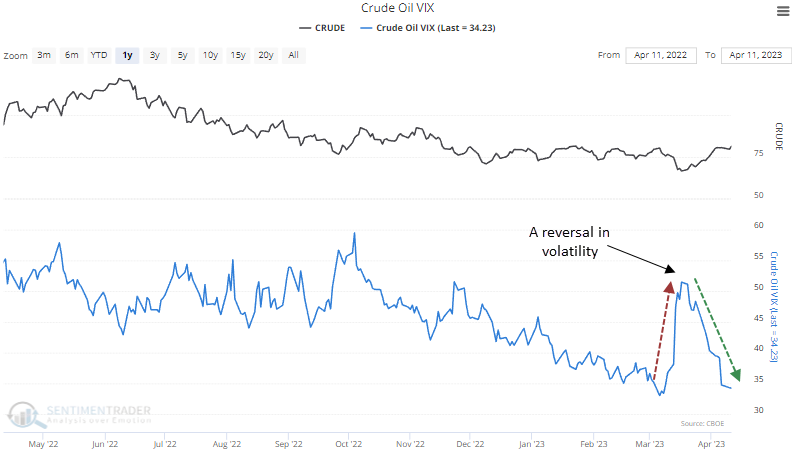

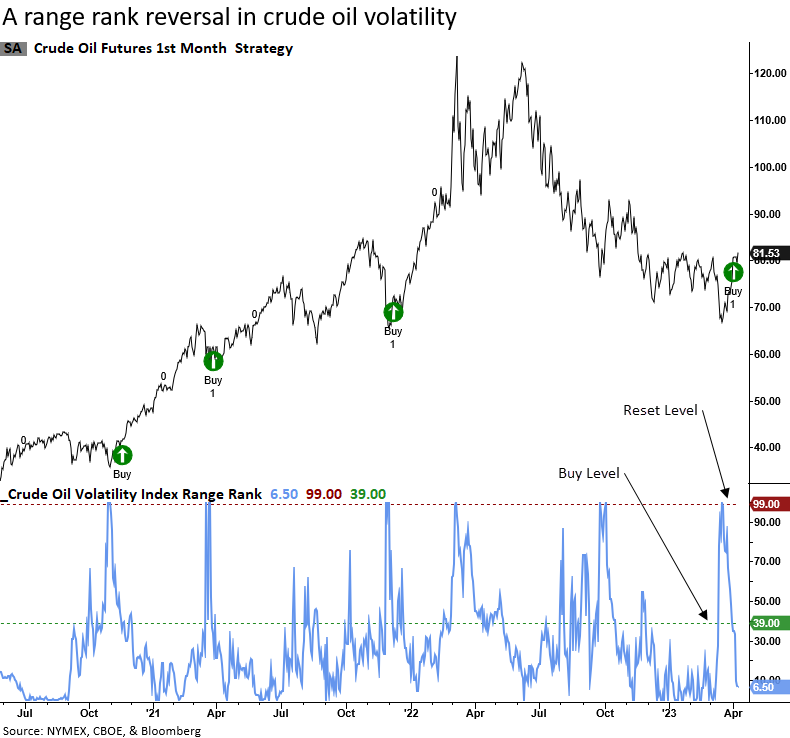

A bullish reversal in the Volatility Index for crude oil

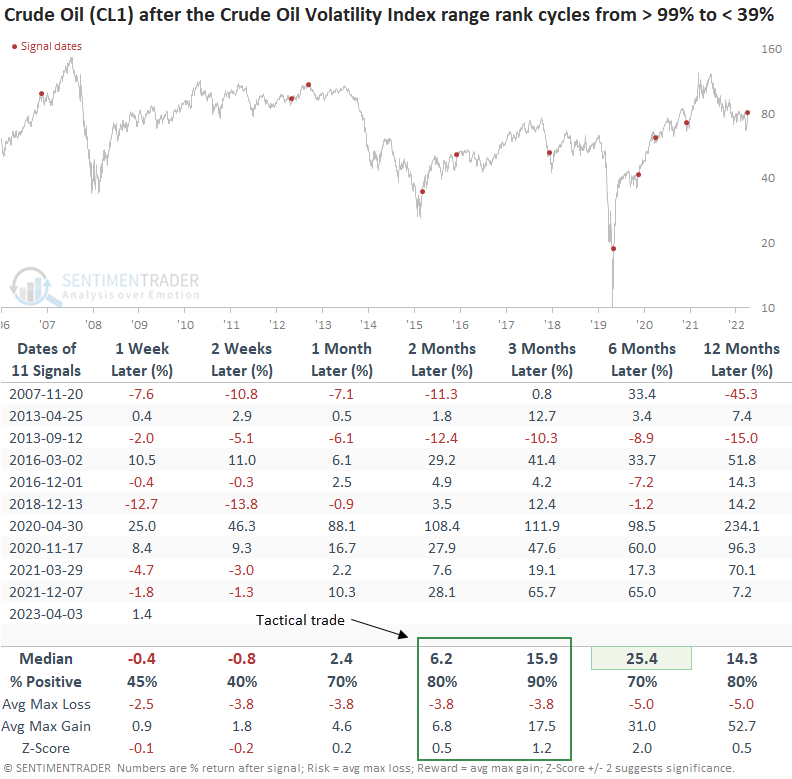

The Crude Oil Volatility Index (OVX), equivalent to the CBOE's Volatility Index (VIX) for the S&P 500, surged higher and subsequently reversed lower, triggering a buy signal for crude oil.

I apply an 84-day range rank to the Crude Oil VIX. After the range rank increases above a reset level of 99%, the system generates a buy signal when the indicator falls below 39%, and oil exhibits positive price momentum.

Like the price reversal signal, crude oil pauses for a few weeks after the volatility range rank alert. Once the pause ends, oil takes off with excellent results in the two and three-month windows.

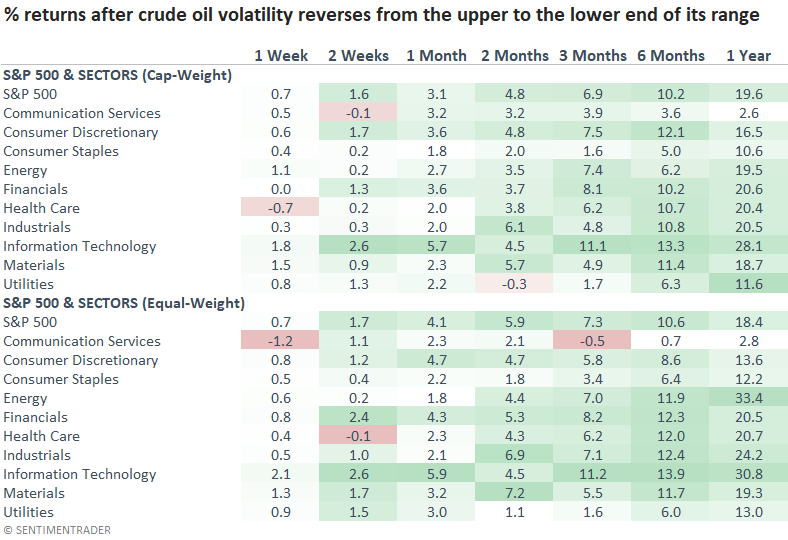

The reversal in the Crude Oil Volatility Index had very little if any, impact on stocks. We must remember the volatility series has a limited history and that most of the study period occurred in a bull market for stocks.

Interestingly, the energy sector lagged behind the broad market across most time frames.

What the research tells us...

Crude oil remains firmly in a bearish long-term downtrend. Still, the recent reversal in price and volatility measures for oil suggests the counter-trend rally that started in March can continue over the next few months. A tactical trade looks compelling as the recent breakout from a multi-month base provides plenty of support to define our risk reward.