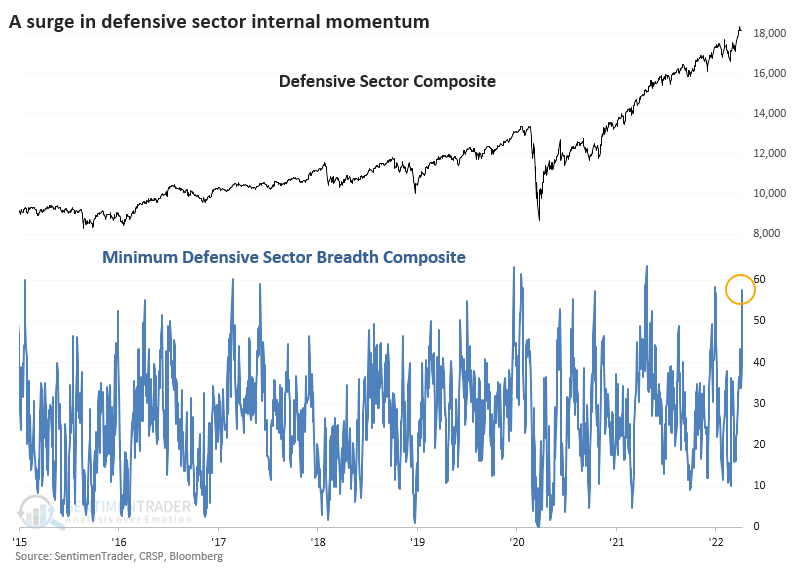

A surge in defensive vs cyclical breadth

Key points:

- The three most defensive sectors have seen a surge in internal participation

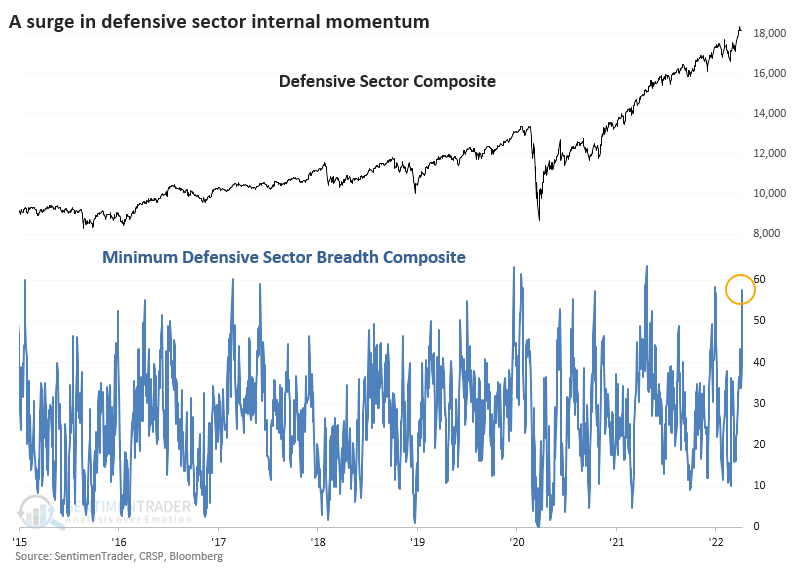

- When breadth has been this good, defensive stocks have tended to underperform the S&P 500

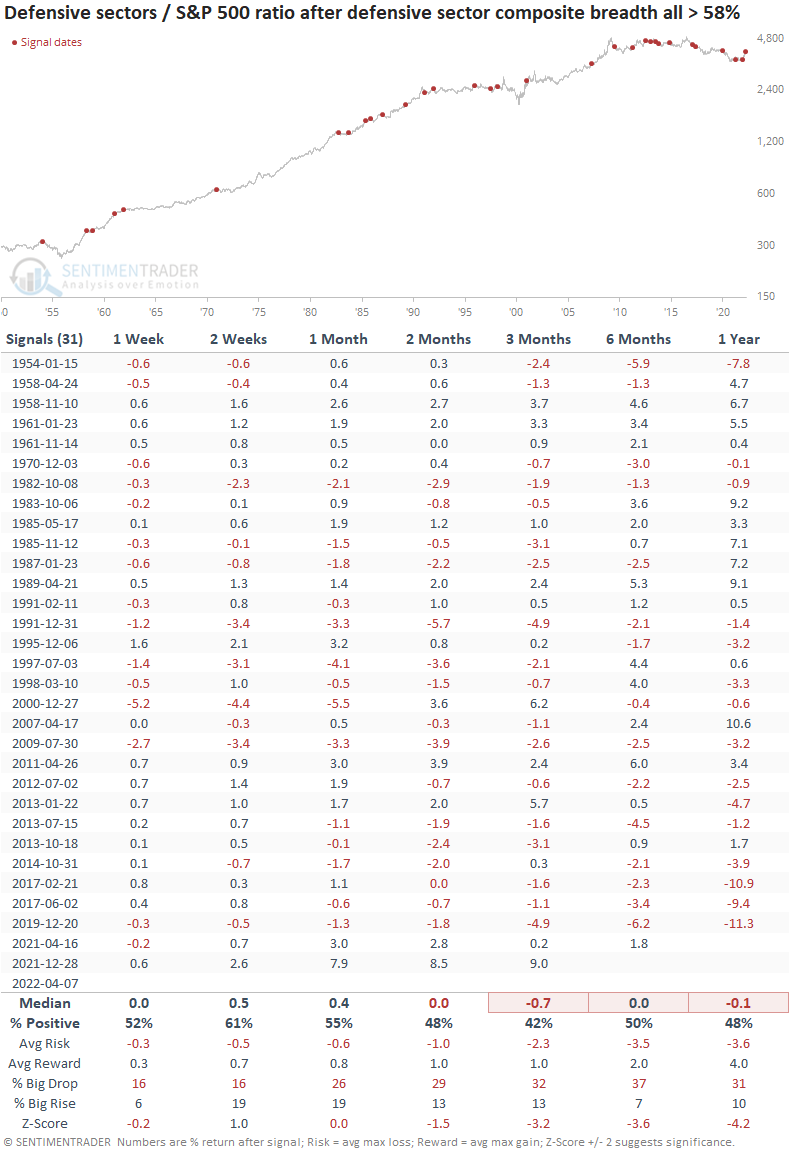

- They have even more consistently underperformed cyclical stocks

Defensive stocks show impressive participation

Utilities have been some of the leading stocks over the past month, a spot usually reserved for more exciting sectors. They're not alone, as Health Care and Consumer Staples have done exceptionally well, too. Overall breadth within the three most defensive sectors has been excellent.

As we saw yesterday with Utilities, though, maybe it's been a bit too excellent. Defensive sectors generally don't perform well after a bout of extreme upside momentum. Among the three, Utilities tend to have the worst time after bursts of buying pressure.

Using a similar composite of breadth that we used for Utilities and applied to Staples and Health Care, all three are showing extreme and broa-based participation across indicators.

Unlike what we saw with Utilities, this didn't necessarily mean that the stocks would decline in the weeks and months ahead. But what it did mean was that defensive sectors consistently underperformed the S&P 500.

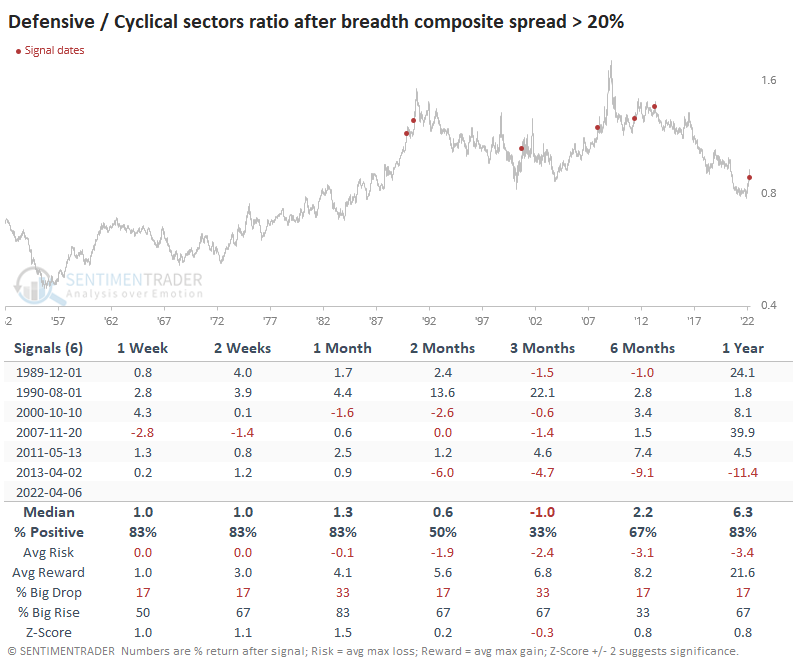

To an even larger degree, defensive sectors tended to underperform cyclical ones. Over the next three months, the defensive factor outperformed the cyclical one only 32% of the time. There were some significant exceptions, including the last signal. But 23 out of 31 signals saw a loss in the ratio at some point between one and three months later.

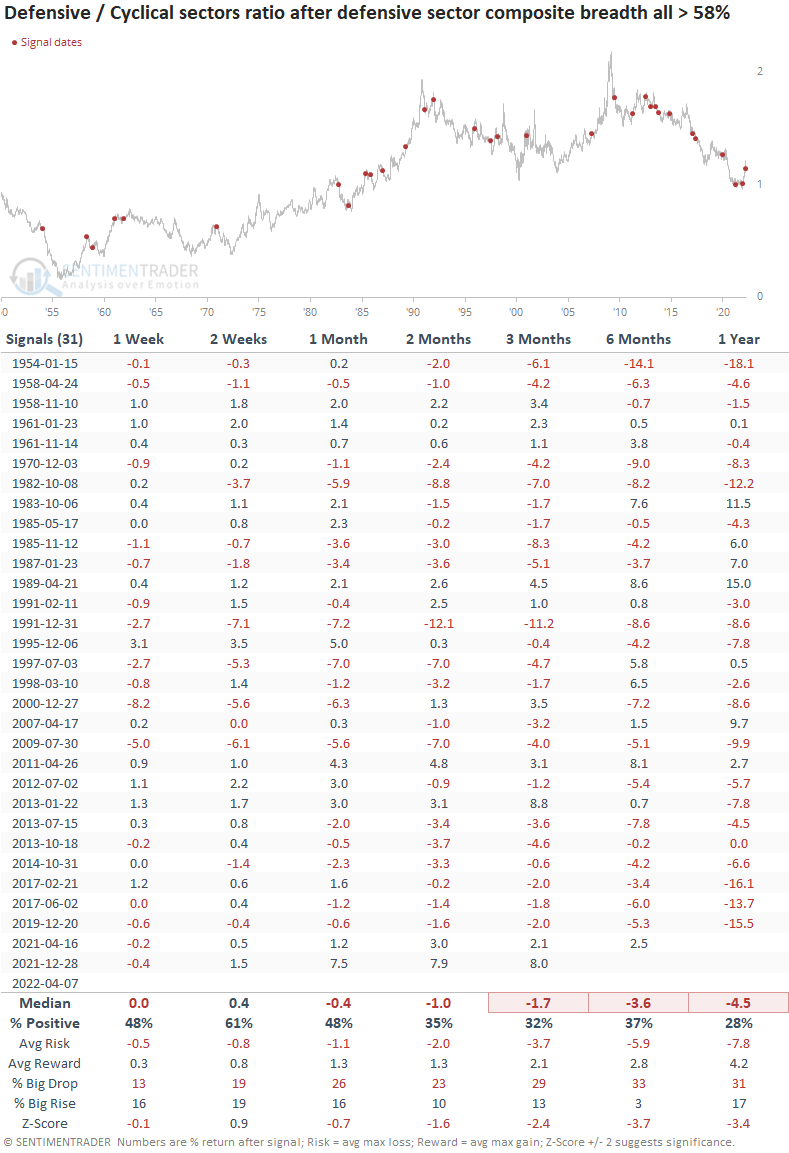

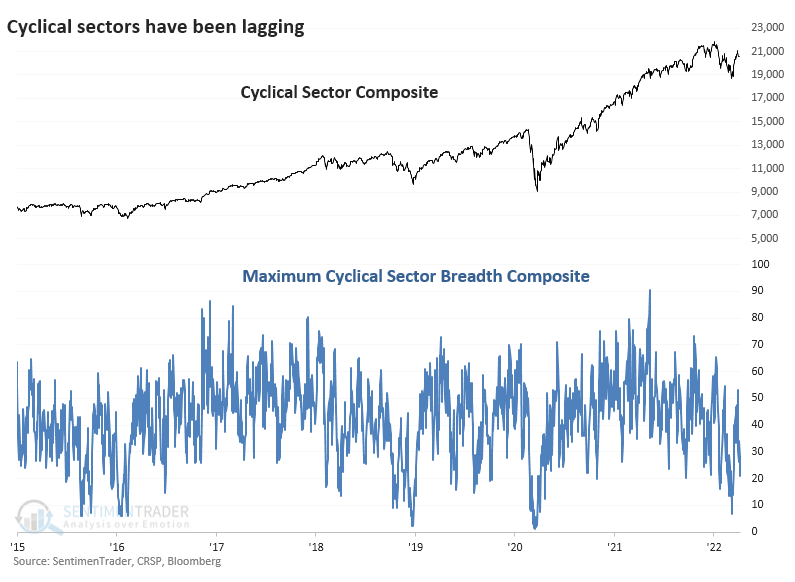

Cyclicals have NOT been surging

At the opposite end of the defensive sectors are cyclicals like Financials, Technology, and Consumer Discretionary. Internal participation in those three sectors has been poor. While it's off the worst levels from March, the last few days have seen the maximum breadth composite among those three sectors fall again.

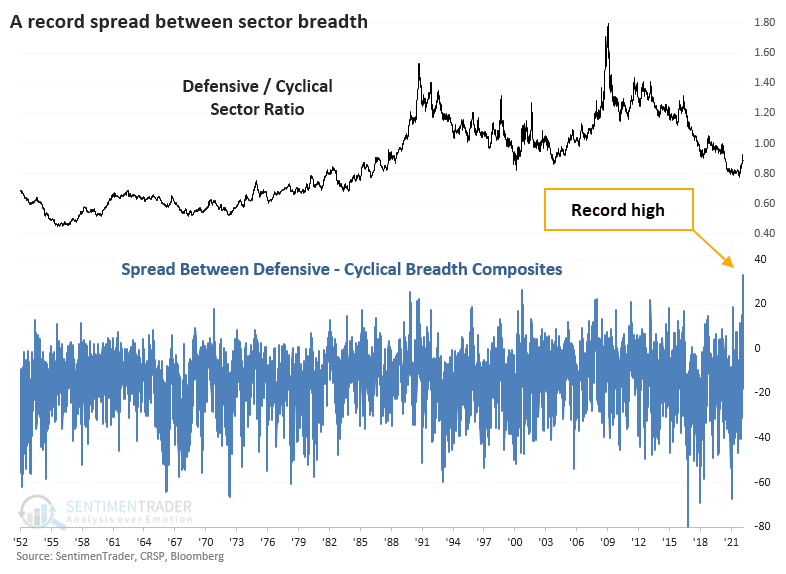

The minimum composite among the three defensive sectors is nearing 60%, but the maximum composite among the three cyclical sectors is plunging toward 20%. That has led to a record divergence between them.

After other high readings, defensive stocks continued to outperform in the short-term but gave back most or all of those gains in the months ahead. A year later, though, defensive stocks had outperformed after all but one signal.

What the research tells us...

Google searches for "recession" are the highest in two years and nearing one of the highest readings since 2004. News articles in the Bloomberg database mentioning "recession" spiked in March, so it's a hot topic in the median and watercooler. Investors have been piling into defensive stocks as a result, which is perfectly logical as those stocks tend to hold up the best during economic contractions. The problem is that when investors pile in to the degree they have over the past month, those returns tend to be poor, or at least worse than cyclical sectors and the broader market.