A small trader retreat...kind of

There seems to be a growing narrative that retail traders have left the market, or at least pulled back greatly, and stocks have held up just fine. The latest stimmy hasn't engaged new investors like the prior rounds did since there's more to do now than sit in the basement and click on tickers that seem to generate profits every day.

Take this Monday headline from the Wall Street Journal, for example.

The article goes on to note:

Individual investors kicked off 2021 at a sprinter's pace. Now, they are finally showing signs of fatigue.

Trading activity among nonprofessional investors has slowed in recent weeks after a blockbuster start to the year, with the group plowing less money into everything from U.S. stocks to bullish call options.

That doesn't really tell the whole story.

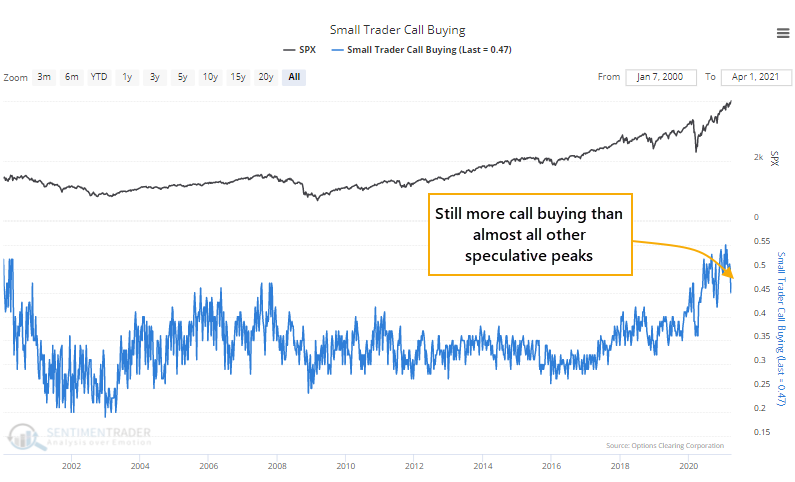

During last week's holiday-shortened sessions, the smallest of traders spent 47% of their volume on speculative call buying. Sure, that's down from 55% in January but it's still higher than any other pre-2020 week in 20 years other than (barely) the peak in 2000.

It's not like they suddenly bought a bunch of protective puts, too. Our ROBO Put/Call Ratio - one of the few ways for investors to see precisely who is doing precisely what - dropped last week and remains mired among the lowest readings in history.

| Stat Box For the 16th time in its history, the S&P 500 ETF, SPY, gapped up by more than 0.5% and added more than 0.5% to its gains intraday while hitting a new high. These "gap and go" setups typically didn't "go" all that much, with all but one of them closing the gap eventually. |

What else we're looking at

- A more detailed look at small-trader call vs put buying last week

- Including all options strategies, and relative to overall volume levels, small traders clearly still have a bias

- Taking a look at a crude oil ETF and its performance in April

- Going back further, a major energy fund shows a distinct pattern at this time of year

- Updating a signal on copper