A small-cap surge of historic proportions

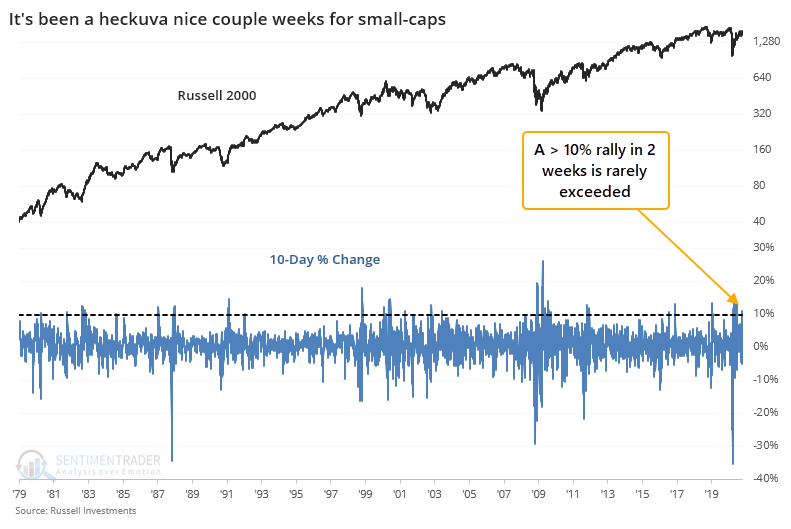

It's been one heck of a nice couple of weeks for small-cap stocks. As recently as a few weeks ago, there was a lot of talk about their relative weakness and how they tend to lag during Q4. Not so much anymore.

Over the past two weeks, the small-cap Russell 2000 has surged more than 11%, one of its largest 10-day gains since inception.

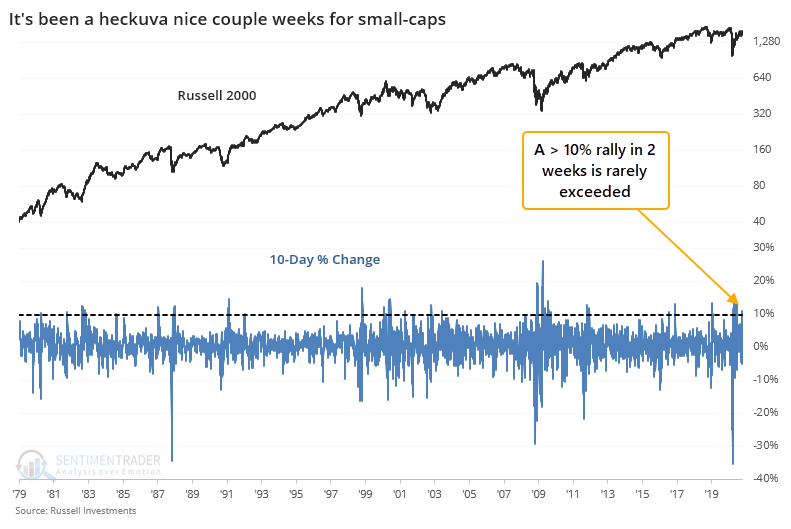

This kind of rebound typically happens after severe weakness, either on a relative or absolute basis. Either way, there have been only 20 distinct times over the past 40 years when the index shot higher by at least 10% over a 10-day stretch.

When buying interest was so intense, it tended to generate even more excitement. During the next month, the Russell never showed a loss, which is remarkable. In addition, there was a 60% probability of a big rise versus only a 5% probability of a big drop (see this Knowledge Base article for a more detailed explanation of terms).

Over the next 3 months, the risk/reward was heavily skewed toward the "reward" side, with a maximum gain that averaged more than 12% versus maximum risk that barely exceeded -1%.

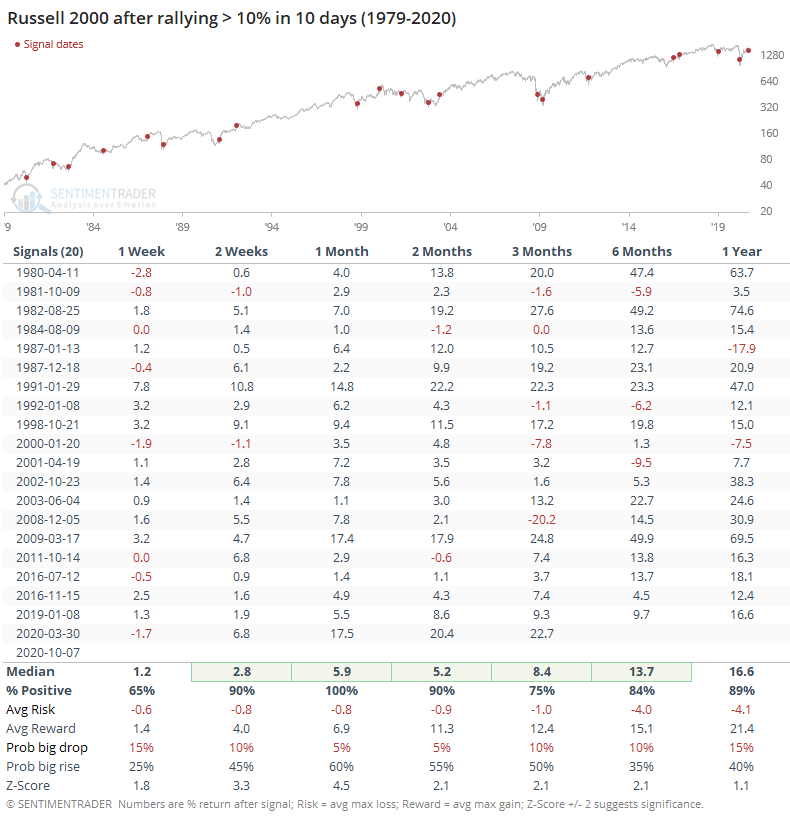

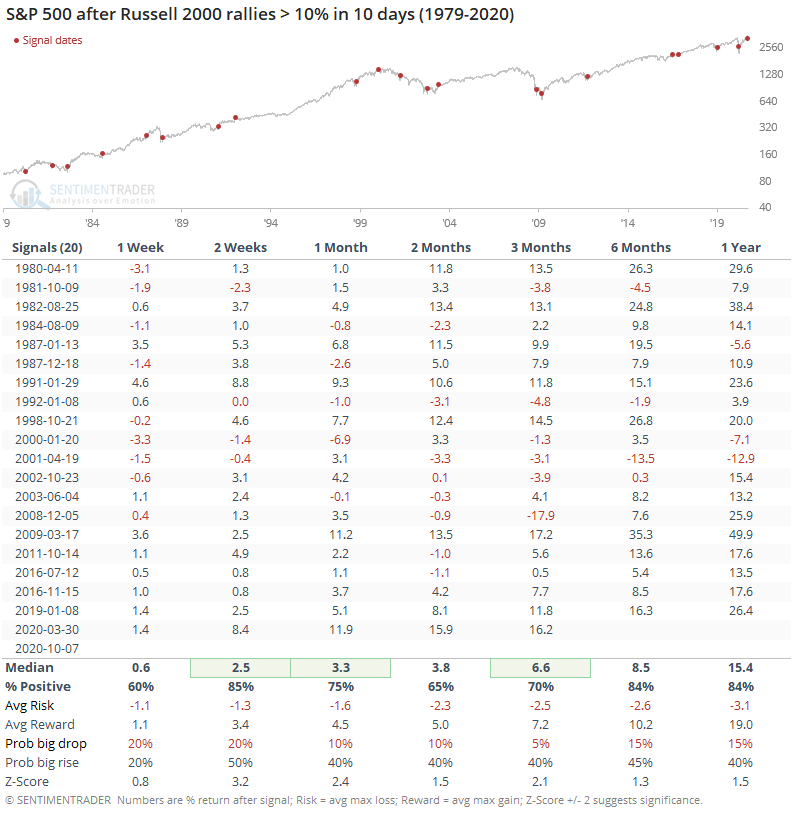

It was a good sign for the broader market, as well, though not as good as for the Russell itself.

The consistency of gains, median return, and risk/reward for the S&P were quite good across all time frames, and the probability of an abnormally large rise was about 3x greater than the probability of an abnormally large loss. That didn't mean there were no losses, though - it would have hurt pretty good in 2001 and 2008.

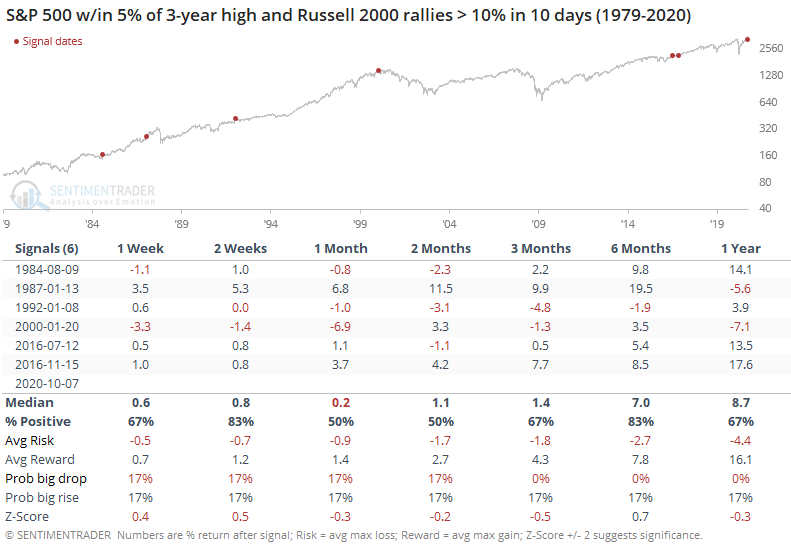

There were only a handful of times this happened when the S&P was within 5% of a multi-year high.

Again, this didn't prevent any losses at all, but they were at least contained. In 2000, it ultimately rolled over into a protracted bear market, but not before stocks rallied for months.

The strength in small-caps is why we're also seeing a surge in some of the breadth metrics. Those, too, have boded well for future returns.