A simple trading strategy for QQQ using Social Sentiment

Over the weekend, I was asked to take a look at strategies for the QQQ ETF using our QQQ social sentiment indicator.

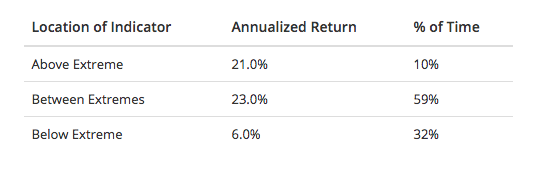

Before I start doing any development on a strategy, I like to first look at the threshold returns of the indicator at question to determine if there's enough returns to work with in the strategy. The QQQ Social Sentiment threshold returns (shown in Table 1) show some decent for extremes, so its definitely worth diving into a few simple strategies with his indicator to see what we can see.

[caption id="attachment_1105" align="aligncenter" width="544"] Table 1: QQQ Social Sentiment Threshold Returns[/caption]

Table 1: QQQ Social Sentiment Threshold Returns[/caption]

When looking at strategies for indicators, I like to start simple so I built the simplest strategy that I could. For this strategy, the rules are:

- a buy signal is given when the QQQ Social Sentiment indicator closes above a Pessimistic Extreme (2.5). A buy order is placed at the open the day after a signal is generated.

- a sell signal is given when the QQQ Social Sentiment indicator closes below an Optimistic Extreme (0.9). A sell order is placed at the open the day after a signal is generated.

- Commission is a percentage based on the size of the traded shares

- Rather than use a set number of shares, this strategy uses all of the available cash to purchase shares.

- Starting account size is $100K

- Trading dates are: Nov 3 2011 to Jan 6 2017 (all available dates for our social sentiment indicator).

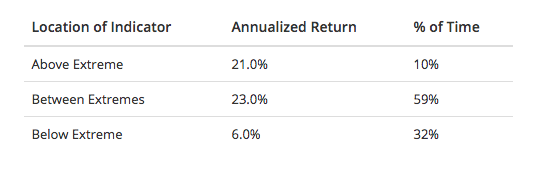

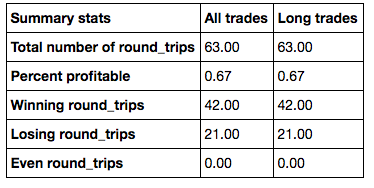

The trading strategy delivers some good results with an 8.48% annual return (without any leverage), 0.68% average per trade return, 1.49% average winning trade return and a 67% win rate. Additionally, drawdowns are fairly well managed with the largest drawdown being 11.66% lasting 53 days.

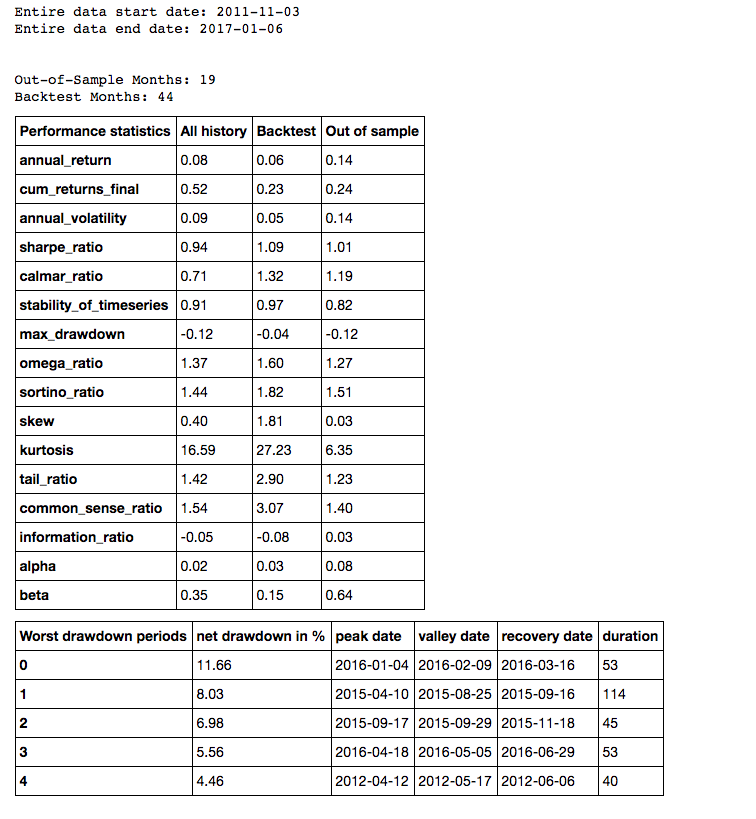

Trade statistics and performance for this trading strategy is provided below.

[caption id="attachment_1104" align="aligncenter" width="374"] Table 2: QQQ Social Sentiment Summary Stats[/caption]

Table 2: QQQ Social Sentiment Summary Stats[/caption]

[caption id="attachment_1103" align="aligncenter" width="464"] Table 3: QQQ Social Sentiment Trade Stats[/caption]

Table 3: QQQ Social Sentiment Trade Stats[/caption]

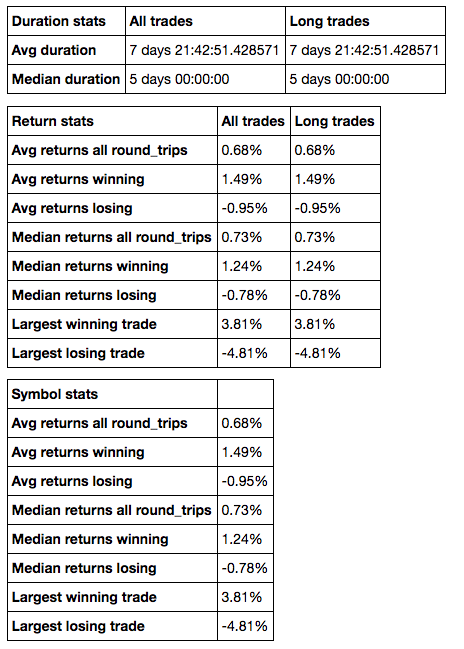

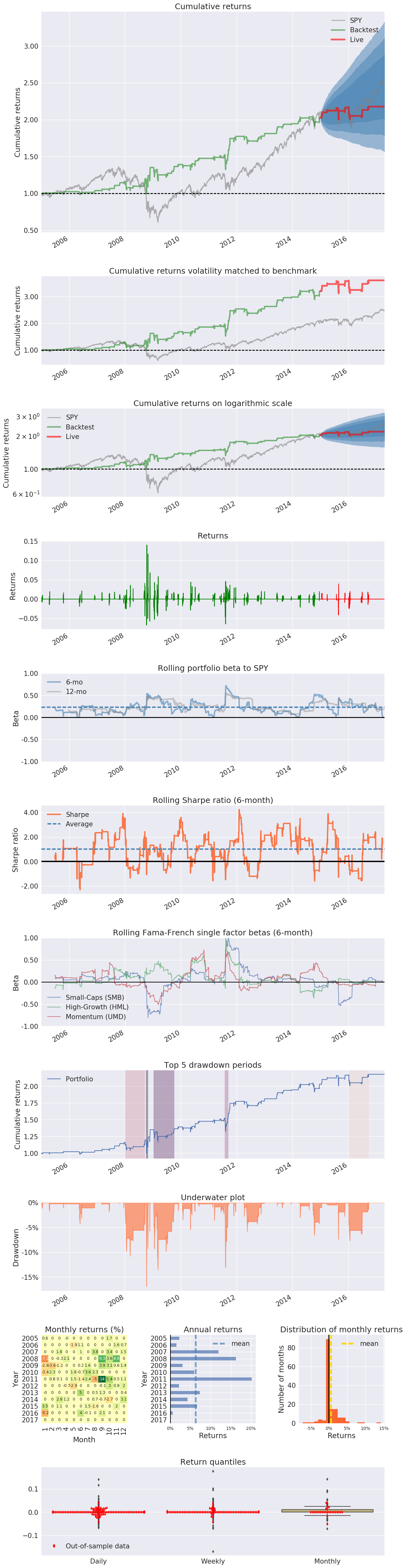

Additional trade statistics and performance graphs are displayed below.

[caption id="attachment_1109" align="aligncenter" width="700"] Table 4: QQQ Trade Statistics[/caption]

Table 4: QQQ Trade Statistics[/caption]

[caption id="attachment_1106" align="aligncenter" width="700"] Figure 1: QQQ Social Sentiment Performance Graphs[/caption]

Figure 1: QQQ Social Sentiment Performance Graphs[/caption]