A significant shift in the interest rate environment

Key points:

- The percentage of Treasury yields closing at a 2-month low increased to 100%

- After similar yield breakdowns, the 10-year bond yield was lower 75% of the time

- Stocks love lower yields, with the S&P 500 increasing 90% of the time a year later

A reversal in bond yields with bullish implications for bonds and stocks

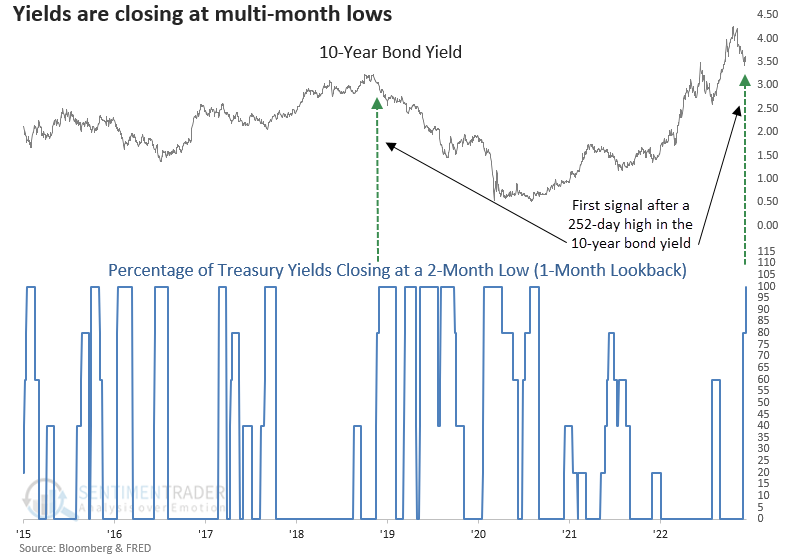

For the first time in more than two years, Treasury yields ranging from 2-10 years closed at a 2-month low in the past month.

The reversal lower in yields follows a period where interest rates across the curve broke out to annual highs at one of the fastest paces in history, which wreaked havoc on bond and stock investors.

Let's assess the outlook for bonds and stocks after 100% of Treasury yields ranging from 2-10 years close at a 2-month low in the past month. I will use a reset condition that requires the 10-year bond yield to close at a 252-day high before a new signal can occur again. The reset provides context as it identifies the first signal after a high, which is the case now.

A multi-month breakdown across the curve precedes falling yields

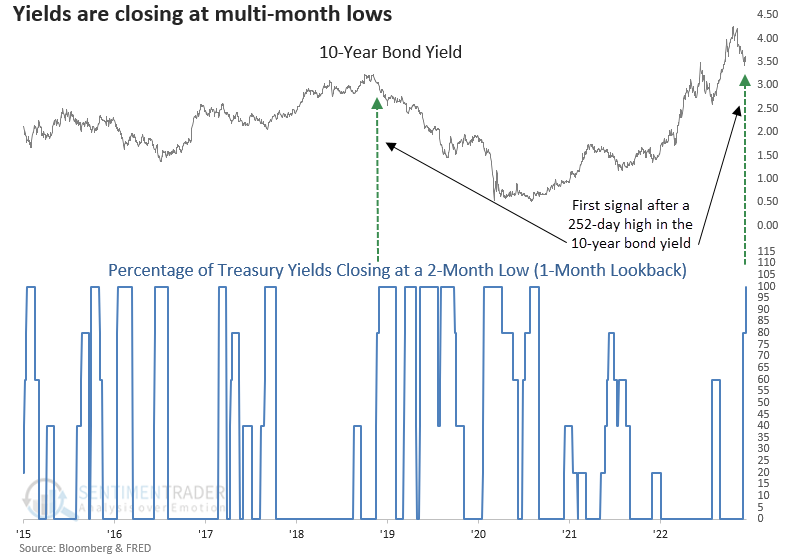

The 2-month low for Treasury yields across the curve provides a compelling case for an easing in the 10-year bond yield. Six months later, rates were lower 75% of the time. Historical precedents during the inflationary 1970-82 period are limited. However, rates were lower in all three instances a month later.

Yields across the curve tend to fall from 1-12 months later. Not surprisingly, long-duration bonds show slightly better win rates.

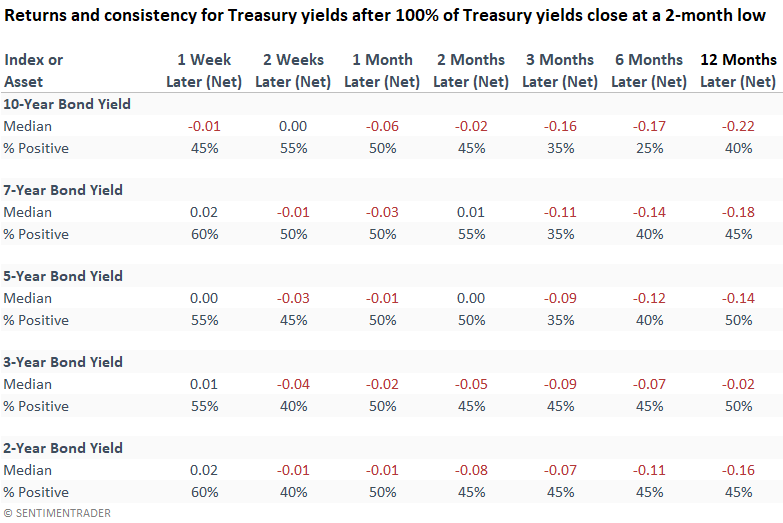

Stocks love the initial easing in yields after a higher rate regime

While a few signals, like 2000 and 2007, are alarming, the overall message from an easing in rates is extremely bullish for stocks. The S&P 500 was higher 90% of the time a year later.

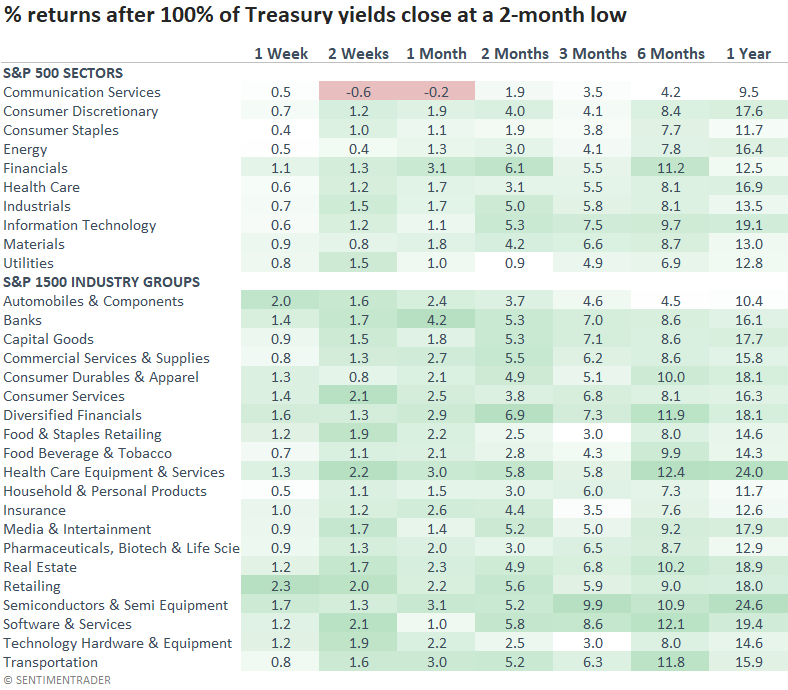

From a sector and industry perspective, Financials and Technology tended to perform the best across most time frames. After a year like 2022, Technology-oriented investors would welcome a rate reprieve.

What the research tells us...

If you haven't noticed, stocks and bonds are taking their cue from the latest inflation data or FOMC member headlines. I try my best to avoid the daily noise and focus on big-picture trends, which I monitor through my models. On Tuesday, we got some potentially good news as yields ranging from 2-10 years have fallen to multi-month lows. The rate regime reversal is bullish for bonds and stocks, especially over the next six to twelve months. Bonds look more compelling if you're in the camp that a recession occurs in 2023.