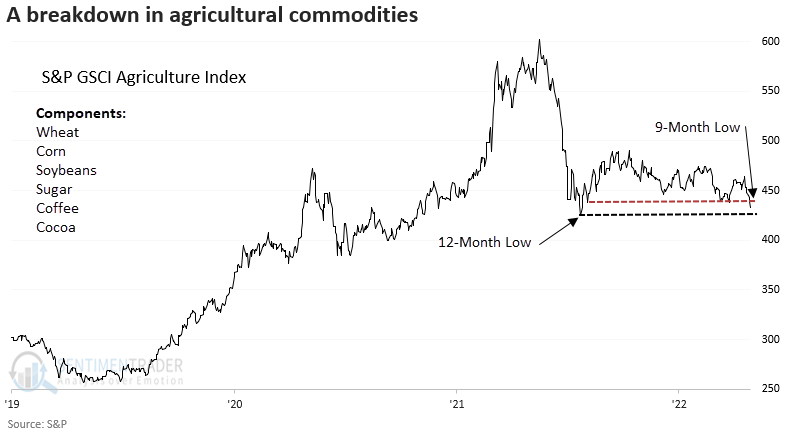

A significant breakdown in an agricultural commodity index

Key points:

- The S&P GSCI Agriculture Index closed at a 9-month low but not a 12-month low

- Similar price patterns preceded negative returns for the Agriculture Index

- Wheat completed a top, and now corn and soybeans look poised to break to the downside

A potential further easing in the grocery bill for some essential items

On Wednesday, I shared a report highlighting a sharp downward shift in price trends for a broad basket of commodities. The deterioration continued on Thursday for several commodities, especially ones in the agriculture category.

The S&P GSCI Agriculture Index, which contains food items like corn, wheat, and soybeans, closed at a 9-month low but not a 12-month low.

With a 1-year low, only a few percentage points lower, agricultural commodities appear to be on the brink of a material breakdown, which would unwind one of the more significant multi-year advances in history for foods we consume daily.

The breakdown in the Agriculture Index comes after the second-best 2-year return for the commodity Index in history.

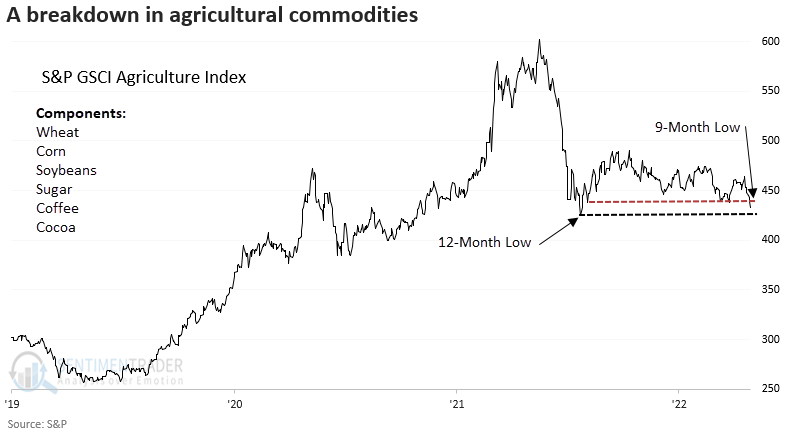

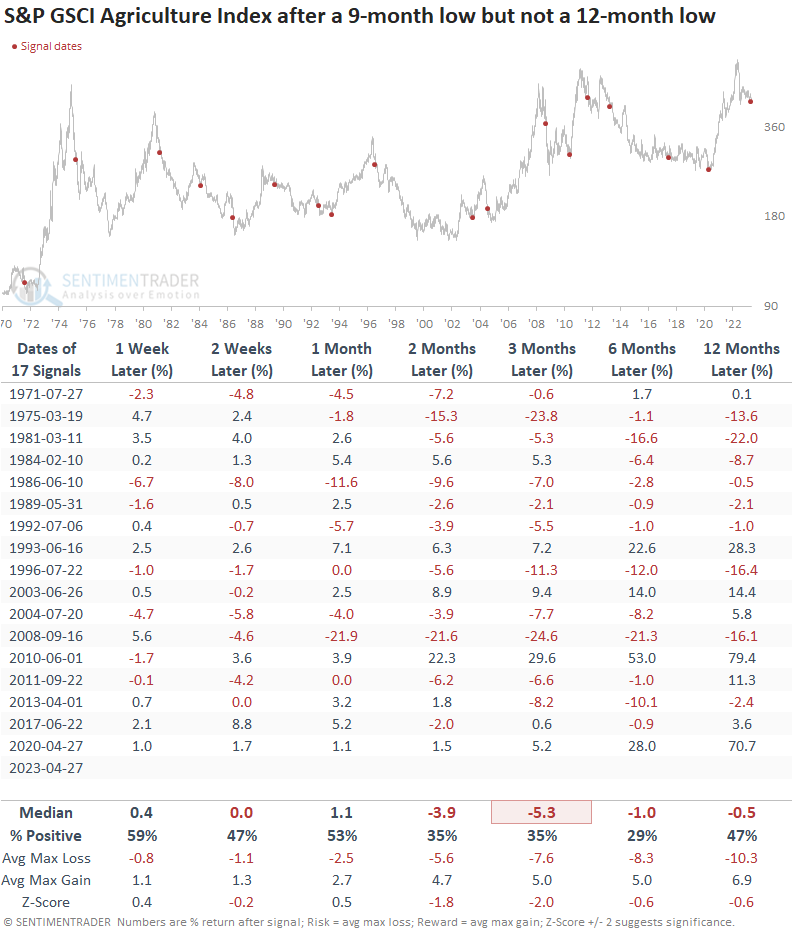

Similar breakdowns preceded negative returns

When the Agriculture Index closes at a 9-month low but not a 12-month low, Index returns are negative across most time horizons. Six months later, the Index was lower 71% of the time, with all precedents but two showing a negative return at some point over that same time frame.

If I isolate signals that occurred after the Agriculture Index increased by 50% or more over two years, the prospects for agricultural commodities are abysmal.

Components on the cusp of a potential breakdown

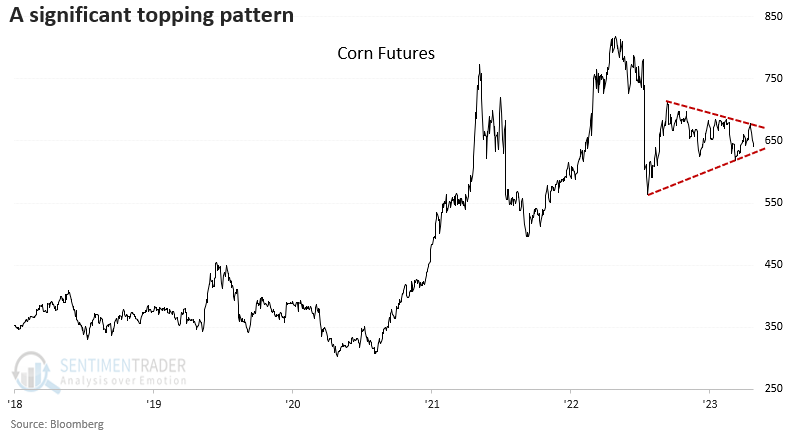

With wheat futures already completing a meaningful top formation, corn looks poised to break to the downside from a multi-month consolidation pattern.

Starting in June, seasonality for corn futures turns negative. So, the weight of the evidence will get worse.

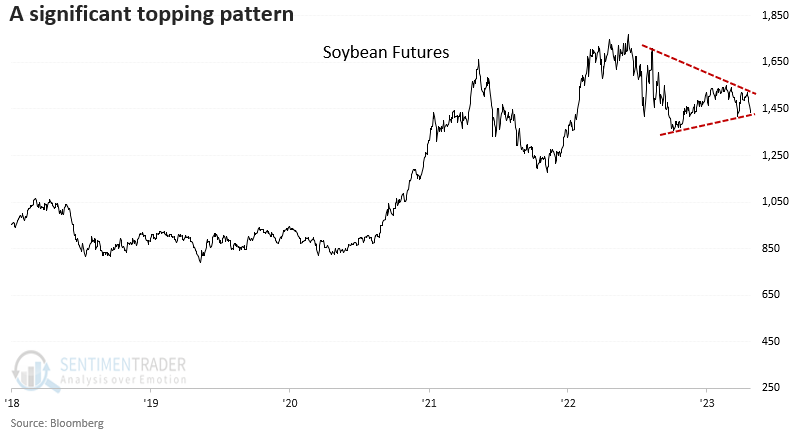

The price pattern in soybeans looks similar to corn, a multi-month consolidation on the cusp of a significant break of support.

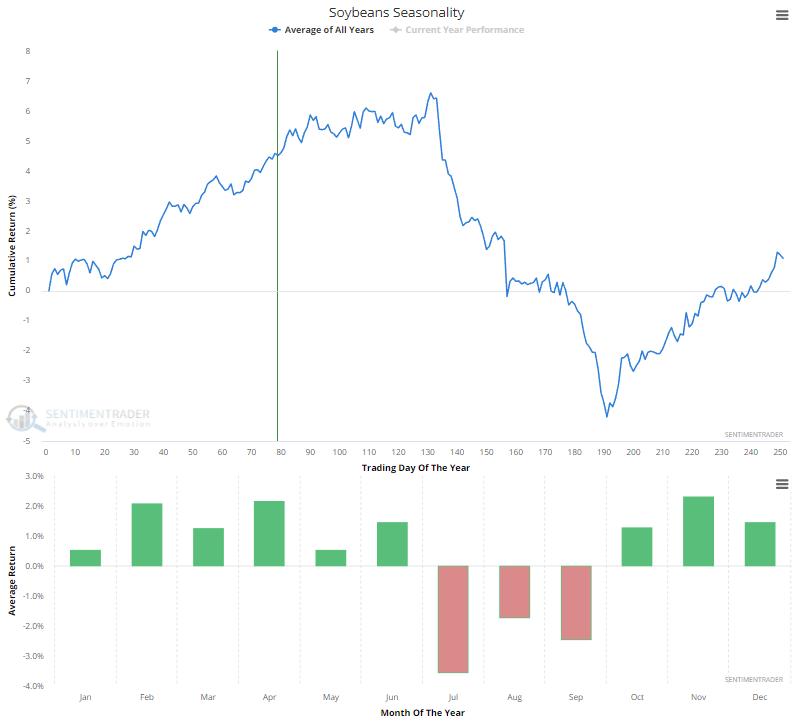

Negative soybean seasonality kicks in a month later than corn, with the worst returns for any month of the year coming in July.

What the research tells us...

Agricultural commodities had a phenomenal run post the covid crash, similar to many other assets. The unwind of that period looks poised to continue as the S&P GSCI Agriculture Index closed at a 9-month low but not a 12-month low. After similar price patterns, the Index showed negative returns across most time frames. The outlook for agricultural commodities looks abysmal when the pattern triggers after a two-year return of 50% or more, like now. Two components of the Index that look poised for a downside break are corn and soybeans, easily accessible for non-futures accounts via an exchange-traded fund like CORN or SOYB.