A shining light amid struggling emerging markets

On Thursday, we saw that Chinese stocks have been struggling, even though some of the indexes have fared okay. Elsewhere in Asia, there's a market that's been doing much better.

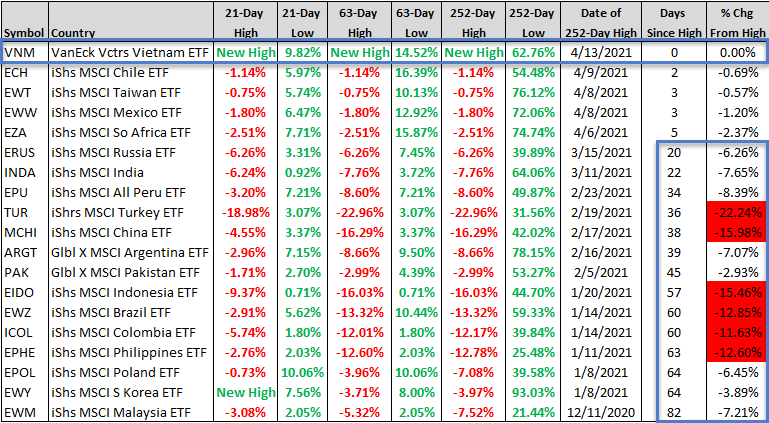

Vietnam is one bright spot in a sea of negative trends that looks interesting. The table below shows a sample of emerging / frontier country ETFs along with their performance versus their most recent 1-, 3-, and 12-month highs and lows.

Vietnam just registered a new 252-day high on Tuesday. Chile, Taiwan, Mexico, and South Africa all remain within five days of a 252-day high. As far as the rest of the countries, the last two columns highlight how several ETFs remain well below the previous peak in terms of both duration and percentage.

Vietnam is a shining light in an otherwise weak environment for emerging market countries as measured by absolute and relative trends. As always, the U.S. Dollar Index has a lot to say about these trends, too.

| Stat Box For the 1st time in more than 50 sessions, gold closed above its 50-day moving average. When it crossed above this average following at least a 6-month low, gold's median return over the next 3 months was only -1.1%. |

What else we're looking at

- A more in-depth look at country trends and breadth within Vietnam

- What Wall Street strategists are saying about the S&P 500's prospects for 2021

- Looking at forward returns following a thrust in economic and consumer economic gauges

- What it means when Q1 price action behaved the way it did in the S&P 500