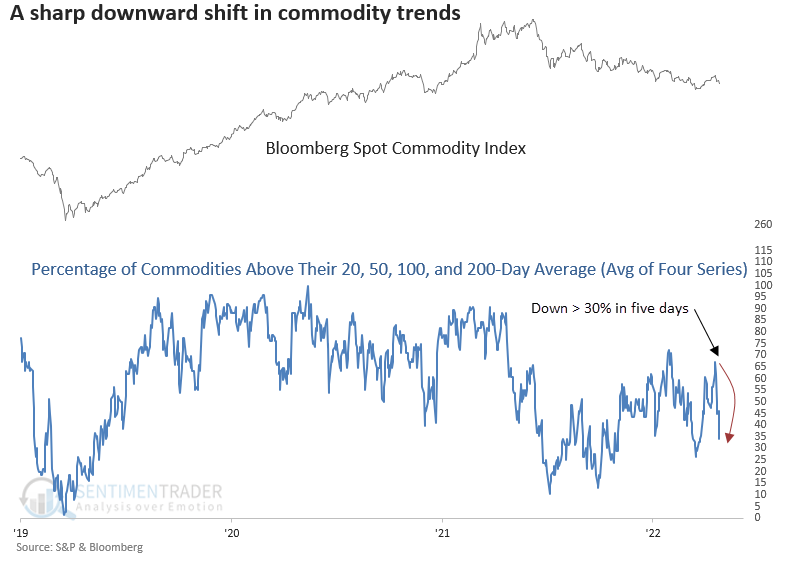

A sharp downward shift in commodity trends

Key points:

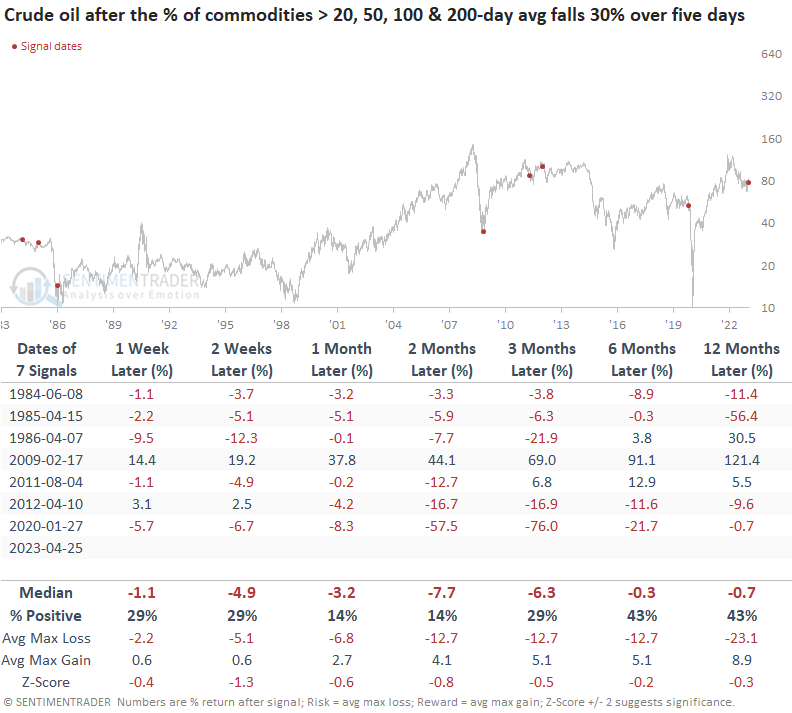

- A breadth composite for commodities declined by more than 30% in five days

- Similar downshifts in price trends led to unfavorable returns over the next three months

- When trends cycle downward near a high, commodity returns are even worse

After a brief bounce, the downtrend in commodities looks set to resume

A composite, which combines the percentage of commodities trading above their 20, 50, 100, and 200-day average, declined by more than 30% over the last five days.

For perspective, the prior downward shift of this magnitude occurred during the Covid crash in January 2020.

With the Dollar Index (DXY) in a downtrend, which tends to be bullish, other factors like slowing economic growth are impacting commodity trends.

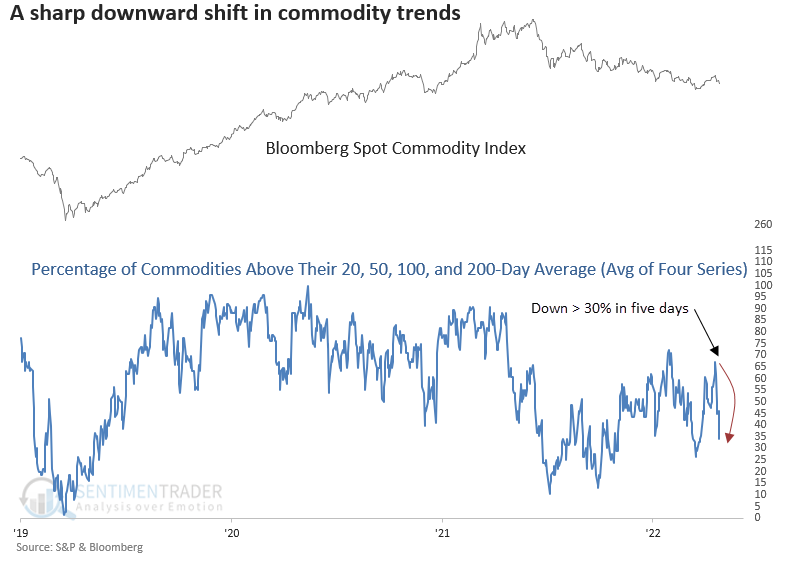

The composite does not include gold and silver. And the signal includes two additional conditions for context similar to the current environment.

Additional Signal Conditions:

- The percentage of commodities above their 200-day average < 42%

- The average for the composite < 42%

Similar shifts in commodity trends preceded negative returns

When the commodity composite falls by 30% or more in five days or less, the Bloomberg Spot Commodity Index tends to decline on a consistent basis over the next three months. Recent signals look more alarming

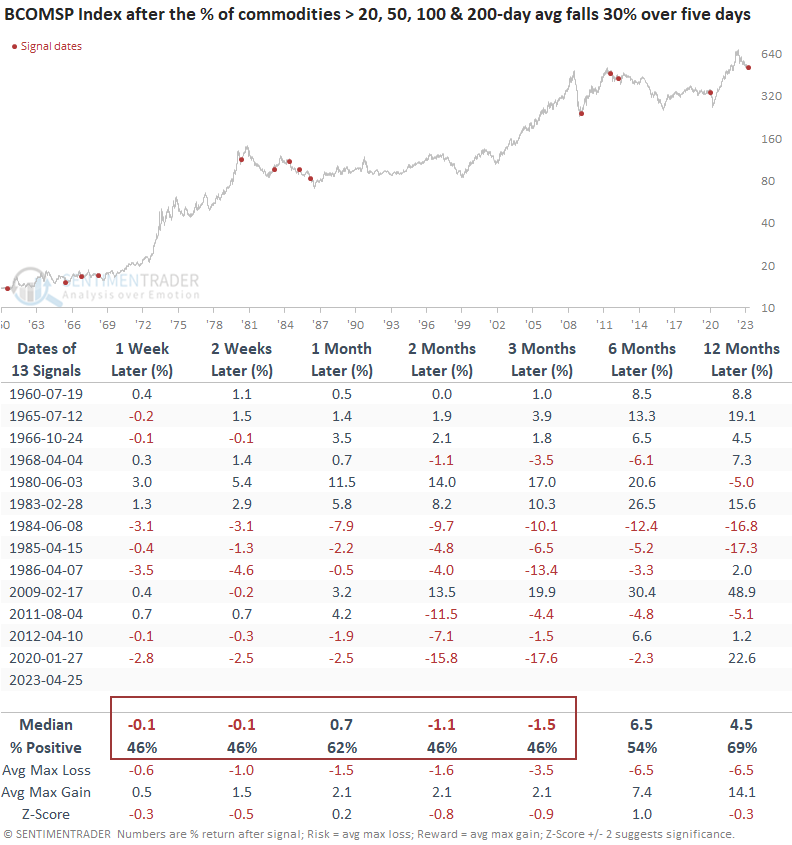

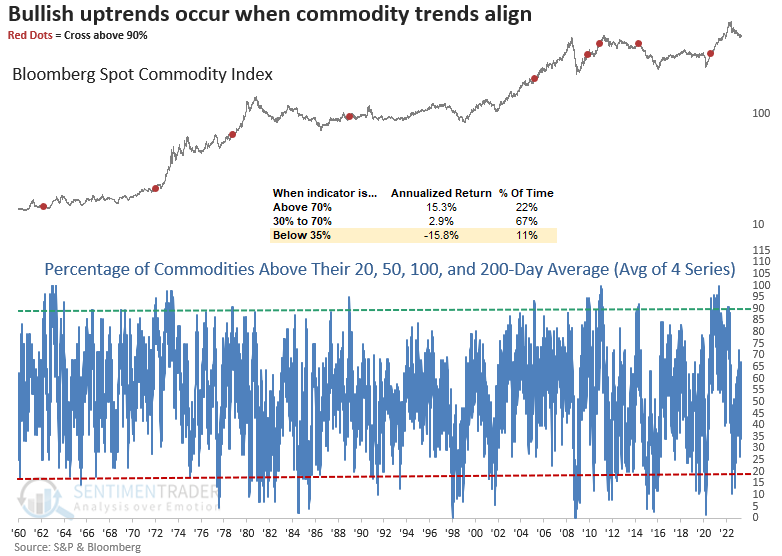

The new signal occurred five days after a 6-week high for the Bloomberg Spot Commodity Index. Let's add that context to the original conditions. However, I must adjust the net change from -30% to -20%. Otherwise, the sample size is only two alerts.

When the composite cycles downward near a high, returns and win rates for the Commodity Index look worse across all time frames. The previous signal occurred right after the significant rally from June to August 2022, which coincided with a broad selloff in risk assets.

In a previous note, I shared a bullish reversal signal for crude oil. The tactical trade idea suggested oil could initially struggle before moving higher. Now that commodity trends have reversed, that trade looks less compelling.

Due to data limitations, the crude oil outlook table contains fewer signals.

What excites me about a broad-based allocation to a Commodity Index/ETF?

Investors thinking about an allocation to a broad-based Commodity Index/ETF would be better off waiting for price trends to align in unison.

The Bloomberg Spot Commodity Index returns are excellent when the composite averages 70% or greater. And a cross above 90% typically indicates a secular uptrend.

What the research tells us...

A composite, which measures price trends across multiple horizons, declined by more than 30% over a five-day period. After similar downshifts, the Bloomberg Spot Commodity Index struggled over the next three months. The outlook is even more unfavorable when a signal occurs near a high.