A seasonally weak period for unleaded gas and CRB Index - does it matter?

Key points

- Unleaded gas and the CRB Index are entering their weakest seasonal periods of the year

- This DOES NOT mean that commodities in general - and gasoline, in particular, are headed lower in the months ahead, only that traders should be alert for that possibility

- Price action is always more critical than seasonality

Seasonality versus price action

Some people try to confer magical power upon seasonal patterns. Others dismiss seasonality altogether as a market factor. The answer might be somewhere in the middle. Essentially, seasonality tells us "when to look where." In other words, it is much like any other indicator. The beginning or end of any typically favorable or unfavorable seasonal period should NOT be considered an automatic buy or sell signal. The beginning of a favorable seasonal period tells us to look for a buying opportunity, and the start of an unfavorable seasonal period simply tells us to look for an opportunity to sell (or sell short).

Suppose a market is already weak at the outset of an unfavorable seasonal period. That can be an opportune time to enter a short position (with a reasonable stop-loss in place). On the other hand, if a market enters an unfavorable seasonal period while price action is strong, it makes sense to wait for price action to cool off and/or form a sort of reversal pattern before playing the short side.

Unleaded gas enters the danger zone

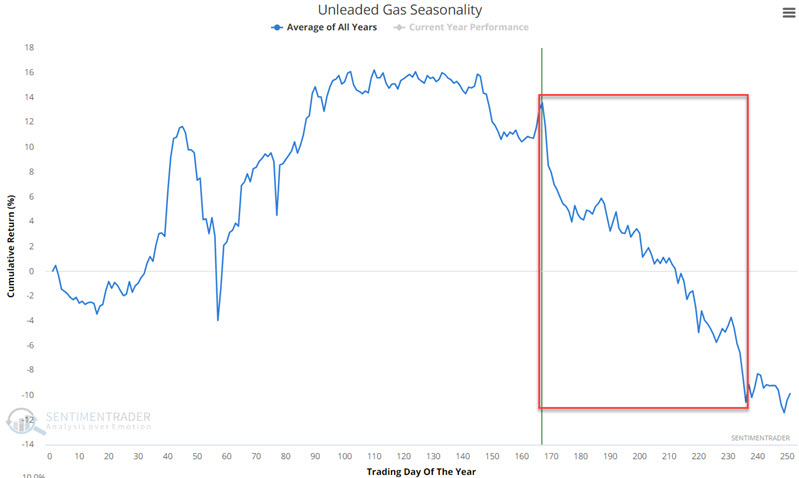

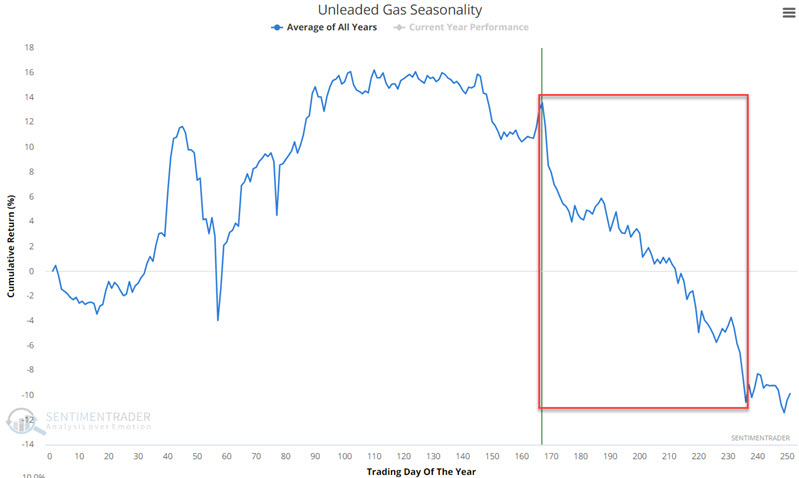

The chart below displays the annual seasonal trend for unleaded gas futures.

The red box highlights the period that extends from the close on Trading Day of Year #167 through TDY #236. For 2023, this period extends through the close on 2023-11-30.

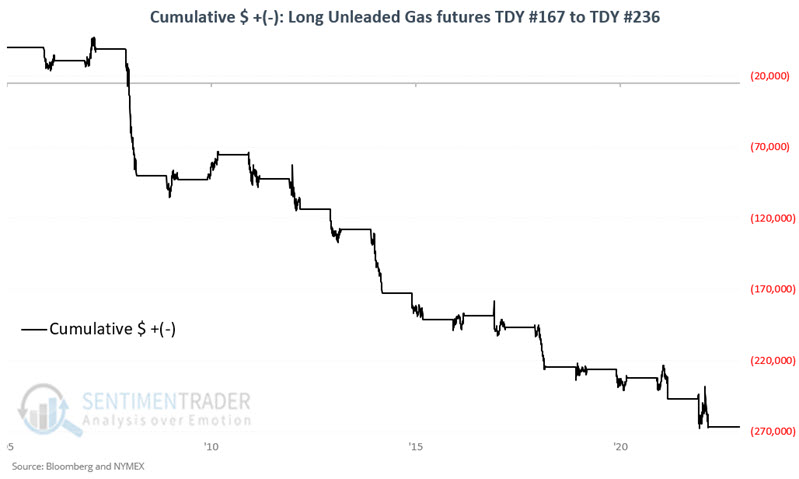

The chart below displays the hypothetical cumulative $ +(-) from holding a long position in unleaded gas futures only during this unfavorable period every year since 2006.

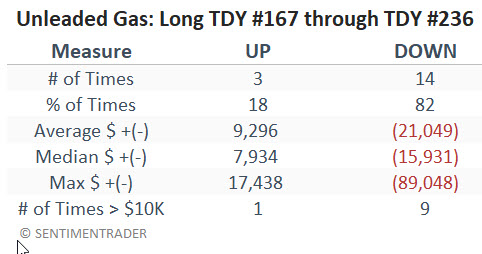

The table below summarizes unleaded gas futures performance during this unfavorable period.

Unleaded gas futures and the U.S. Gasoline Fund (ETF ticker UGA) enjoyed a strong rally from an early May low to a high on 2023-08-11. Since then, they have traded slightly lower. In the meantime, crude oil has continued to surge higher, as has the overall energy stock sector. Given unleaded's strong tendency for weakness during the year's second half, it is reasonable for traders to look for opportunities to play the short side. But deciding when the exact "right moment" to do so is - and applying appropriate stop-loss criteria - is up to each individual trader.

CRB Index is also entering an unfavorable period

The CRB Index is an index based on price changes for a basket of commodities. As I wrote about here, here, here, and here, the potential for substantial gain in commodities - both on an absolute basis and relative to stocks - appears high in the years ahead. Since June 30th, the CRB Index is up +8.7%. That said, commodities as an asset class have shown a historical tendency to experience weakness during the period directly ahead.

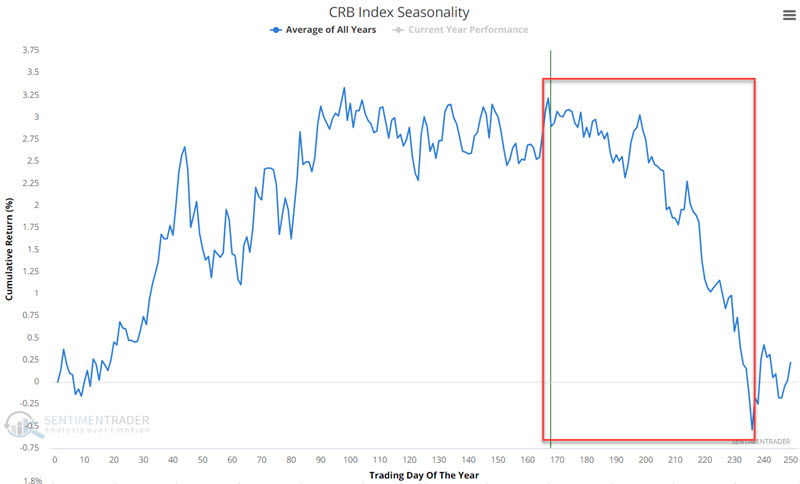

The chart below displays the annual seasonal trend for the CRB Index

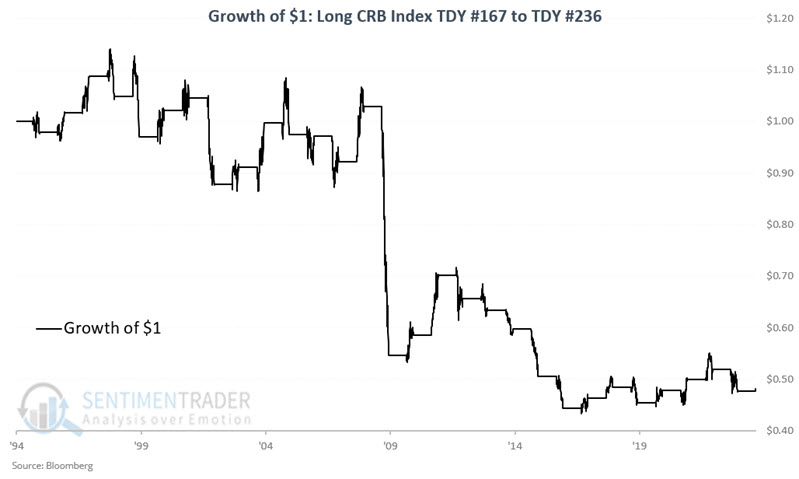

The chart below shows the hypothetical cumulative growth of $1 achieved by holding a long position in the CRB Index only during this unfavorable period every year since 1994.

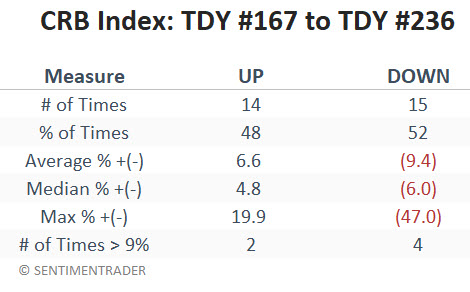

The table below summarizes CRB Index performance during this unfavorable period.

The foremost thing to note in the table above is that whether the CRB Index rises or falls during the TDY #167 to TDY #236 period has essentially been a coin flip (14 times up, 15 times down). What skews the results negative is that the down years have, on average, been much worse than the up years were good. As with unleaded gas, traders might be wary of commodities in the months directly ahead BUT should also be careful not to fight the trend if that trend remains bullish.

What the research tells us…

Seasonality tells a trader what markets to focus on at a given time and in which direction to lean. Historical tendencies tell us to look for an opportunity to trade the short side of unleaded gas and commodities as an asset class. However, with both in established uptrends - and with the current strength in crude oil and the overall energy stock sector - traders should be wary of fighting the current trend and are likely best advised to monitor price action to look for a suitable entry point. Deciding how much capital to allocate, when to actually enter, and when to exit a trade remains the responsibility of each individual trader.