A rising S&P 500 and VIX suggests a consolidation

Key points:

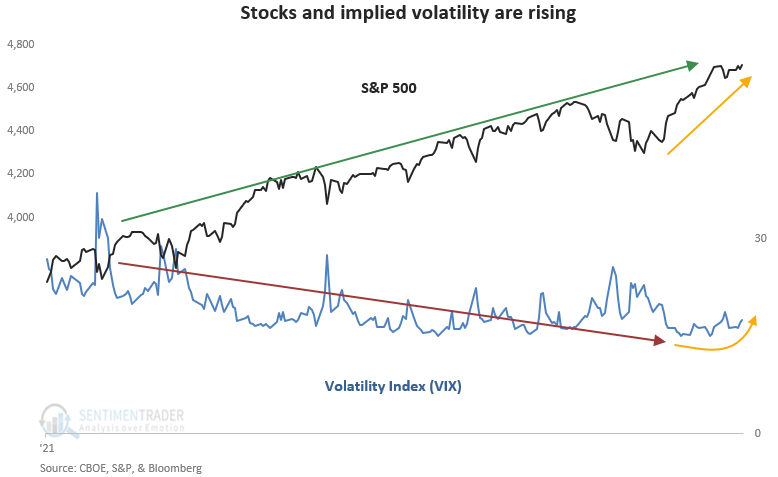

- The S&P 500 Index has recorded 11 new highs in the trailing 20-day period

- The Volatility Index (VIX) has recorded 0 new lows in the trailing 20-day period

- When the S&P 500 and the VIX rise in unison, it suggests a short-term consolidation

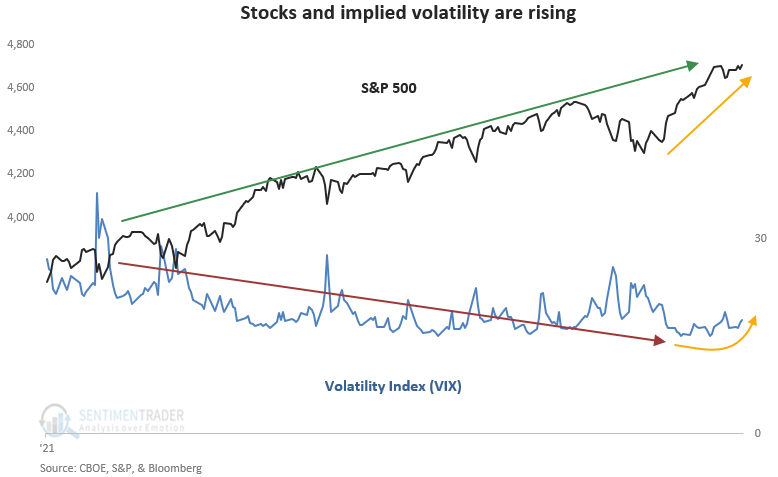

Implied volatility and stocks move in opposite directions

The Volatility Index (VIX) measures the market's expectations for volatility over the coming 30 days. It is often referred to as the fear gauge because it tends to rise when the market declines. Conversely, when stocks rise, the fear gauge falls.

However, there are times when the VIX and stocks rise in unison, which is the case now. It can be a sign of optimism in some circumstances as traders are willing to pay any price to get a piece of the action in a FOMO-driven market. The runup to the January 2018 Volmageddon peak comes to mind.

Let's assess the outlook for the S&P 500 when the S&P 500 has recorded 11 new 252-day highs, and the VIX index has recorded 0 new 63-day lows in a trailing 20-day period.

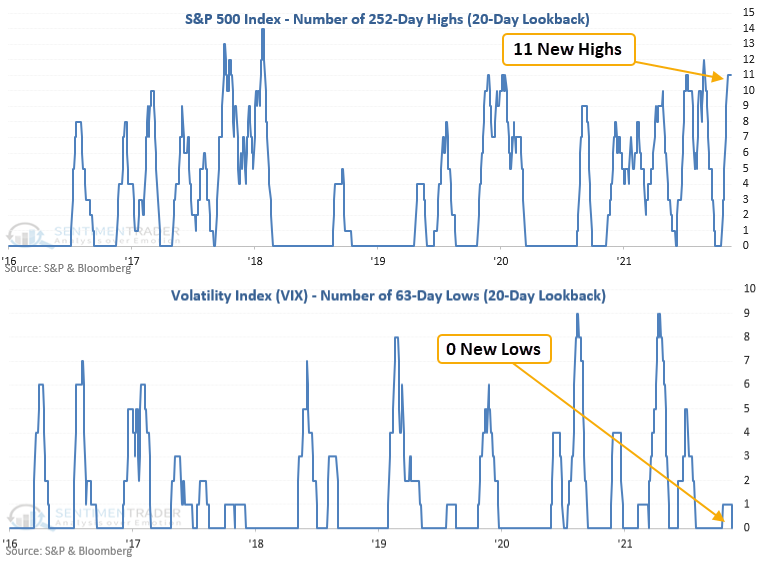

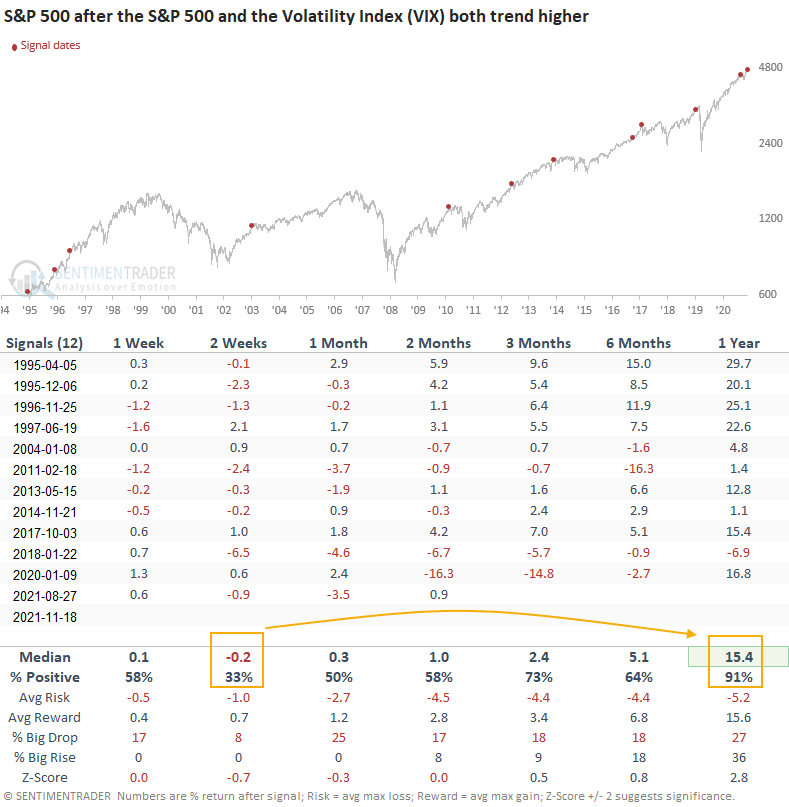

Similar signals preceded short-term consolidations

This signal has triggered 12 other times over the past 27 years. After the others, future returns and win rates were mixed to slightly weak in the short term. However, the long-term results suggest the muddled near-term picture is most likely nothing more than a healthy consolidation.

What the research tells us...

When the S&P 500 and the VIX Index rise in unison over a 1-month time frame, a fear-of-missing-out environment creates an optimistic sentiment backdrop. Similar setups to what we're seeing now have preceded consolidations in the short term. However, the outlook suggests a timeout that refreshes a bullish medium and long-term trend backdrop.