A reversal in uptrends triggers a buy signal for India

Key points:

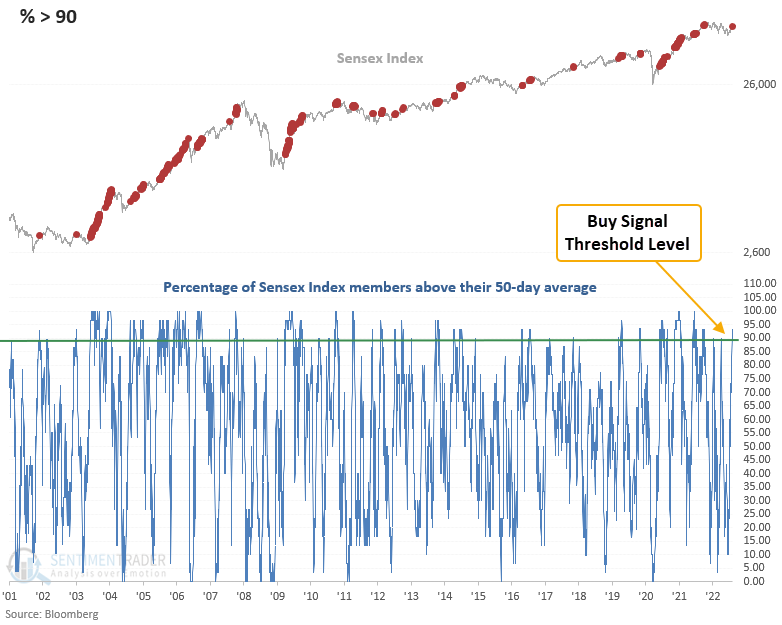

- Sensex Index members trading above their 50-day average increased above 90%

- The surge in medium-term uptrends triggered a new buy signal for stocks in India

- After similar signals, the Sensex Index closed higher 88% of the time three months later

An overwhelming number of Sensex members have positive medium-term price trends

In a recent note, I shared how I use the percentage of index members above their 50-day average to give me the all-clear signal after a bear market. I monitor medium-term price trend thrust signals for several domestic and international indexes, which have been absent until now. This week, the Sensex Index jumped out of the gate with a new alert.

Let's assess the Sensex Index's outlook when the number of members trading above their 50-day average exceeds 90%. I screened out repeats by requiring the indicator to fall below 25% before a new signal could trigger again.

Similar signals preceded gains 88% of the time

This model generated a signal 24 other times over the past 21 years. Forward returns, win rates, and z-scores look favorable, especially in the 3-month window. The alert hit a rough patch between 2010-12 when most emerging market countries struggled due to high inflation and unfriendly central banks. So, we must keep that in mind as the current environment is similar. If we look at the bear markets in 2000-02 and 2007-08, we see only two signals, which were both positive at some point in the first six months. The avoidance of a whipsaw signal during the 2007-08 bear market is why I like this indicator.

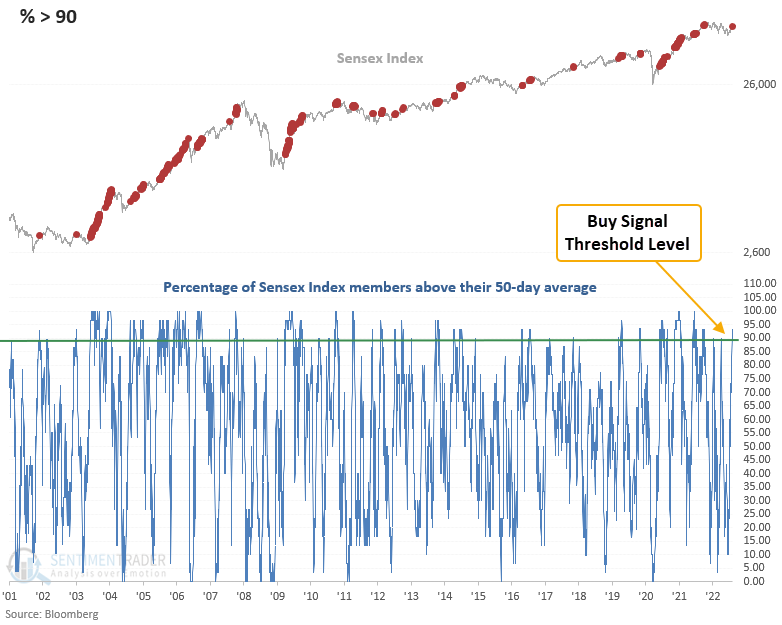

Absolute price trend score improvement

When I apply the Sensex Index to my composite trend model, we see a nice improvement over the last month, with the score reversing from negative ten to plus two. So, the index confirms the internal strength of its members. If you were wondering, the trend score for the S&P 500 currently resides at negative two.

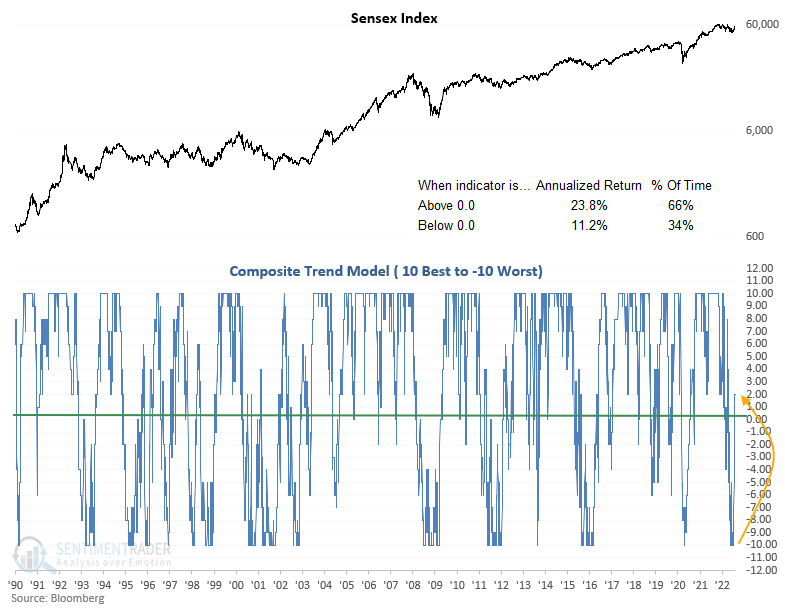

Relative price trend score versus the S&P 500

Suppose I apply the Sensex Index to my composite relative trend score model and compare it to the S&P 500. In that case, we see that it has the best possible relative trend profile. So, the Sensex Index is outperforming the world's most watched benchmark.

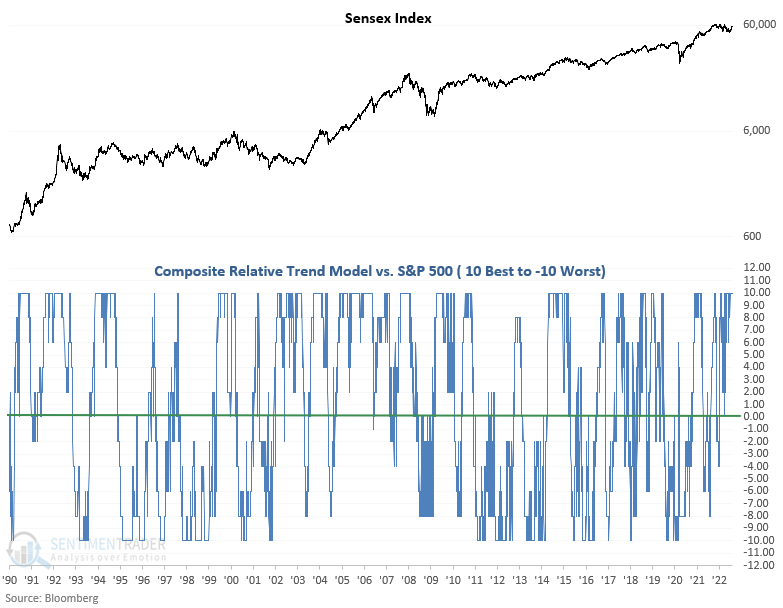

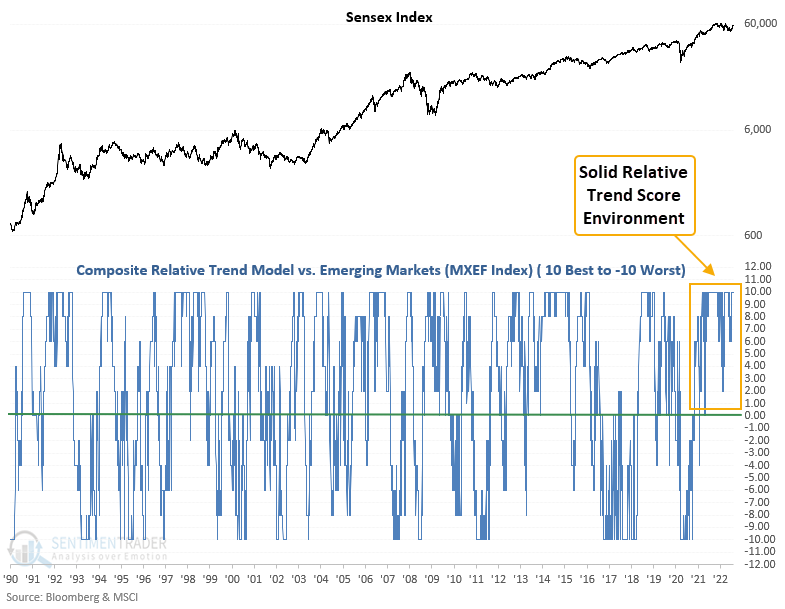

Relative price trend score versus Emerging Markets

The Sensex Index has been a relative winner versus the MSCI Emerging Markets Index for most of the post-pandemic period. Given the new thrust signal, I suspect that trend continues.

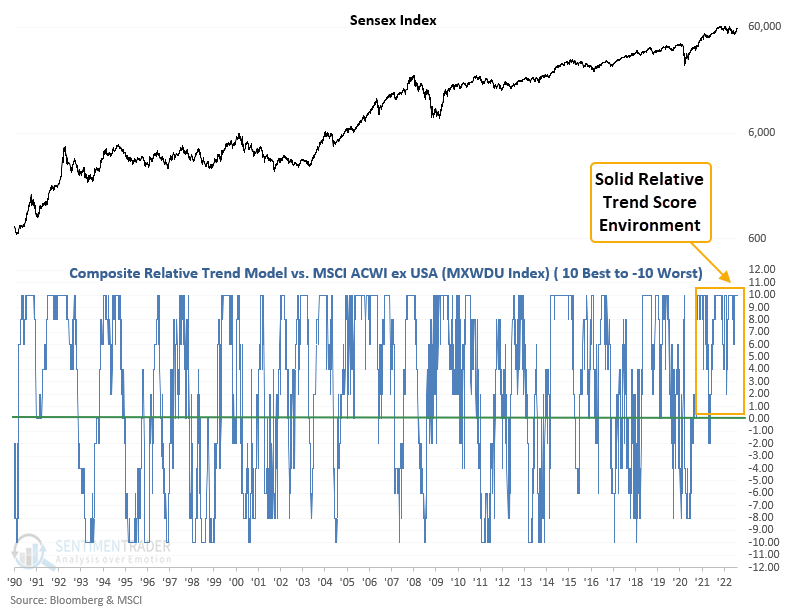

Relative price trend score versus the World ex USA

If we compare the Sensex Index to the MSCI ACWI ex USA, we once again see a perfect relative trend score of ten. India is outperforming on a global basis.

What the research tells us...

When the number of Sensex Index members trading above their 50-day average exceeds 90%, the high level of participation is typically a bullish barometer for future Index gains. The signal shows a favorable outlook across all time frames, especially in the 3-month window where the win rate and z-score are impressive. The Sensex Index has been one of the better performers compared to several global benchmarks. Given the new thrust signal, I would expect the trend to continue.