A reversal in sentiment suggests higher stock prices

Key points:

- The intermediate-term optimism index reversed higher relative to its recent range

- The S&P 500 ETF (SPY) shows a strong tendency to rally after similar patterns

Using the optimism index as a way to measure sentiment regime changes

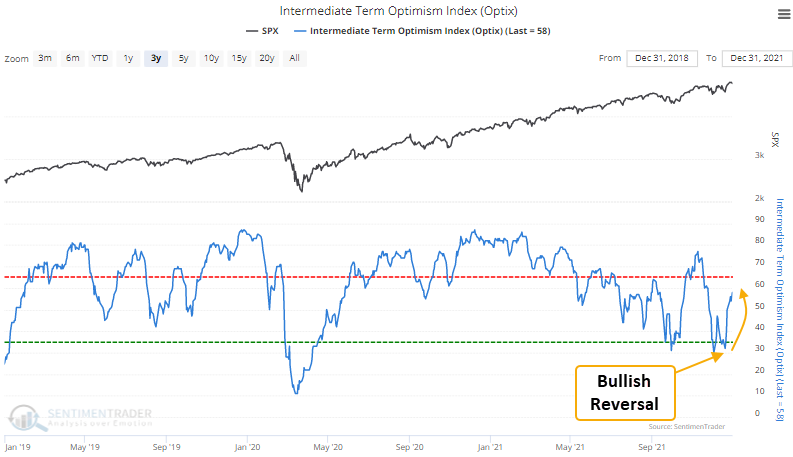

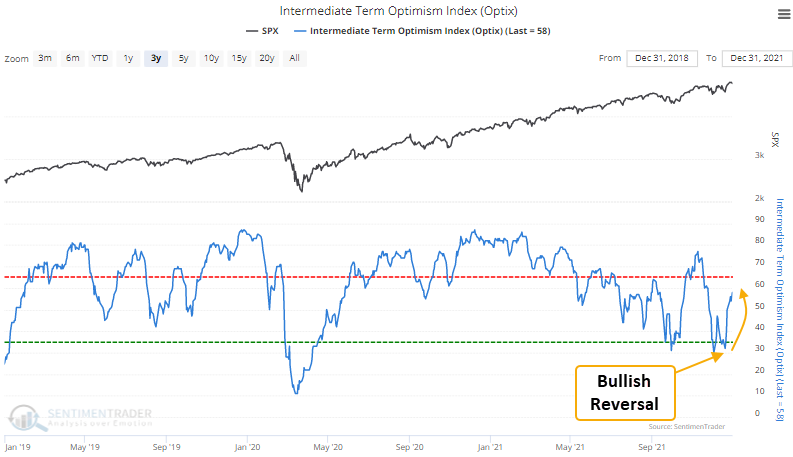

A trading model that uses the Intermediate Term Optimism Index (Optix) to identify when sentiment reverses from a period of pessimism issued a buy signal last week.

The model applies a 42-day range rank to Intermediate Term Optimism Index. As a reminder, the range rank indicator measures the current value relative to all other values over a lookback period. 100 is the highest, and 0 is the lowest. The pessimistic reset condition is confirmed when the range rank for the Optix Index crosses below the 5th percentile. A new buy signal occurs when the range rank crosses back above the 55th percentile. At the same time, the 5-day rate of change for the SPY ETF must be >= 1.5%. i.e., market momentum is positive.

Sentiment signals work best when they reverse from an extreme

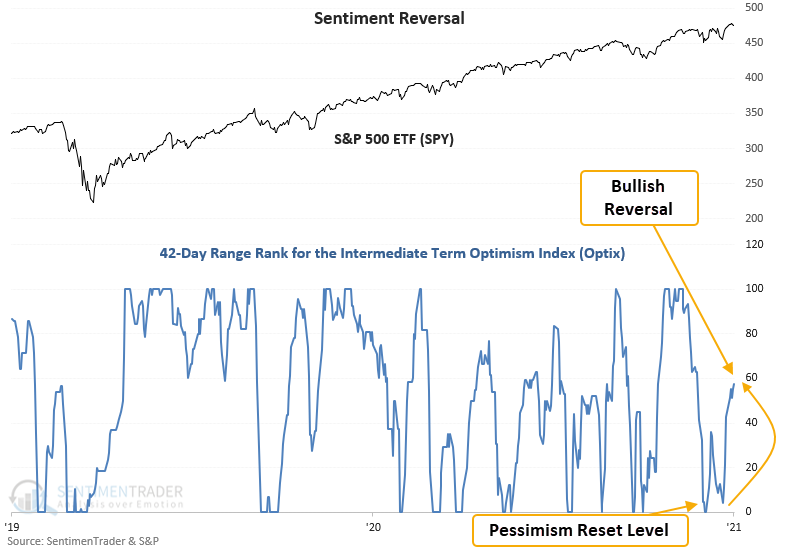

SPY shows a significant z-score in 6 out of 7 periods

This signal has triggered 57 other times over the past 23 years. After the others, SPY's future returns, win rates, and risk/reward profiles were solid across all time frames. Since the 2009 low, the win rate in the 2-month time frame has been excellent, with 30 out of 33 winners. Negative 1-year results are associated with bear market periods.

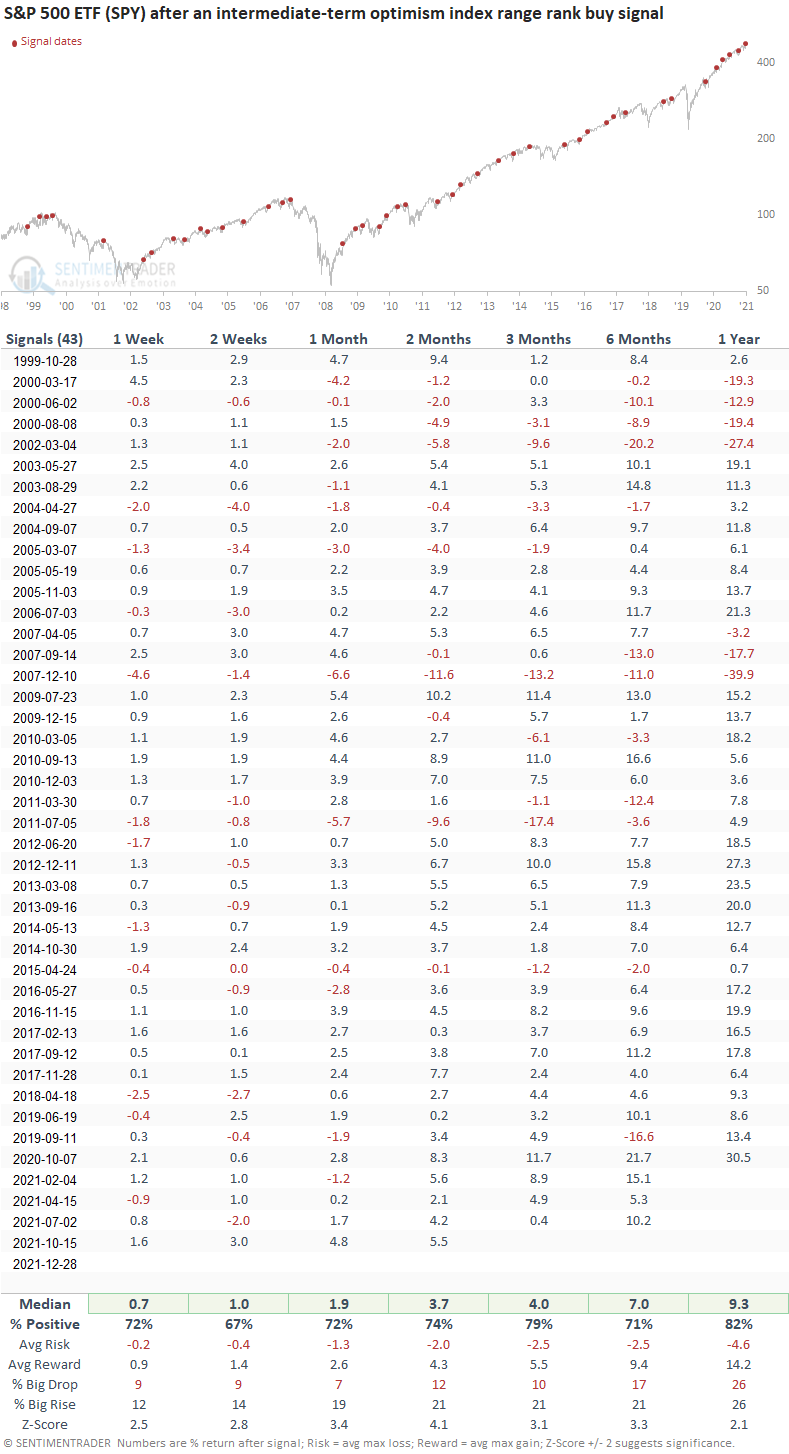

Signals when the SPY ETF is trading above its 200-day moving average

This signal has triggered 43 other times over the past 23 years. After the others, SPY's future returns, win rates, and risk/reward profiles were solid across all time frames. If we compare the two signals, the 3-month time frame shows a nice increase in the win rate. Once again, negative 1-year results are associated with bear market periods.

What the research tells us...

What the research tells us...

When the Intermediate-Term Optimism Index reverses from a pessimist level relative to its 2-month range, it signals that traders have become more optimistic about the future direction of stocks. Using the Optix index to measure that change in sentiment, similar setups to what we're seeing now have preceded rising SPY prices across every time frame.