A reversal in commodity trends suggests higher prices

Key points:

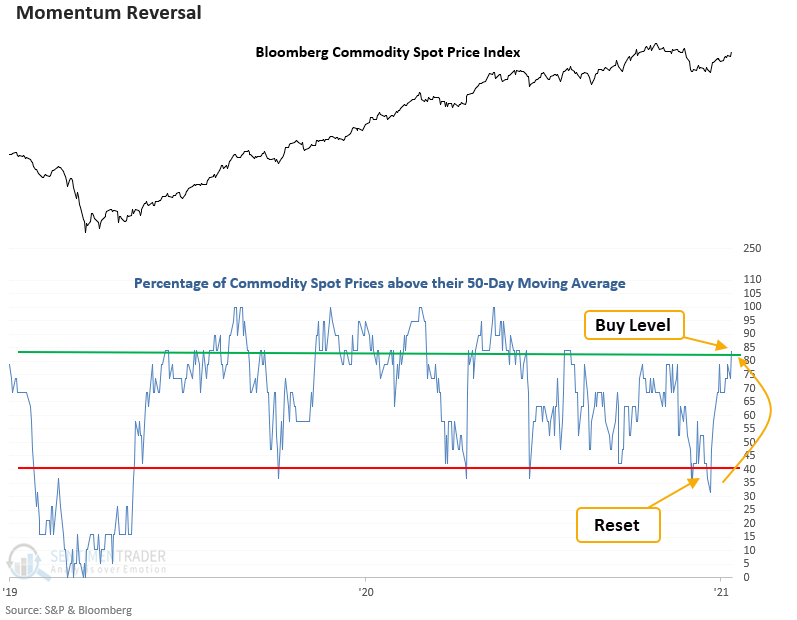

- A basket of commodities trading above their 50-day average surged above 84%

- The burst in participation occurred after fewer than a 1/3 of commodities traded above their 50-day

- A commodity index has rallied 70% of the time over the next 3 months after other signals

Measuring the breadth of participation for commodities

Let's conduct a study to assess the outlook for the Bloomberg commodity spot price index when a basket of spot commodities trading above their respective 50-day average reverses from less than 40% to greater than 83%. I will include a condition that requires the reversal to occur in 30 days or fewer to capture instances similar to the current signal.

Commodity participation is broad-based

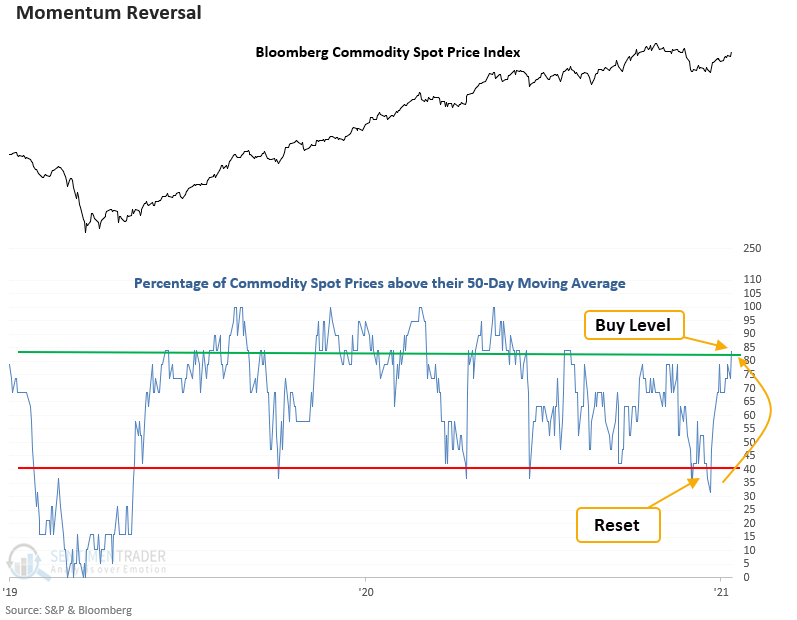

The following table contains the commodities utilized in the percent above 50-day calculation. I don't include gold and silver, given their traditionally defensive nature.

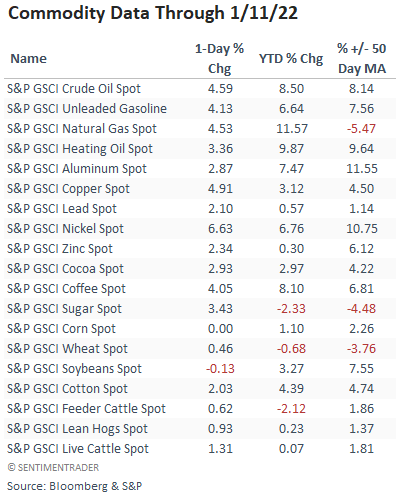

Commodities rallied 70% of the time after other signals

This signal has triggered 57 other times over the past 51 years. After the others, commodity future returns, win rates, and z-scores look solid across all time frames, especially the 3-month window. Recent consistency looks excellent in the 2 and 3-month time frames, with 16 out of 17 and 15 out of 17 winners, respectively.

What the research tells us...

When commodities trading above their 50-day average reverse from oversold to overbought in a short time frame, momentum begets more momentum. Similar setups to what we're seeing now have preceded rising commodity prices, especially in the 3-month window.