A resurgence in uptrends for value-oriented cyclical stocks

Key points:

- More than 90% of stocks in value-oriented cyclical sectors closed above their 50-day average

- Similar participation levels led to better than random returns in the S&P 500 over the next year

- From a sector perspective, a rotation from growth to value looks unlikely

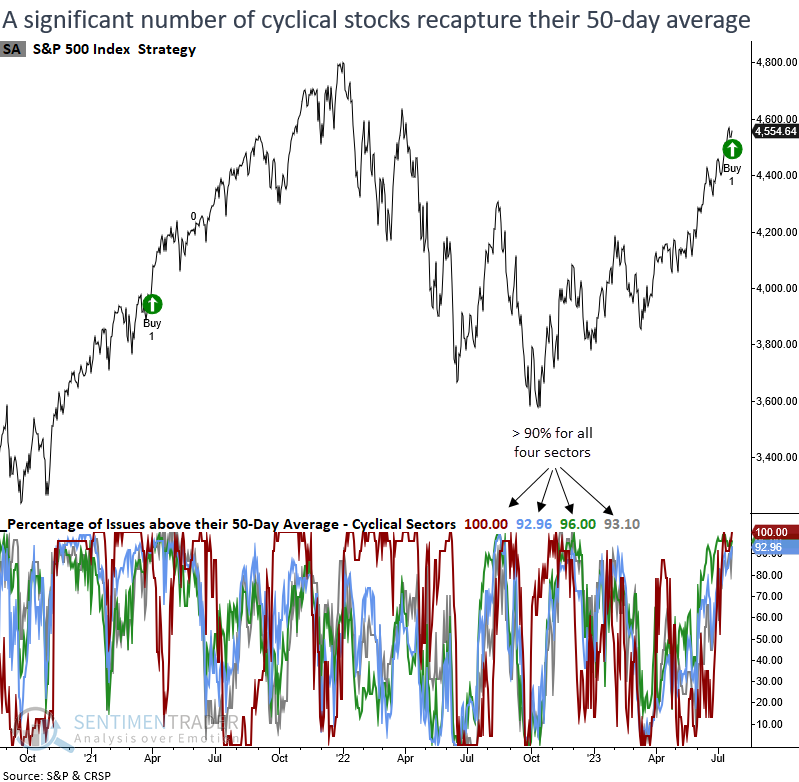

Participation broadens in value-oriented cyclical stocks

We can remove the narrow market breadth wall of worry from our list of concerns.

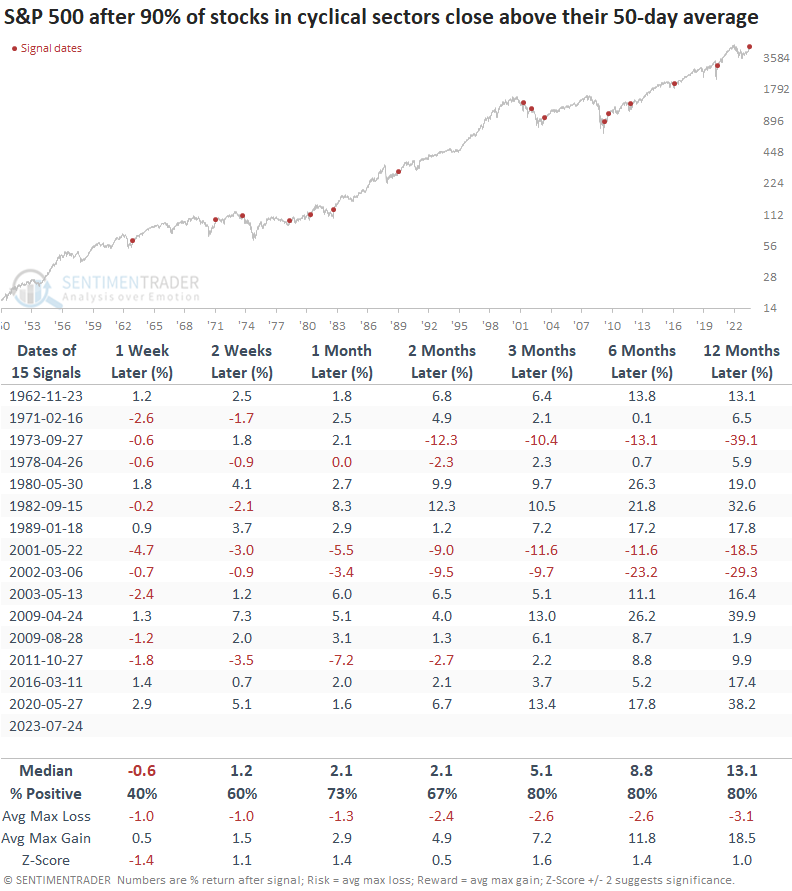

For the first time since the low in October 2022, more than 90% of stocks in the Energy, Financials, Industrials, and Materials sectors closed above their respective 50-day average on the same day.

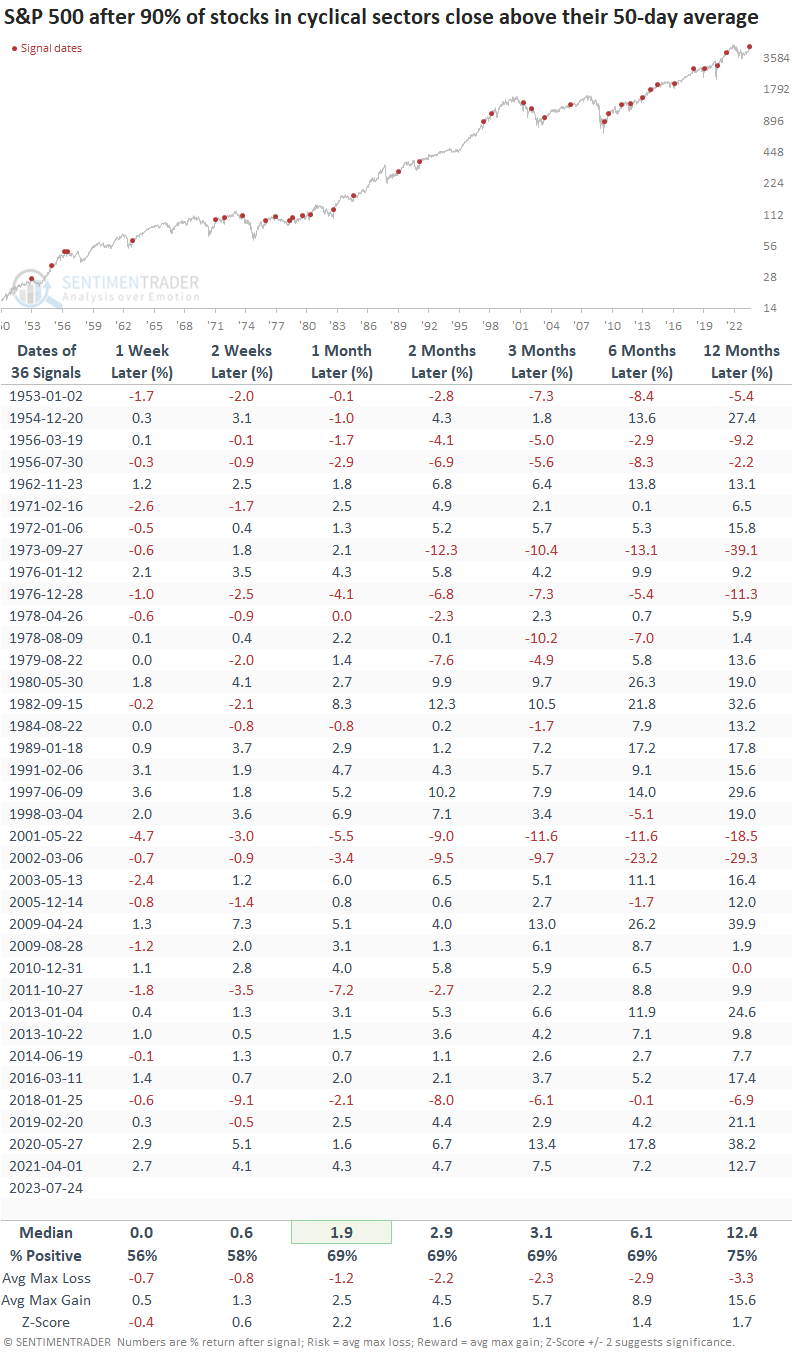

Similar participation levels preceded an upward bias in the S&P 500

When more than 90% of value-oriented cyclical sector stocks close above their 50-day average in unison, the S&P 500 tends to see additional gains that exceed the average return over the study period. Except for 1973 and the signals during the Dotcom bust, both of which took place in downtrends, drawdowns were reasonably modest.

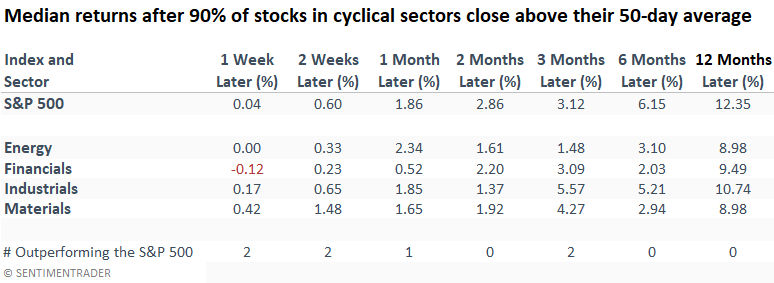

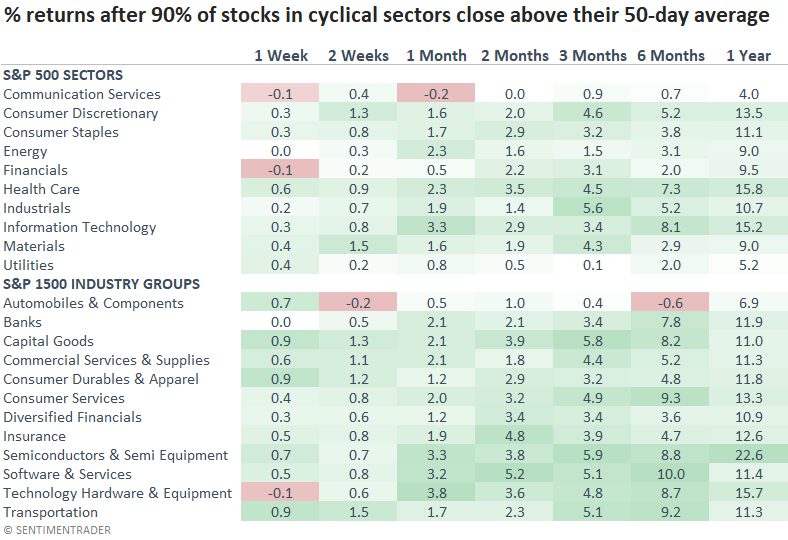

Suppose we compare the forward returns for the value-oriented cyclical sectors to the S&P 500. In that case, there's not a lot of evidence to suggest that we should be thinking about rotating money to value despite the resurgence in uptrends.

Growth-oriented sectors like Consumer Discretionary, Technology, and Health Care outperform all other groups on a fairly consistent basis.

The standout performer in the cyclical industry group category was undoubtedly semiconductors.

Additional context

By examining signals that occurred when the S&P 500 was down more than 5% from a 2-year high, similar to the current situation, returns and win rates improved relative to the original study results.

What the research tells us...

The current uptrend in the stock market is gaining momentum thanks to the growing participation of stocks from value-oriented cyclical sectors. This resurgence in value stocks is undoubtedly a positive sign for the overall market environment. However, while bullish, it does not suggest we should rotate from growth to value. For now, stay with what's working, Technology and Consumer Discretionary.