A recovery in the Hang Seng

Key points:

- The Hang Seng has cycled from seeing half of its stocks at new lows to almost none

- This comes on the heels of what had been historic levels of oversold conditions and widespread selling pressure

- Similar behavior didn't necessarily mark short-term lows, but long-term returns were impressive

In Hong Kong, an impressive rebound from depressing conditions

Asian stocks suffered a historic bout of selling pressure at the end of October, Now, bulls have to hope it's not a repeat of March.

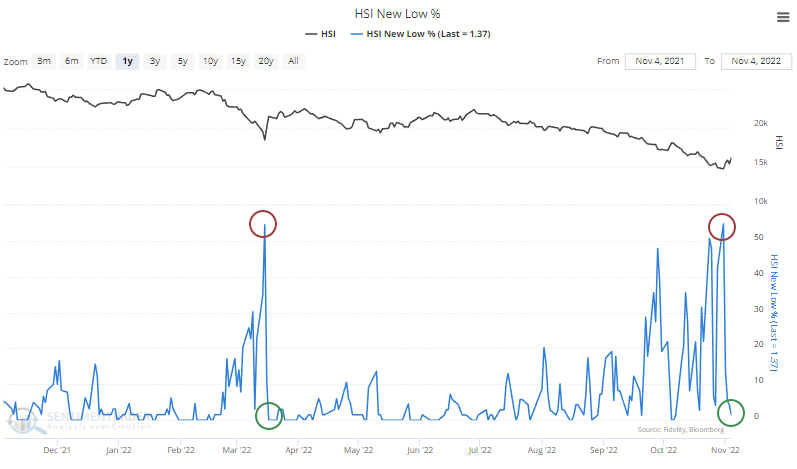

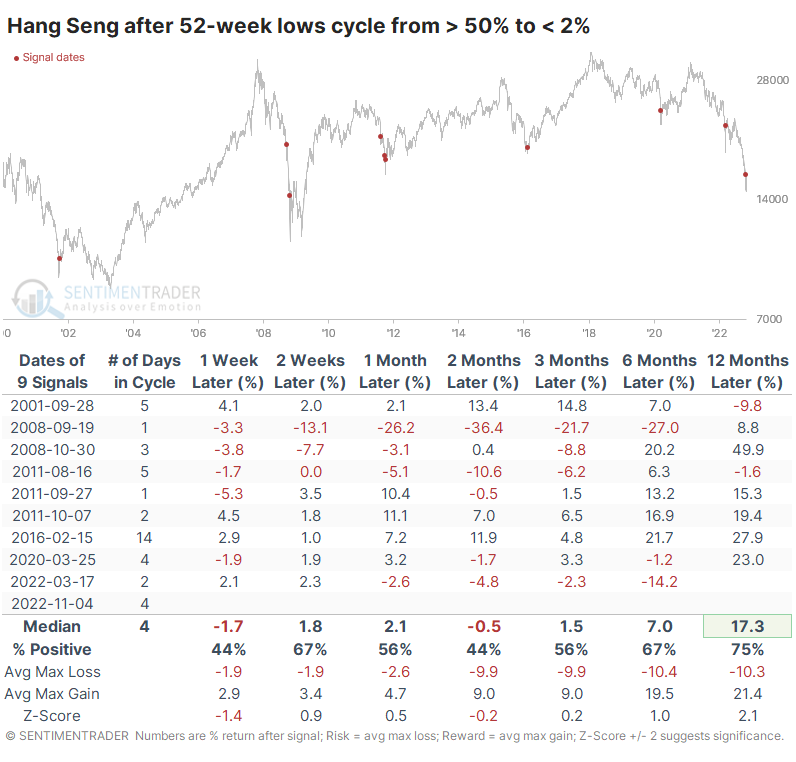

Last week, more than half of the stocks in the Hang Seng index fell to a 52-week low. That was the most since the plunge in March and among only 22 other days in nearly 20 years. With the rally so far in November, the stocks recovered well, and new lows dropped to a minuscule amount.

When there was a cycle of more than half of stocks in the Hang Seng falling to a new low, then that dried up to almost nothing, the index tended to rebound. It was rocky, though; over the next couple of months, more than half the signals showed a negative return, and the last instance was a complete failure. But over the next year, there were only two losses, one of which was insignificant and erased in the months following.

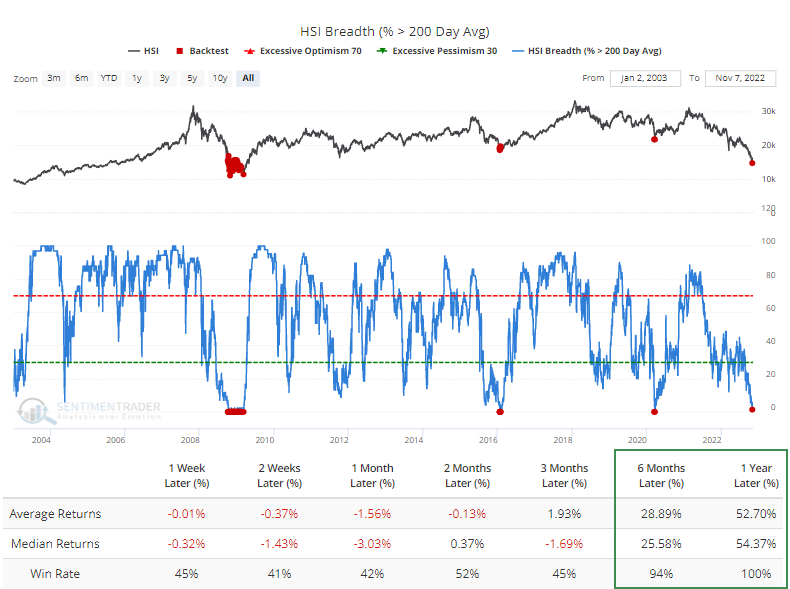

The plunge in those stocks pushed nearly all of them below their 200-day moving averages. There have only been a handful of days matching this level of coordinated selling pressure. Short-term returns were poor, according to the Backtest Engine, but six months later, losses were rare. A year later, there were none, and the Hang Seng averaged a return of about 54%.

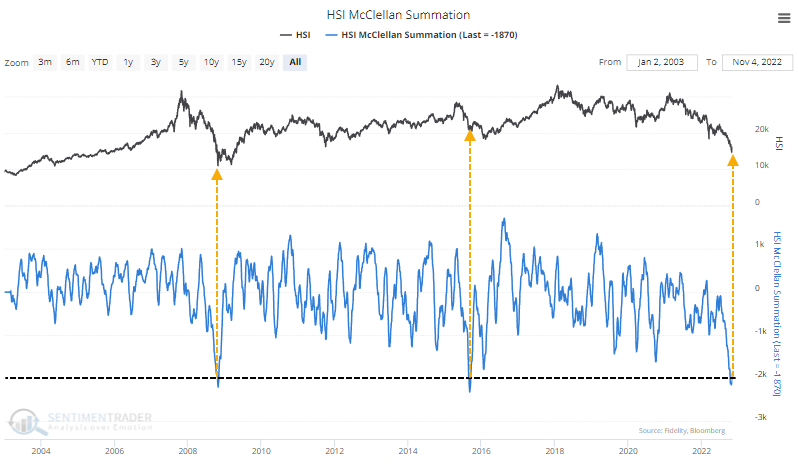

The long-term McClellan Summation Index has turned up from one of its most oversold levels, thanks to the severe selling heading into last week and then the explosive rally. The only two periods with similar behavior were October 2008 and September 2015. Neither one was an impressive buy signal, but over the next 1-2 years, the maximum gains far outweighed the maximum losses.

What the research tells us...

Asian stocks, especially in the Technology sector, have rug-pulled investors several times over the past year. As the stocks plummet, it gets harder to trust that this time is "it" even as valuations get more compelling and investors become ever-more discouraged. The stocks have seen about as much selling as any sector ever does, with the expected amount of aggravated sentiment. Their rebound over the past week has been impressive and ushered in encouraging precedents. Now, buyers just need to show they're willing to hang around for longer than other rallies over the past year.