A Record Glut of Shares from Money Losers

A rising tide lifts all boats in life and markets. And the rising tide of money has lifted the fortunes of many companies that otherwise would have sunk long ago.

As the Wall Street Journal notes:

"The frenzied stock-buying activity that may have saved AMC Entertainment Holdings Inc. from bankruptcy is opening up a potential escape hatch for other troubled borrowers as well.

More companies with steep financial challenges are seeking a lifeline from equity markets, eager to capitalize on the surge of interest in stock buying from nonprofessional investors.

But equity markets now are more open to supporting troubled issuers, in large part because of risk-hungry individual investors eager to speculate, according to bankers and investors following the trend."

We can see this explicitly in the amount of money raised from secondary and add-on share issuance between money-making and money-losing corporations in the U.S. In March, we looked at the explosion in IPOs, which has been a concern for a while.

A TREND TOWARD MONEY-LOSERS

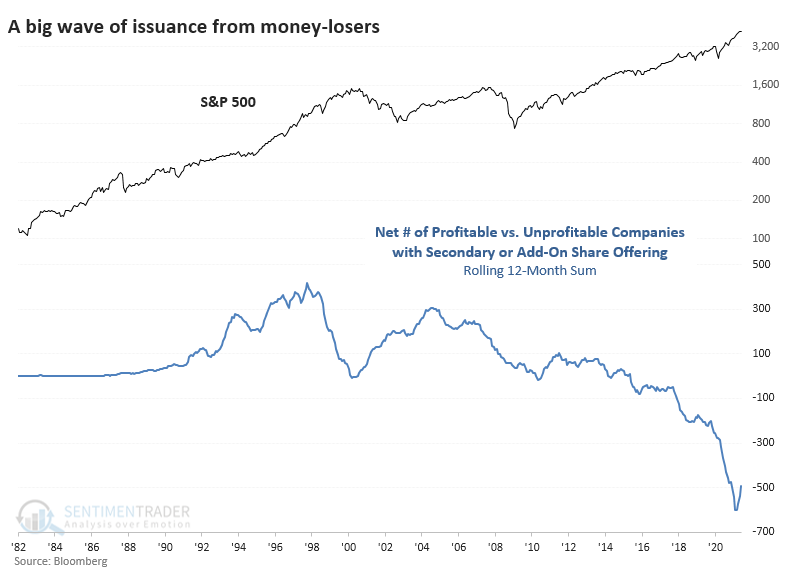

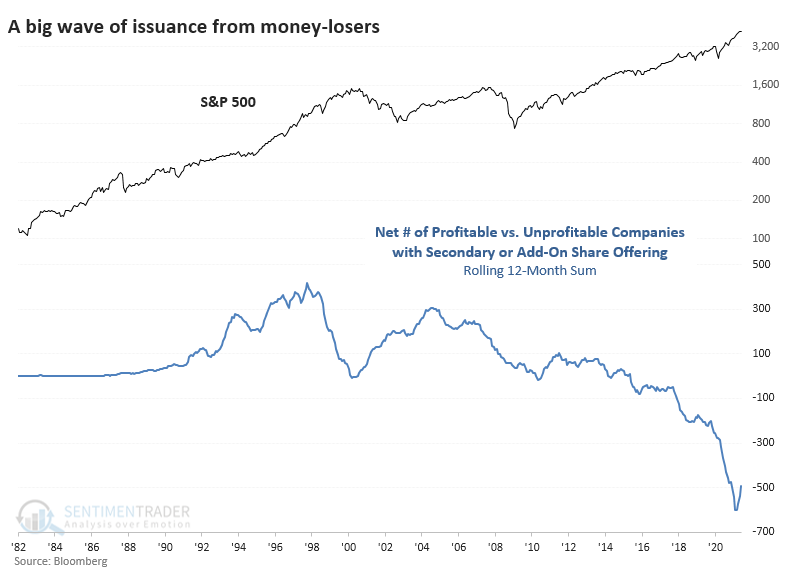

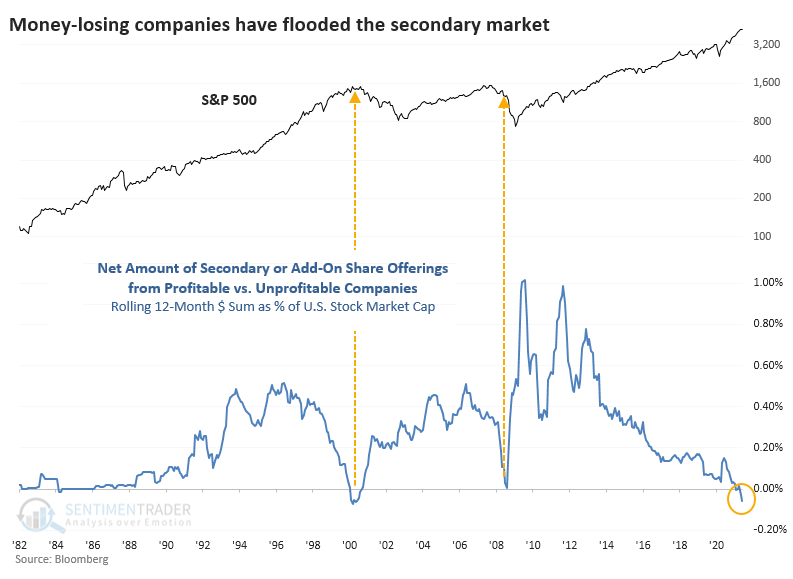

According to Bloomberg data, there have been 254 profitable companies issuing secondary or add-on shares over the past 12 months. But there have been 748 unprofitable companies doing the same, for a net differential of more than 500 companies.

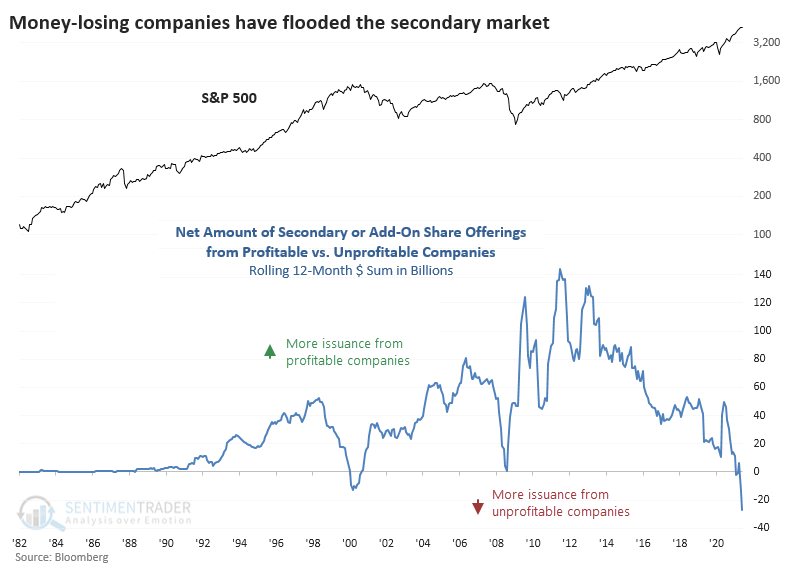

All of this issuance amounted to more than $27 billion worth of offerings that have been priced. That, too, is a record amount dating back 40 years.

ONLY TWO HISTORICAL PRECEDENTS

As a percentage of the U.S. equity market, this is about 0.1%, which is nothing more than a blip. That's not really the point. It's not about the amount of issuance; it's about a market environment that allows this to happen.

We've been in the Enthusiasm phase of a Typical Sentiment Cycle for more than six months now. The phase usually exhibits all of these factors.

- High optimism

- Easy credit (too easy, with loose terms)

- A rush of initial and secondary offerings

- Risky stocks outperforming

- Stretched valuations

Optimism has ebbed from its peak in February, and some risky stocks have been clobbered. However, the other factors are still in play. We need to be on the lookout for internal divergences and warnings among technical indicators during and after these phases. So far, those have been spotty. We'll have to watch if conditions like we saw earlier this week continue.