A Record Beat Rate For Earnings As Investors Flee World ETFs

This is an abridged version of our Daily Report.

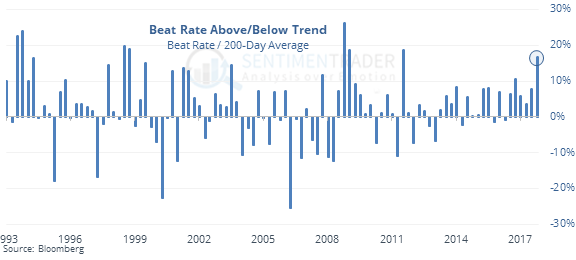

A record beat rate

S&P 500 companies have beat earnings expectations to a record degree. As we near the two-week mark of earnings season, about 90% of companies reported better-than-anticipated earnings. That’s more than 15% above the average beat rate from the past year.

Other impressive starts to earnings season led to lower returns, and vice-versa.

Domestically focused

Investors have pulled $14 billion from world ETFs in 8 weeks, a 4-year extreme. It’s also extreme relative to domestic funds, a good sign for world funds as they outperformed the S&P the two other times there was such a wide divergence in fund flows.

The latest Commitments of Traders report was released, covering positions through Tuesday

The 3-Year Min/Max Screen shows several multi-year extremes in “smart money” hedger positions. They’ve been aggressively adding to their exposure to coffee and now hold a net 18.3% of open interest. According to the Backtest Engine, that has happened only 3 other times since 1992.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |