A reason for caution in silver

Key Points

- Silver has a history of moving in a highly cyclical fashion

- Being aware of the current seasonal status can help keep traders on the right side of this volatile market

- One of the weakest seasonal periods of the year begins in late September and lasts until late October

Silver in a downtrend

The chart below (courtesy of Optuma) displays price action for silver in recent years.

Some traders will see a market trying to put in a bottom, while others will see a market in an established long-term downtrend. Let's look at what seasonality is suggesting for the months ahead.

Silver seasonality

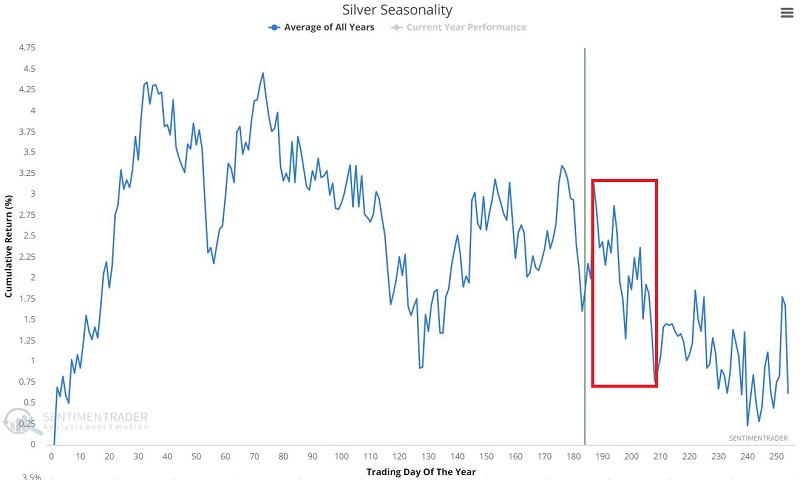

The chart below displays the annual seasonal trend for silver futures. The red box highlights an impending period of seasonal weakness. Any holiday on which electronic trading occurs is counted as a trading day.

Silver unfavorable period performance

The unfavorable period for silver in question runs from the close on Trading Day of the Year (TDY) #187 and extends through the close on TDY #208. For 2022 this starts at the close on September 20 and ends on October 19.

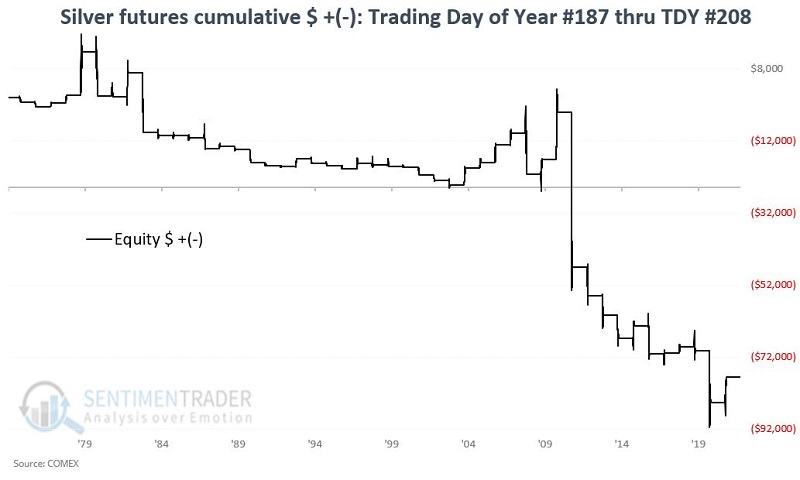

The chart below shows the hypothetical return achieved by holding a long position in silver futures only during the unfavorable period marked by the red box in the chart above.

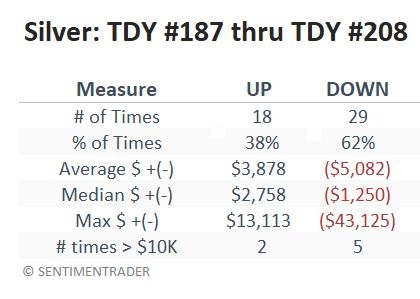

From the end of 1974 though the present, the cumulative loss during the red box unfavorable periods was -$77,588. The table below shows that silver declined 62% of the time during these windows, with a significantly larger average and maximum decline.

What the research tells us…

With seasonality is that there is no guarantee that future results will emulate those in the past. I typically use seasonal trends as another indicator designed to highlight opportunities with better-than-average potential. When both the current seasonal trend and the current trend in price are in sync, I will consider a position in the direction of the concurring trends. At the very least, I will avoid trading long if both price and seasonality are in unfavorable trends.

At the moment, one can argue that silver is highly oversold. One can also make all kinds of bullish arguments for silver based on fundamentals (increased usage of silver in green energy). But for the moment, the combination of price and seasonality suggests caution.