A rare breakout signal for the Technology sector

Key points:

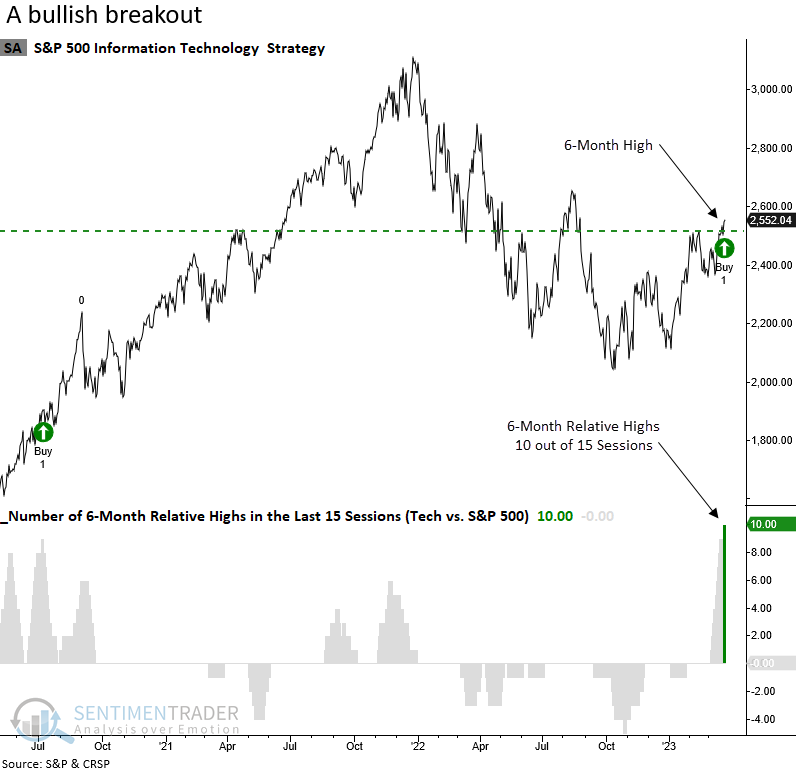

- The S&P 500 Technology sector closed at a 6-month relative high vs. the S&P 500 in 10 out of 15 sessions

- At the same time, the sector closed at the highest price level in more than six months

- After similar dual breakouts, the Technology sector showed excellent absolute and relative performance

A bullish absolute and relative breakout for the Technology sector

With value-oriented groups under severe pressure from the turmoil in the banking sector, investors wasted no time rotating money to Technology stocks, especially large-cap ones.

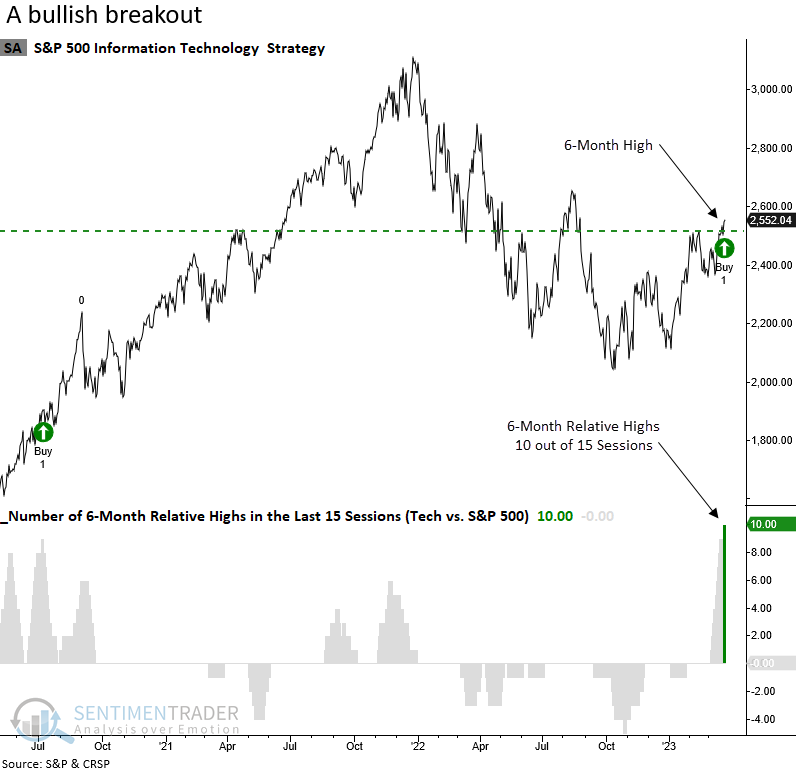

For only the 12th time in more than 60 years, the S&P 500 Technology sector registered a 6-month relative high versus the S&P 500 in 10 out of 15 sessions and simultaneously closed at a 6-month price high.

The stars could align for Technology stocks with management teams taking aggressive steps to cut costs and a potentially more favorable inflation/interest rate environment.

It's important to note that the breakout signal never occurred during the Dotcom bust, despite some significant bear market rallies.

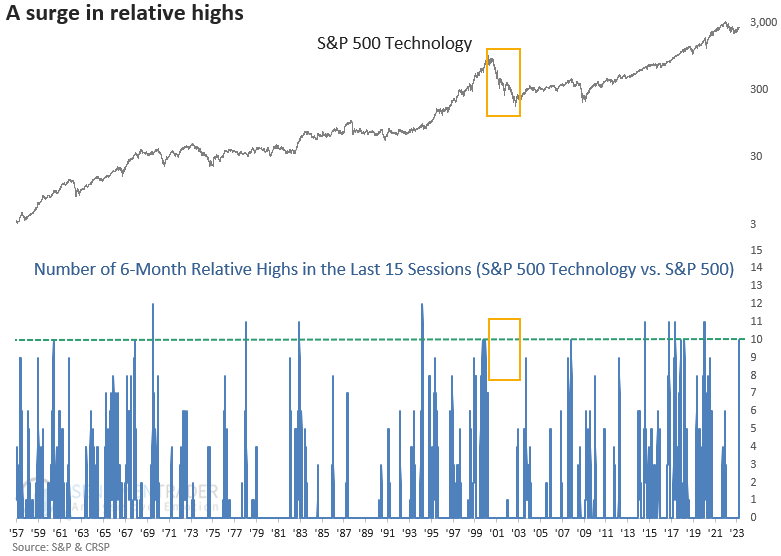

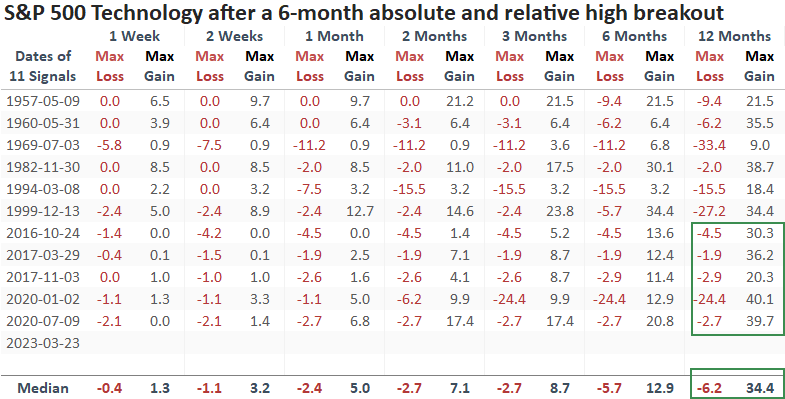

Similar breakouts preceded excellent results for the Technology sector

The Technology sector shows a strong tendency to rally further when the sector registers a 6-month relative high versus the S&P 500 in 10 out of 15 sessions and closes at the highest price level in six months.

Six months later, the group was higher in all but one case, which occurred in 1957.

Besides 1969, the max gain was significantly better than the max loss a year later in most cases, especially recent signals.

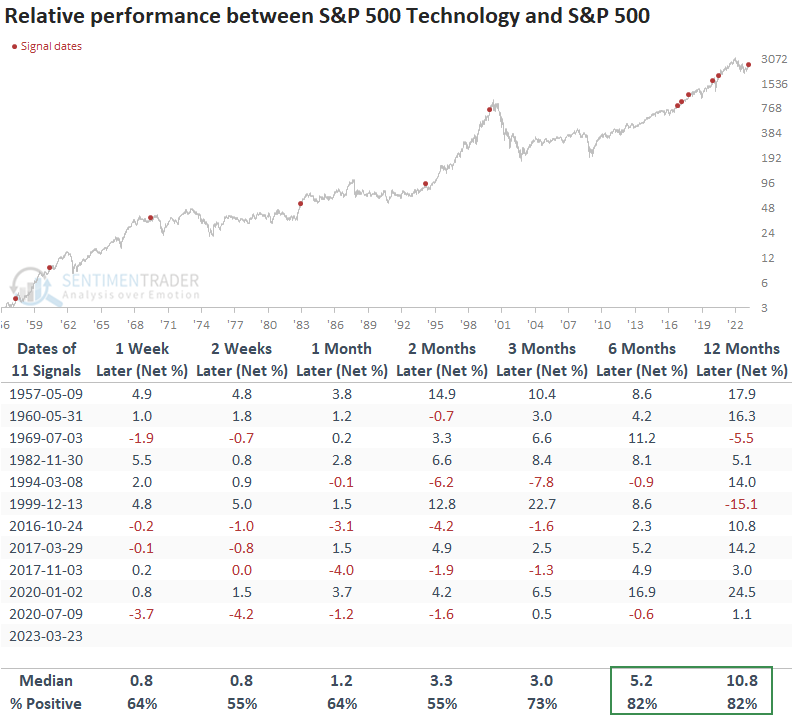

Relative outperformance by the S&P 500 Technology sector looks excellent across all time frames, especially over the next six to twelve months.

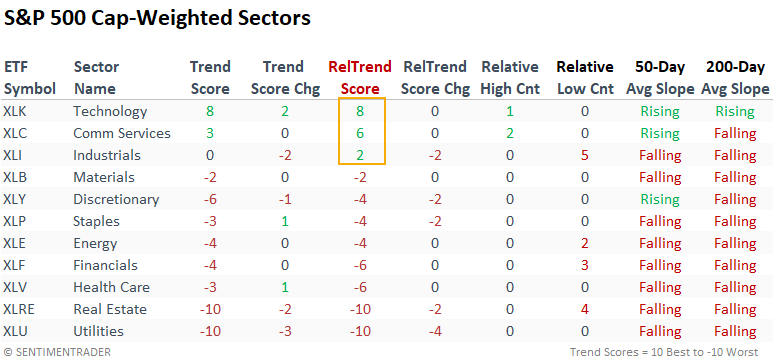

Current absolute and relative price trend scores

Technology maintains the highest relative trend score among all sectors. And it's the only sector with a rising 50 and 200-day moving average. So, absolute and relative price trends look bullish, especially compared to other groups.

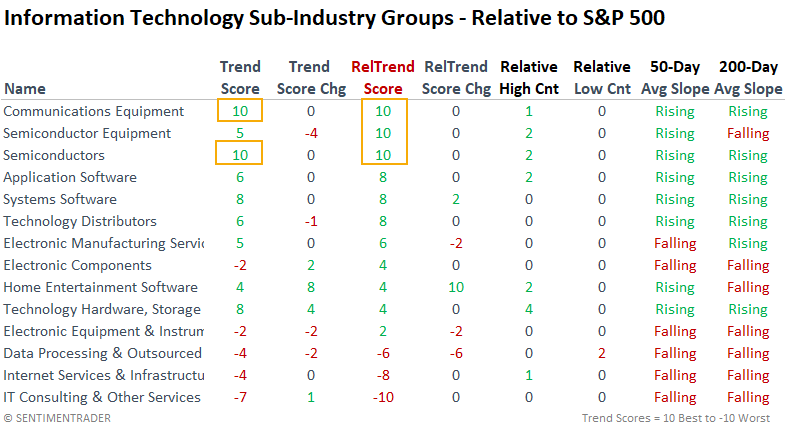

When we look under the hood of the Technology sector, most groups maintain a positive absolute and relative trend score. Semiconductors, which I highlighted in a note a few months ago, continue to impress with perfect trend scores on both composite models.

What the research tells us...

While Technology was already showing signs of bullish price action after a difficult 2022, investors pushed even more chips into the pot with the recent unrest in the banking industry. For only the 12th time in history, the S&P 500 Technology sector registered a 6-month relative high versus the S&P 500 in 10 out of 15 sessions and simultaneously closed at a 6-month high. After similar breakouts, the group was higher 91% of the time over the next six months and handily outperformed the S&P 500 over that same period.