A Quick Update on Copper

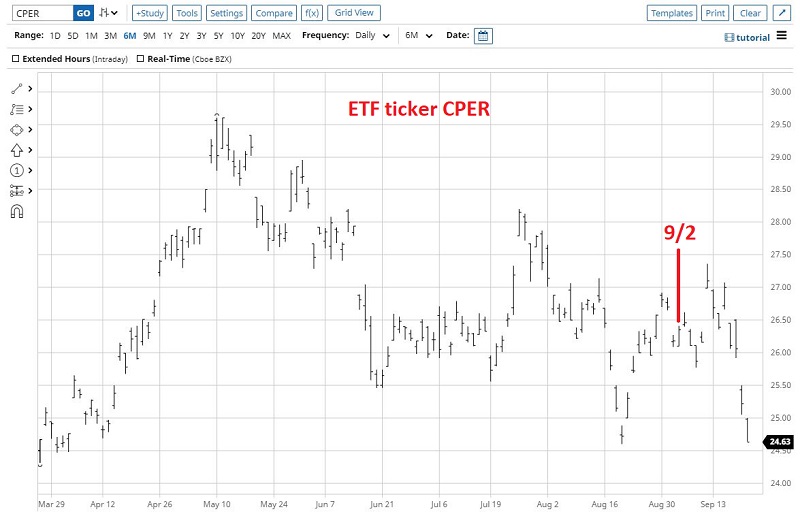

In this article dated 9/2, I covered the status of copper at that time. Overall, it painted a fairly unfavorable outlook for copper. Since that time (and as this is written), December copper futures have declined from roughly $4.30 to roughly $4.02. This represents about a $7,000 decline in the value of a copper futures contract (All price bar charts below are courtesy of Stockcharts.com).

Likewise, the ETF ticker CPER (which ostensibly tracks the price of copper futures but trades like shares of stock) has declined roughly -6.5%.

So, is the worst over for copper?

PRICE

The potential good news is that copper may be nearing a potential support area. See the chart below.

On the flip side, copper is below its 70-day exponential moving average.

To see the performance of copper historically while it is below this EMA, please see the linked article.

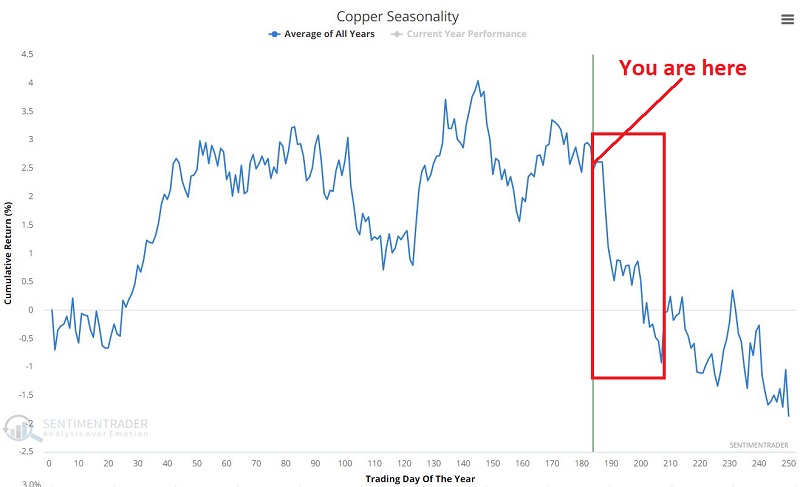

SEASONALITY

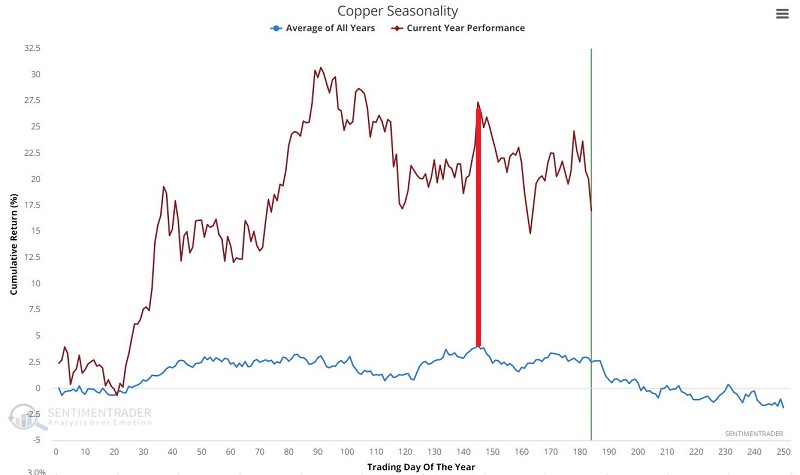

The Annual Seasonal Trend for copper appears in the chart below, along with the actual performance for this year.

Note that in 2021, copper has followed its seasonal trend pretty closely (in terms of trend, not necessarily in magnitude). The most recent decline started right on cue.

Also, note in the chart below (the same as above without the actual performance) that things could get much worse before they get better from a solely seasonal point of view.

To see the performance of copper historically during this unfavorable seasonal period, please see the linked article.

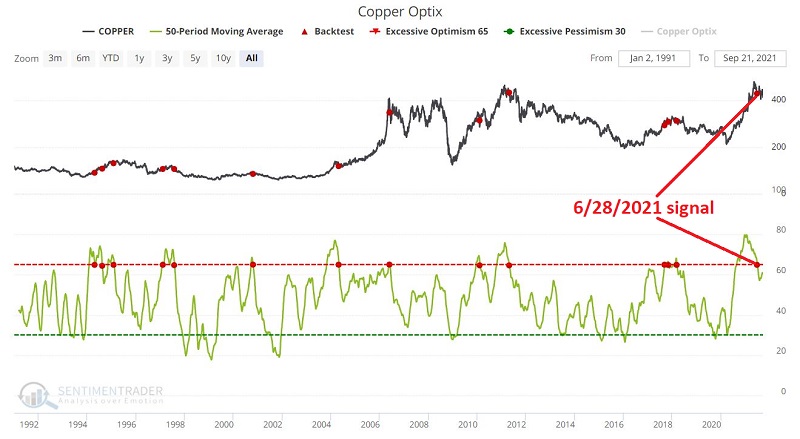

SENTIMENT

Note that this Backtest Engine Scan recently gave a bearish signal for copper. Previous signals appear in the chart below.

To see the performance of copper following previous signals, please see the linked article.

SUMMARY

Price, seasonality, and sentiment are all presently aligned on the unfavorable side for copper. Does this mean that copper cannot rally from here? Or that copper is doomed to fall much further from here? Not at all. Still, in the long run, successful trading generally involves weighing the evidence in each given situation and trying to find an "edge."

For now, the weight of the evidence continues to be unfavorable for copper.