A QQQ Bear Call Spread for the Short-Term Bear

I seem to be on something of an options jag this week, so why stop now? In this piece, I will highlight a hypothetical trade using options on ticker QQQ.

First things first:

- As always, the example that follows is for educational purposes only and NOT a "recommendation."

- I am completely agnostic regarding the short-term direction for ticker QQQ (Invesco QQQ Trust )

- The example trade below would ONLY be entered by a trader who is highly confident in the belief that QQQ will NOT break out to new highs in the weeks ahead, AND;

- By a trader who is prepared to "act" to minimize risk if the need arises

THE SETUP

The chart below displays the Annual Seasonal Trend for the Nasdaq 100 Index (the QQQ tracks index). There are never any guarantees with seasonal trends, but the fact that we are at a possible inflection point for NDX is fairly obvious.

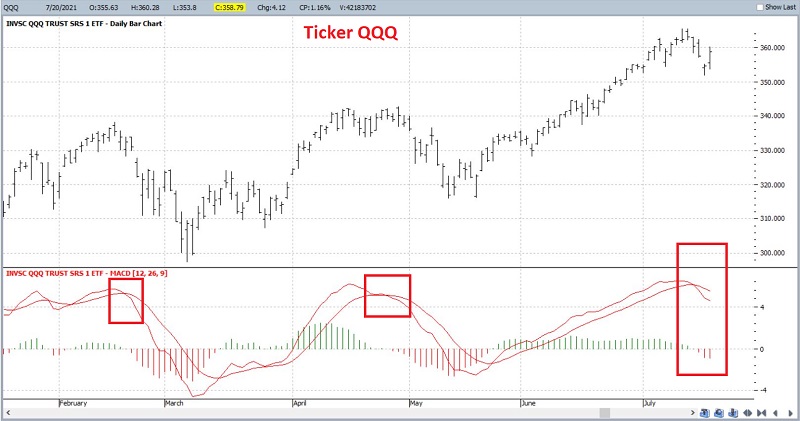

The chart below (courtesy of ProfitSource) shows a daily bar chart for QQQ. Note that the MACD indicator has rolled over and crossed over to the downside.

For the sake of illustration, let's assume that our hypothetical trader looks at these two charts and develops the opinion that QQQ is NOT going to rally strongly in the near term (repeating now, this is a hypothetical outlook for the sake of illustration and not an argument that I am explicitly making).

In essence, our trader does not necessarily believe that QQQ is destined to break sharply lower from here. But they do believe that it will "go basically nowhere" for at least a little while, possibly trading in a range. A strategy that an options trader can employ in this situation is referred to as a "bear call credit spread."

THE BEAR CALL CREDIT SPREAD

This strategy is utilized by selling an out-of-the-money call option and simultaneously buying a further out-of-the-money call option. For our example trade, we will:

- Sell 20 QQQ Aug13 370 calls @ $1.77

- Buy 20 QQQ Aug13 371 calls @ $1.52

The particulars for this trade appear in the screenshot below and the risk curves (i.e., the expected P/L as of a given date/QQQ price) in the chart below that.

Things to notice:

- QQQ is trading at $358.79 a share

- The options expire in 24 calendar days

- The maximum profit potential is $500 (if QQQ is at or below $370 at expiration)

- The maximum risk is -$1,500 (if QQQ is at or above $371 at expiration)

- The breakeven price is $370.25

- If QQQ trades above $370 a share, there is the risk of assignment

In a nutshell, this trade makes money if QQQ does anything EXCEPT rally 3.1% or more in the next 24 days. Clearly, the ONLY reason a trader would consider this position is if they are highly confident that the recent high will act as resistance and that any rally in QQQ will either halt there or not extend much above the recent high of $365.49.

POSITION MANAGEMENT

Now let's talk about the realities of trading this type of position. In a perfect world, QQQ never advances at all, the options expire worthless, and our trader keeps the full $500 credit at expiration.

Unfortunately, things don't always go as planned. And let's face it, betting on QQQ NOT going up has been a pretty lousy trading strategy for some time. In fact, this trade could easily be over by the time you read this piece.

Because this trade has three times as much downside risk as profit potential (sorry folks, that is just typically the nature of "selling premium" option strategy such as this one), it is critically important for our trader to plan out IN ADVANCE how they will react as this trade evolves.

Equally unfortunate is that there is no "one best way" to manage an options trade. So there is no systematic roadmap that states, "if this happens, do this." Nevertheless, it is important to have a plan in place by the time the trade is entered and then STICK TO IT!

So, for our example trade, we will assume that our trader made the following plan.

- If QQQ reaches the short strike of 370, then exit the trade completely - If this happens immediately, the expected loss would be roughly -$720. If it happens by August 5th, the expected loss would be roughly -$590. During the final week before expiration, these options will lose time premium rapidly. The closer to expiration, the higher the likelihood that we might exit with a profit.

- If at any point before expiration, we can exit with a profit of $400 (80% of the maximum profit potential) then exit the trade completely. This allows us to capture the bulk of potential profit while eliminating the risk of having QQQ rally sharply in the remaining days before expiration.

An important reminder: There is nothing "set in stone" regarding either of the above actions. A trader can set a stop-loss higher or lower than $370 on QQQ. Lower means a smaller loss, but also a higher probability of getting stopped out. Higher means a greater loss and potentially a greater risk of assignment.

On the downside, a trader is in no way obligated to close the trade early. If things are going well, the trader can hold on, hoping that the options will expire worthless and that the full $500 credit will end up as realized profit.