A potential trend change for the Dollar Index

Key points:

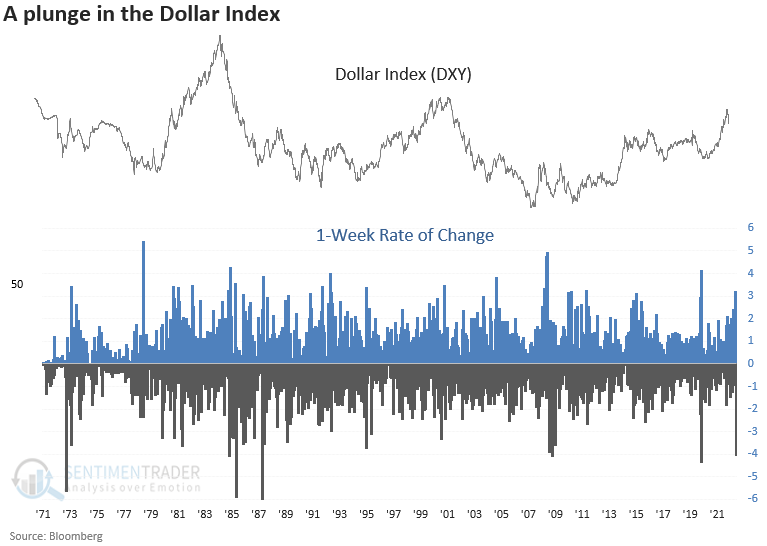

- The Dollar Index (DXY) declined by more than 4% over one week

- After similar plunges, the DXY was lower 100% of the time over the next few months

- Stocks, commodities, and gold show a favorable outlook, especially a year later

A weak dollar tends to favor risk assets

The weaker-than-expected CPI report last week sparked an impressive two-day rally in stocks. The rebound was aided by one of the most significant week-over-week declines in the Dollar Index (DXY) in more than 50 years.

For only the 7th time since 1971, the Dollar Index declined by more than 4% over one week. While one week rarely makes a trend, a decline of this magnitude suggests otherwise. Usually, a potential trend change in the Dollar Index would be a welcome development for risk assets.

Similar plunges preceded negative returns for the Dollar Index

While the sample size is small, a 4% plunge over one week suggests the Dollar Index will trend lower over the next few months and potentially even the following year. Signal dates occurred around significant events like the Arab Oil Embargo, the Plaza Accord, the 1987 crash, the GFC, and the Covid crash.

Edit: The original outlook table used weekly data for the DXY when it should have been daily data. The information is now correct.

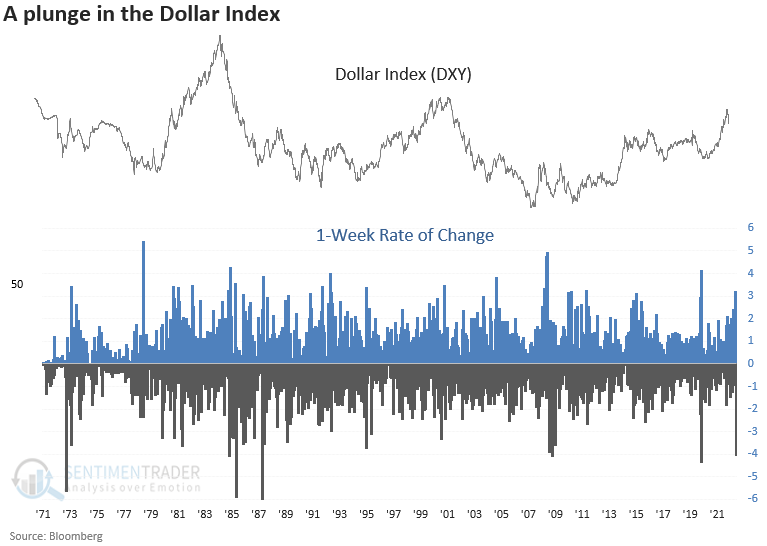

Stocks tend to benefit from a weaker dollar over the long-term

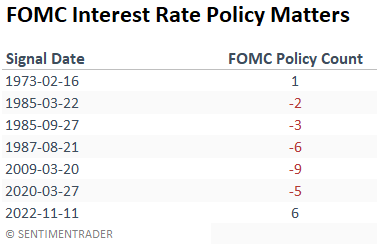

The S&P 500 struggled somewhat over the first few weeks but had an upward bias across long-duration time frames. The one significant failure besides the 1987 crash had one key difference from most other instances-Fed policy.

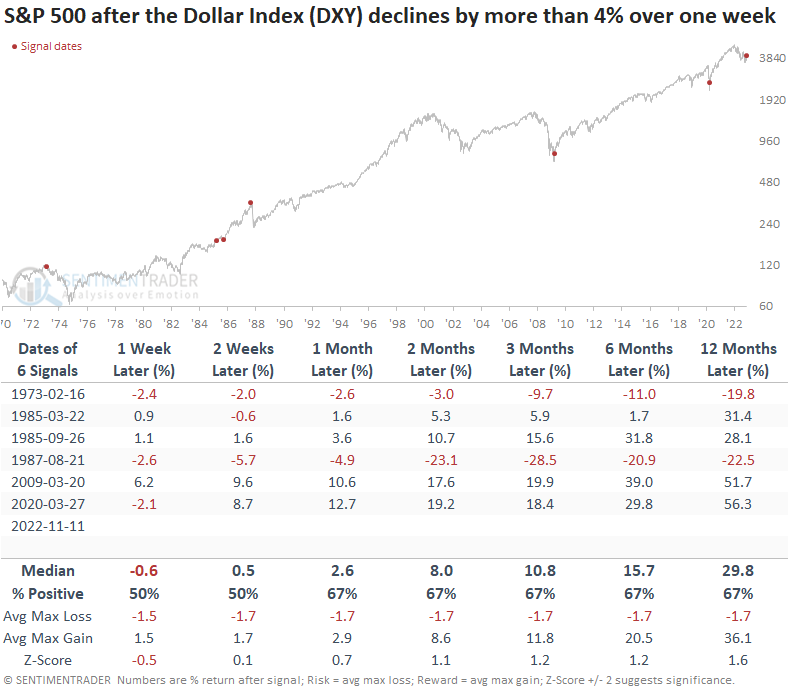

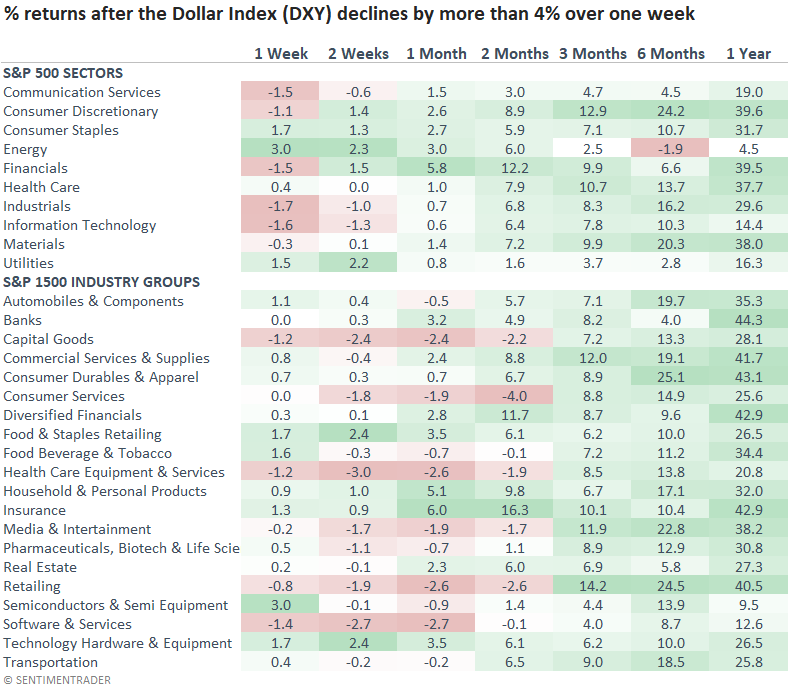

Interestingly, sector performance in the first month shows a similar trend to what we've seen over the last few weeks, with strength in value-oriented groups like energy and financials.

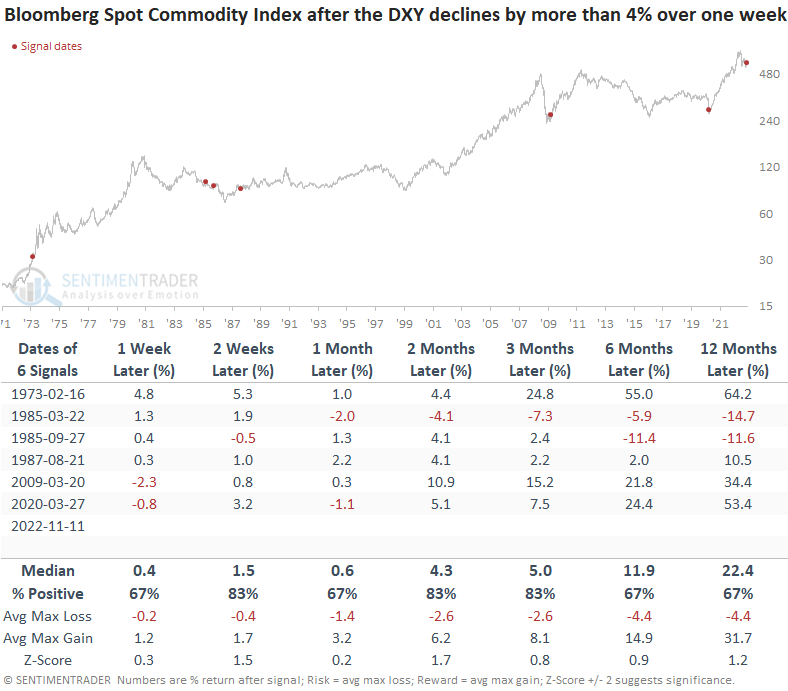

Commodities tend to benefit from a weak dollar

Unlike stocks, commodities show no signs of struggling in the first few weeks after a plunge in the Dollar Index. And long-term results are equally impressive.

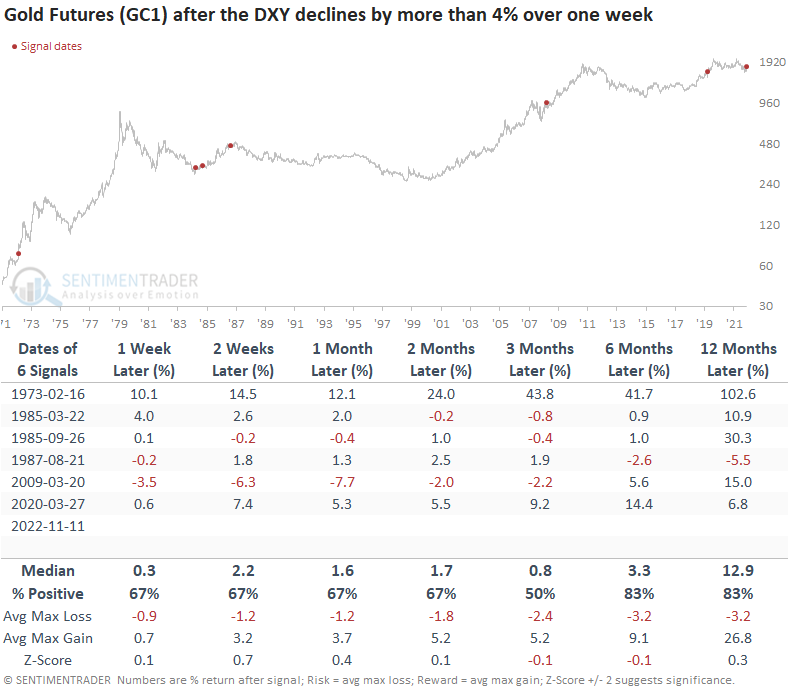

Gold looks favorable across most time frames, especially a year later. The signal shows a gain at some point over the next six months in every case.

What's different this time

What worries me most about the Dollar Index signal is the current interest rate policy from the Federal Reserve. In all prior instances but 1973, Fed policy was easy, not restrictive as is the case now. Stocks got destroyed after the 1973 Dollar Index plunge, as the Fed remained steadfast with their tightening cycle.

What the research tells us...

The week-over-week plunge in the Dollar Index typically leads to further weakness in the Dollar. If the swift reversal foreshadows a potential trend, stocks, commodities, and gold should benefit, especially over the long term. However, we need to be mindful that the current plunge occurred against the backdrop of tight monetary policy, not easy policy. So, this time might be different.