A Possible Respite for the Dollar in May

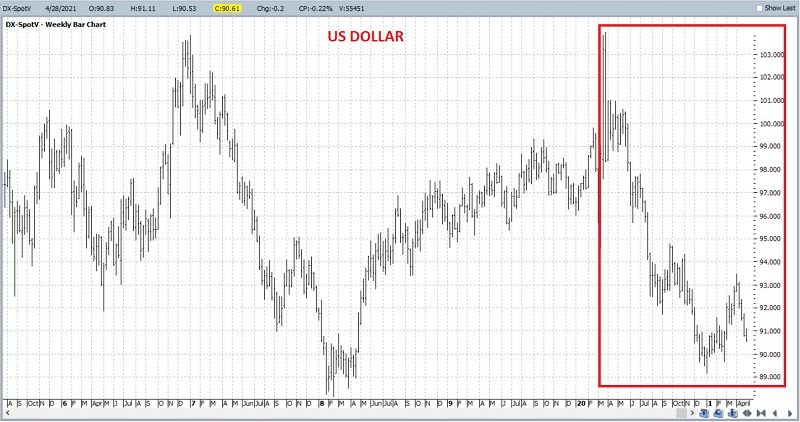

As you can see in the chart below, the U.S. dollar has been extremely weak in the last year.

(Chart courtesy of ProfitSource by HUBB)

Given the current level of money-printing going on and the low rates of interest, one can argue that the weakness is:

- Not without good cause

- Likely to continue for some time

Meanwhile, in the short run, traders might look for a respite during May. Historically, the dollar has shown a tendency to show strength during May, and - just as importantly - most foreign currencies have shown persistent weakness during May. Let's take a closer look.

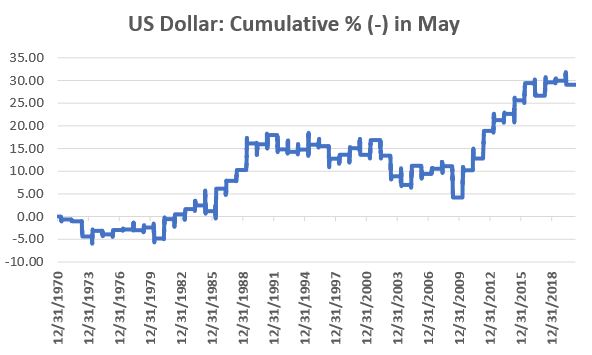

THE DOLLAR IN MAY

The chart below shows the annual seasonal trend for the U.S. Dollar. Notice the "island" uptick in May.

The chart below displays the cumulative % return for the dollar during May since 1971.

The table below summarizes the results from the chart above.

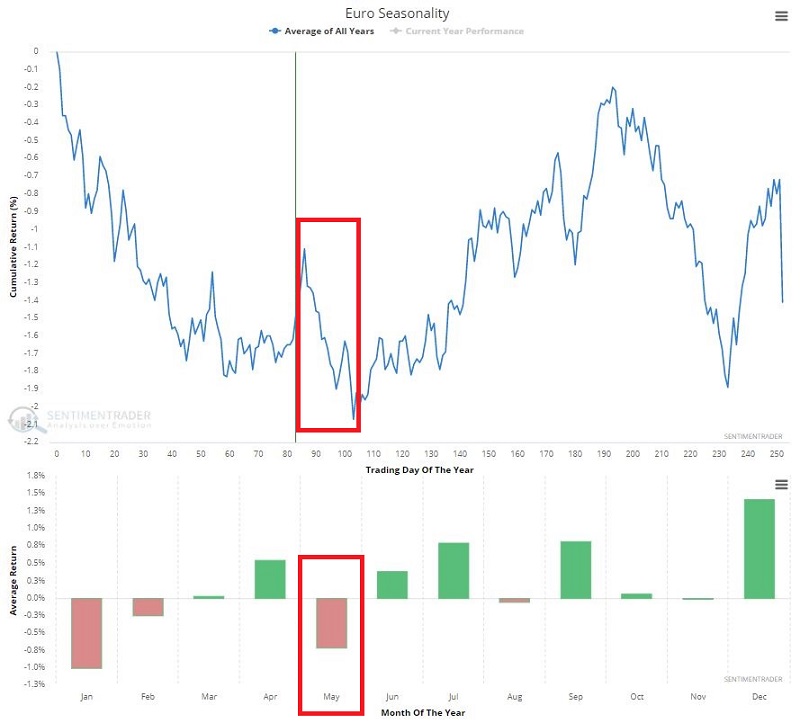

THE EURO IN MAY

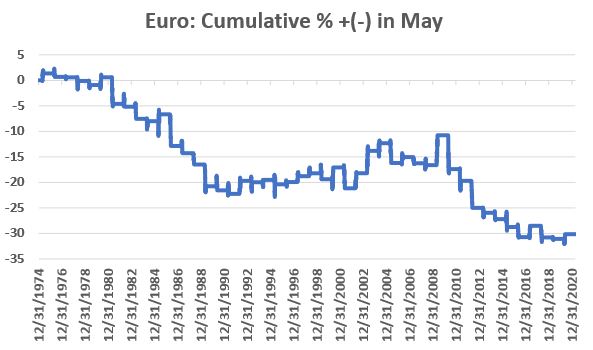

To illustrate the opposite side of the coin, let's look at the euro's performance during May.

DATA NOTE: The euro came into existence in January of 1999. The data before 1999 used below is calculated and supplied by Bloomberg and uses the EUR weights to reconstruct the currency before 1999. It used basically the same makeup of currencies weighted to GDP.

The chart below shows the annual seasonal trend for the euro.

The chart below displays the cumulative % return for the dollar during May since 1971.

The table below summarizes the results from the chart above.

SUMMARY

None of the above results by any means insure a dollar rally (or euro decline) in the month ahead. But if the dollar is going to recover from its recent slump, the historical odds appear to favor it doing so during May.