A play to fade natural gas

Key Points

- Natural gas recently formed a potential double top

- Natural gas Optix recently reached a frothy level

- Natural gas remains in a slightly unfavorable seasonal trend for another month

- A trader willing to bet that the rally in natural gas will at least pause for a while may be able to profit via the use of options

Natural gas price action

Chart patterns are popular among technical traders. Nevertheless, what one chooses to see on a particular chart can vary widely from trader to trader and is typically subjective. For better or worse, the only lines I use to trade are horizontal lines that previous market highs or lows (i.e., resistance or support). Even horizontal lines can be subjective. With this caveat in mind, the chart below displays ticker UNG (United States Natural Gas ETF) with a resistance level marked. Note that price tried to break through, failed, and then reversed.

The chart below shows a potential - albeit arbitrarily drawn and entirely subjective - downside reversal off of a double top (courtesy of StockCharts.)

Does this mean that natural gas is doomed and is sure to fall? Not at all. But it provides a trader with an (at least somewhat) objective "line in the sand." The trend can be considered sideways to lower if the price remains below the recent high of $34.50 a share. But if price moves back above this line, the trend is again "up," and all bearish bets are off.

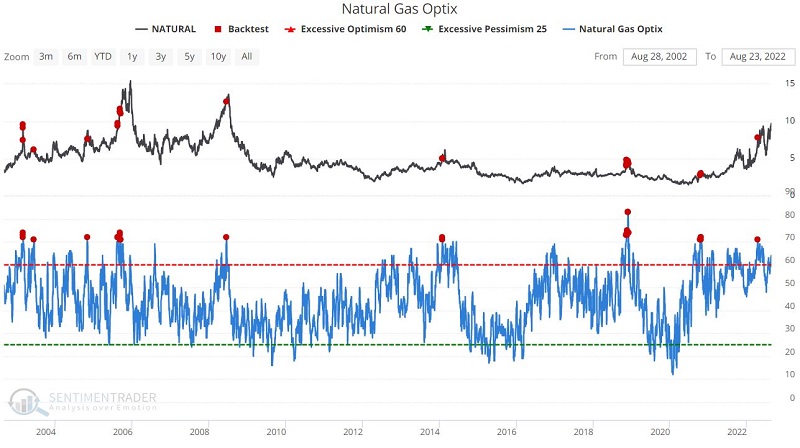

Natural Gas Optix

The chart below displays those times when natural gas Optix was above 70%, indicating overly bullish sentiment among natural gas traders, a bearish contrarian sign.

The table below summarizes natural gas performance following previous 70%+ Optix readings. Things have shown a tendency to get worse as time goes by.

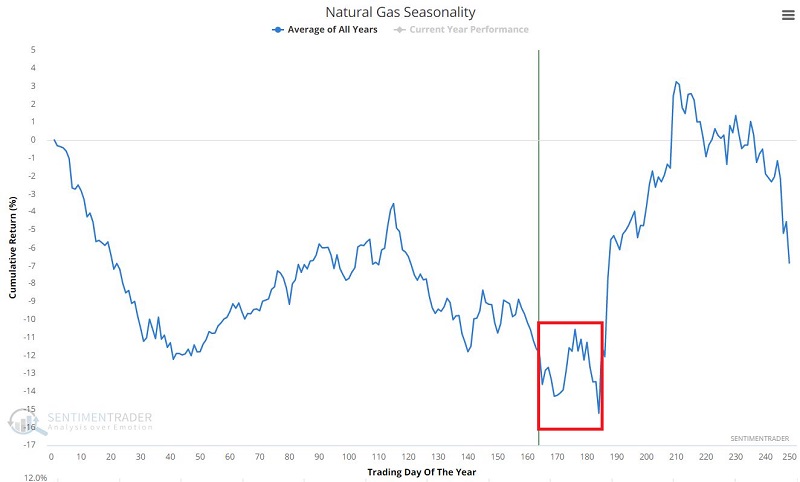

Natural gas seasonality

The chart below displays the annual seasonal trend for natural gas futures. So far in 2022, natural gas has not followed its annual seasonal trend too closely, so we don't want to put too much weight on this factor. Nevertheless, the fact remains that the seasonal trend is unfavorable for roughly another month.

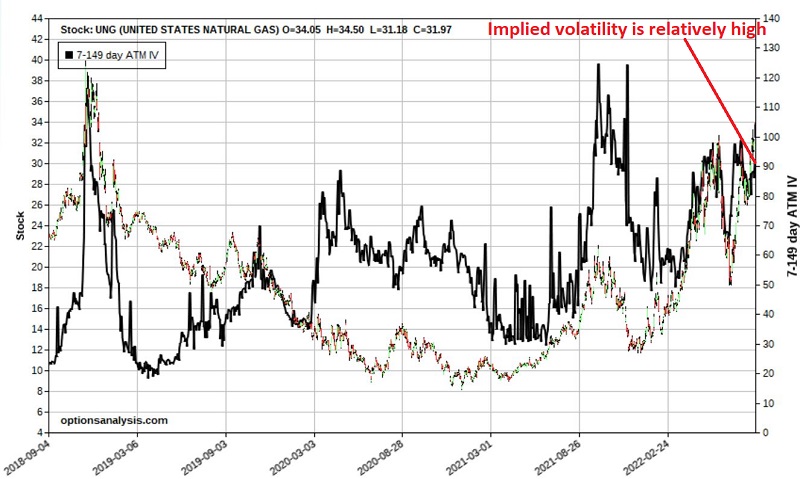

Playing for a "pause" in natural gas with call options

One way to play might be to sell short natural gas futures. However, selling short involves much leverage and theoretically unlimited risk. Instead, we will look at trading options on ticker UNG (United States Natural Gas ETF). As shown in the chart below (all charts and figures below are courtesy of Optionsanalysis), implied volatility (the solid black line) for UNG options is at the high end of the historical range. This tells us that there is an above-average amount of time premium built into UNG options and that this may be an excellent time to sell premium.

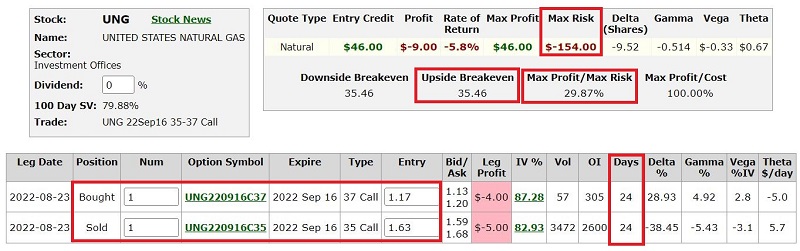

The example trade we will consider is an out-of-the-money bear call credit spread created as follows:

- Buy 1 UNG Sep16 2022 37 call @ $1.17

- Sell 1 UNG Sep16 2022 35 call @ $1.63

The particulars for this position and the risk curves (i.e., the expected profit/loss as of a given date at a particular price for UNG shares) appear below (courtesy of Optionsanalysis).

Things to note:

- The cost to enter a 1-lot is $154

- The maximum risk on a 1-lot is $154 and would only be realized if we held the trade until expiration and UNG is above $37 a share at that time

- The maximum profit potential is $46 (or 29.9% of capital at risk) and would be realized if we held the trade until expiration and UNG is below $35 a share at expiration

The bottom line is that this trade is a bet that natural gas (using UNG as a proxy) will not rally much beyond the latest high during the next 3+ weeks. However, entering an options trade is only half the battle. The other half is creating a plan for exiting the trade with a profit or a loss.

Position Sizing

One aspect that too many option traders don't give enough consideration to is money management, or position sizing. The process can be relatively simple if one adopts a maximum risk % on any given trade. For example, let's assume a trader with a $50,000 account is willing to risk 2% of capital on any trade. The maximum risk on a 1-lot of our bear call spread is -$154. Therefore, a trader could trade a maximum of 6-lot as shown below:

- $50,000 account size x 2% maximum risk on one trade = $1,000 maximum allowable dollar risk on one trade

- $1,000 maximum allow $ risk / $154 risk on a 1-lot of UNG bear call spread = 6 contracts (maximum)

This trader could trade a 1-lot to a 6-lot depending on how much risk they wish to take on this position.

Managing the trade

Cutting a loss: The maximum risk is three times the maximum profit. As a result, we do not want to ride a losing trade to the point where we will risk experiencing the maximum loss of -$154. A bear call spread is not a set it and forget it type of trade. We must stand ready to cut our loss if the price of UNG rises beyond a predesignated point.

The breakeven price for this trade at expiration is $35.46. If we use $36.00 as our (arbitrary) stop-loss point, we can look at where each of the risk curve lines above intersects $36 and estimate the expected loss (see area labeled "stop loss area" in the chart above. Depending on whether $36 a share is hit immediately or at expiration, our expected loss on a 1-lot would be between -$103 (if price jumps to $36 immediately) and -$60 (near expiration).

Taking a profit: There are no rules for when to take a profit on a bear call spread. As long as price remains lower or unchanged, time decay will eat away at the value of this position, and our profit will grow as expiration draws closer. If price never threatens $36 a share, we can simply hold and hope that all options expire worthless and that the maximum profit of $46 will be realized.

Many bear call spread traders prefer to close profitable trades out before expiration if 50% to 80% of the initial premium can be realized. To understand this action, consider the following example:

A trader enters our 37-35 bear call spread, trading a 10-lot. As a result, the maximum profit potential is $460, and the maximum risk is -$1,540. Let's assume that UNG shares drift lower and that the position's value declines from $460 to $200. At this point, the remaining profit potential is only $200, and the maximum risk from this point is -$1,800 (in other words, he could give back the current $260 open profit and suffer the maximum loss of $1,540 on top of that). Some credit spread traders prefer to "ring the cash register" when a decent profit presents itself.

When to take a profit on our example trade is up to each trader to decide for themselves.

A word on the psychology of a bear call spread

A bear call credit spread is a very different type of trade than most investors are used to. Most investors are familiar with buying a stock and hoping its price increases. A credit spread is entirely different. It involves putting on a position and then waiting and waiting. And sometimes, even more waiting. And that is if things are going well (i.e., the underlying security is moving sideways to lower). And despite this need for patience, the trader must also stand ready to act at a moment's notice if the underlying security moves quickly in the wrong direction. If the designated stop-loss point is reached, the trader must act swiftly, or a much more significant loss could accrue quickly.

The biggest dangers for traders new to credit spreads are a) impatience in taking a profit before a decent size profit accrues and b) hesitating to pull the trigger to cut a loss when the time to do so comes.

What the research tells us…

Based on price action, sentiment and seasonality, an argument can be made that natural gas is due for a pause in its recent advance. One possibility is to trade the natural gas market's short side by selling short natural gas futures or buying put options on the ETF ticker UNG. However, using options, the bet does not necessarily need to be that natural gas will decline in price by any appreciable amount. A trader can make money by implementing a bear call spread if natural gas moves lower, sideways, or even slightly higher.

The Catch-22 with a bear call spread is managing risk and determining when to take a profit. For that, there are no hard and fast rules, but only common-sense guidelines.