A persistent uptrend in Gold suggests more upside

Key points:

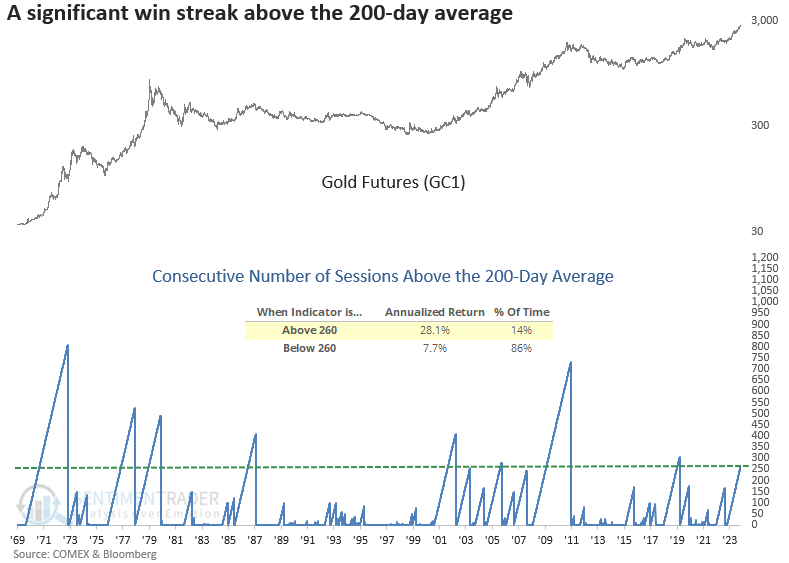

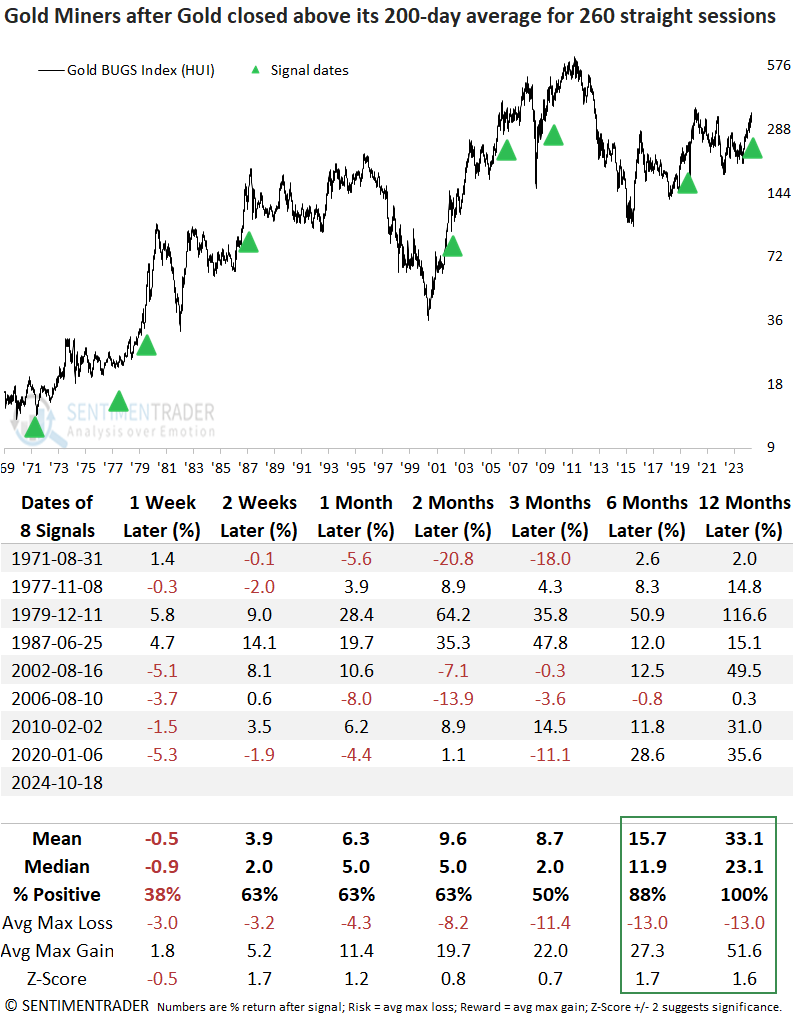

- Gold has now closed above its 200-day average for 260 consecutive sessions

- Similar win streaks saw Gold futures rise 100% of the time over six and twelve months

- A year later, Gold miners rallied 100% of the time, and Silver rallied 88% of the time

The case for a sustained uptrend in Gold gains further credence

Jason recently published a report highlighting that Gold had closed at a new high 37 times over a rolling one-year period. The conclusion was that the precious metal had more upside potential, rising 89% of the time a year later.

Although we'll only know in hindsight whether Gold is in a secular or cyclical uptrend, the case for a sustained advance gained further credence now that the precious metal closed above its 200-day moving average for 260 consecutive sessions.

The previous signal occurred in January 2020, and Gold rallied 23.8% over the subsequent year. Furthermore, when the successive number of days above the 200-day average exceeds a count of 260, the precious metal displayed an annualized return of 28.1%.

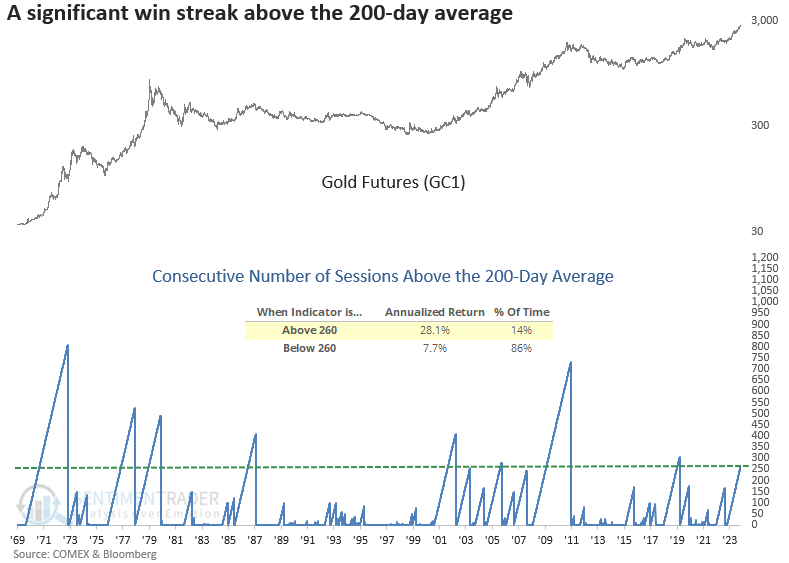

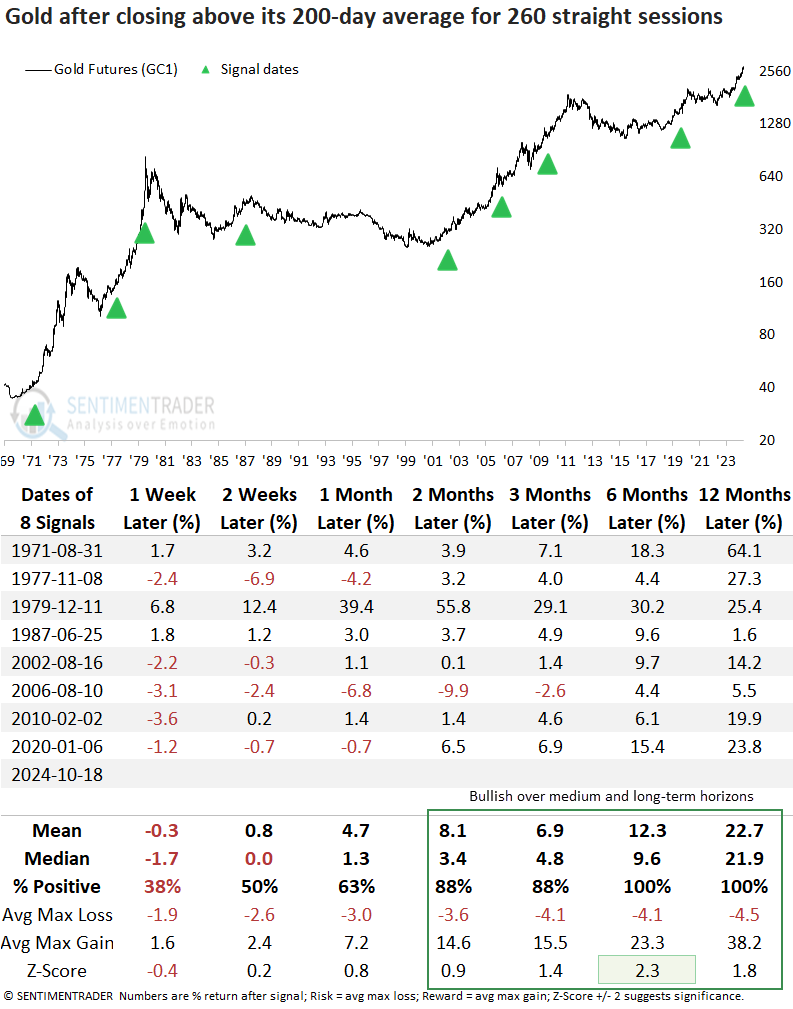

Comparable win streaks preceded additional upside for gold

While the sample size is small, whenever Gold futures closed above its 200-day average for 260 straight sessions, the precious metal rose 100% of the time over the ensuing six and twelve months. Additionally, the six-month horizon showed significance relative to random returns.

Over the subsequent six and twelve months, Gold futures experienced just one instance of a maximum loss exceeding -10%.

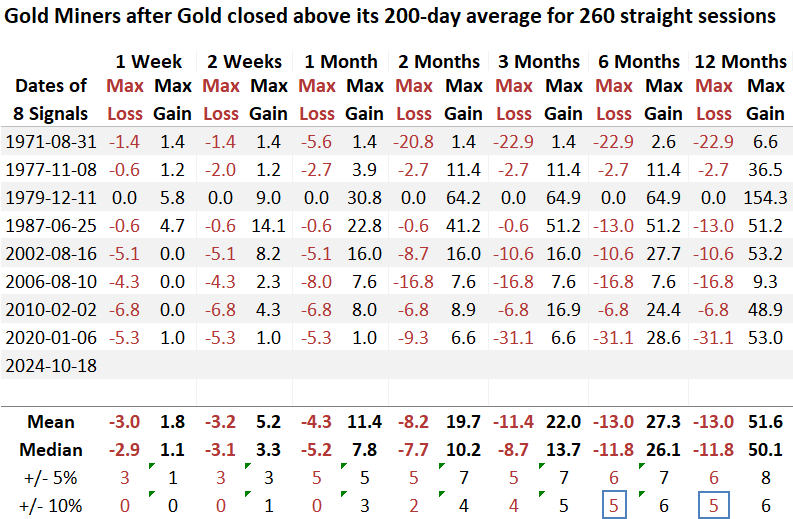

The Gold BUGS Index (HUI) tended to follow the precious metals lead, rallying 100% of the time over the subsequent twelve months. Additionally, both the six and twelve-month horizons almost displayed significance.

If you hold a position in gold miners or are thinking about one, remember that the upward trajectory could be volatile despite a bullish outlook. In the six- and twelve-month windows, maximum losses of over -10% occurred in 5 out of 8 cases

How does Silver perform?

When Gold displays a persistent uptrend like now, Silver tends to tag along, rallying 88% of the time over the following year. However, like gold miners, the path to higher prices was volatile.

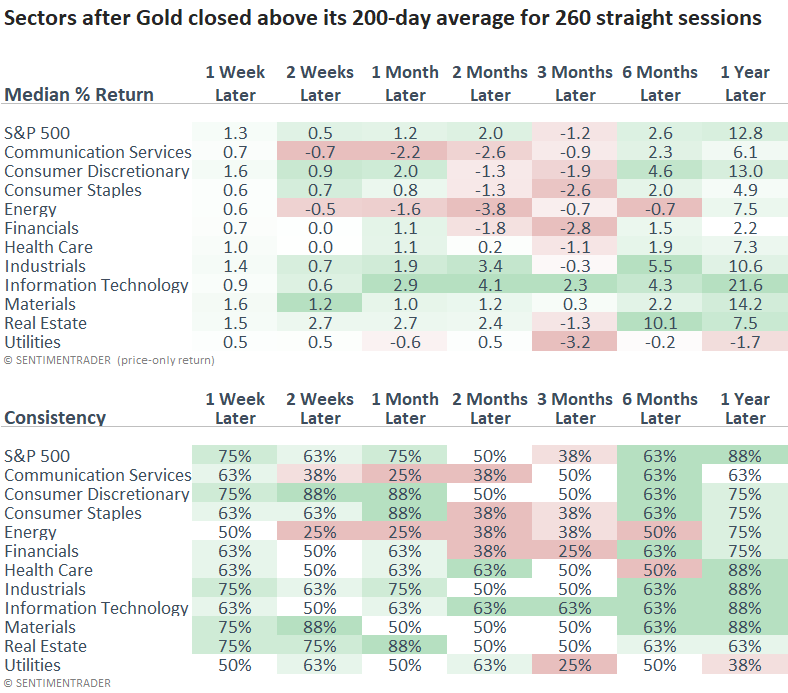

What about stocks?

The S&P 500 and most sectors displayed a negative outlook over the next three months, potentially suggesting some macro factor influenced Gold, which heightened concerns among stock investors. However, a year later, the world's most benchmarked index rose 88% of the time.

What the research tells us...

Gold has now closed above its 200-day moving average for an impressive 260 consecutive days, a persistent trend that strongly indicates the rally in the precious metal is likely to sustain itself over the coming year. Historically, after such periods of extended strength, gold has been higher 100% of the time at both six and twelve-month intervals, suggesting bullish momentum. In this environment, gold miners and silver have also rallied, benefiting from the broader rise in precious metals. Interestingly, while the S&P 500 and its sectors struggled over the medium-term horizon during these periods, they often managed to stage a recovery and rally over longer-term horizons.