A notable breakout in a manufacturing prices paid index

Key points:

- The Philly Fed prices paid index increased to the highest level in over two years

- Similar breakouts in a survey for manufacturing prices paid preceded a bullish outlook for stocks

- Technology outperformed all other sectors over the subsequent year

Should we worry about a breakout in manufacturing prices paid?

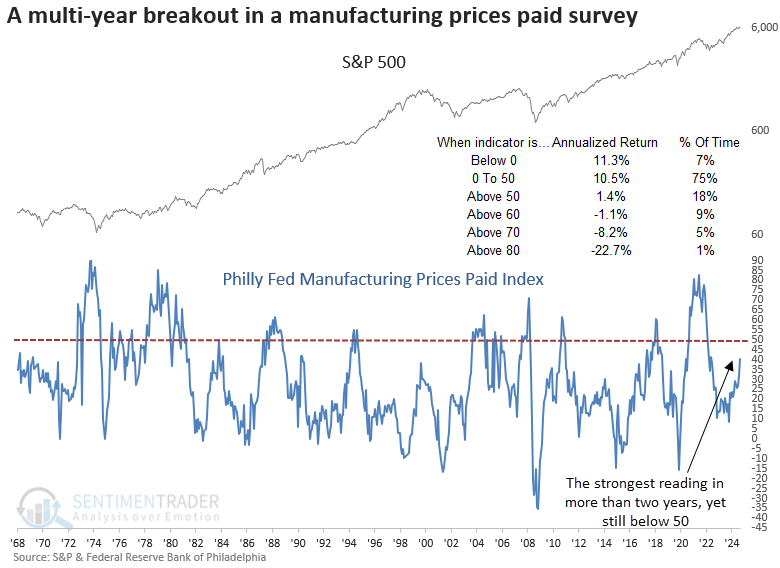

The Federal Reserve Bank of Philadelphia released its manufacturing survey today. Although the overall measure edged down, the prices paid component surged by 9 points, surpassing the highest level in over two years. However, it remained below a reading of 50, a critical piece of context.

As expected, the price-paid index breakout ignited a fresh round of inflation fears across social media and financial news networks, most likely due to recency bias from the 2021-22 surge in inflation.

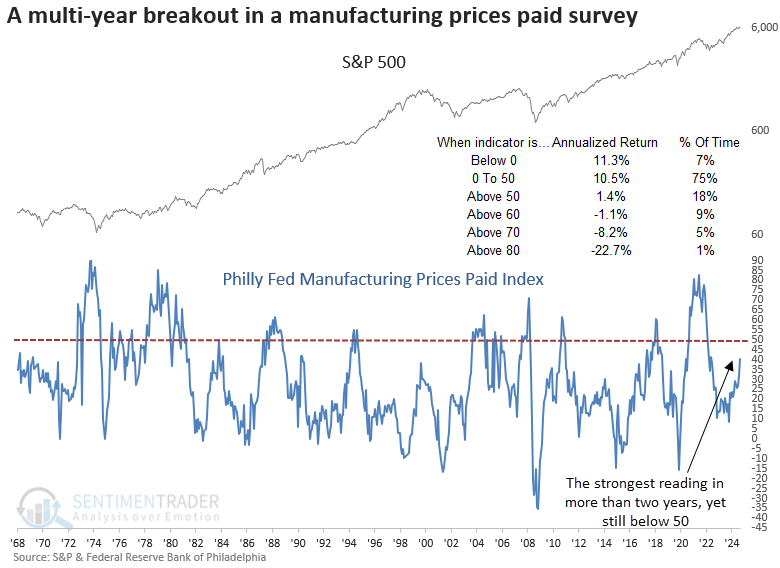

History indicates this fear is unwarranted for now, as S&P 500 returns slow considerably once the index surpasses 50 and turns negative beyond 60, as illustrated in the chart below.

Signal dates were adjusted to align with the third Thursday of the month, coinciding with the data release. Although not a primary stock market signal, survey-based economic data can serve as a historical reference, offering valuable insight into the business cycle and its influence on stock prices.

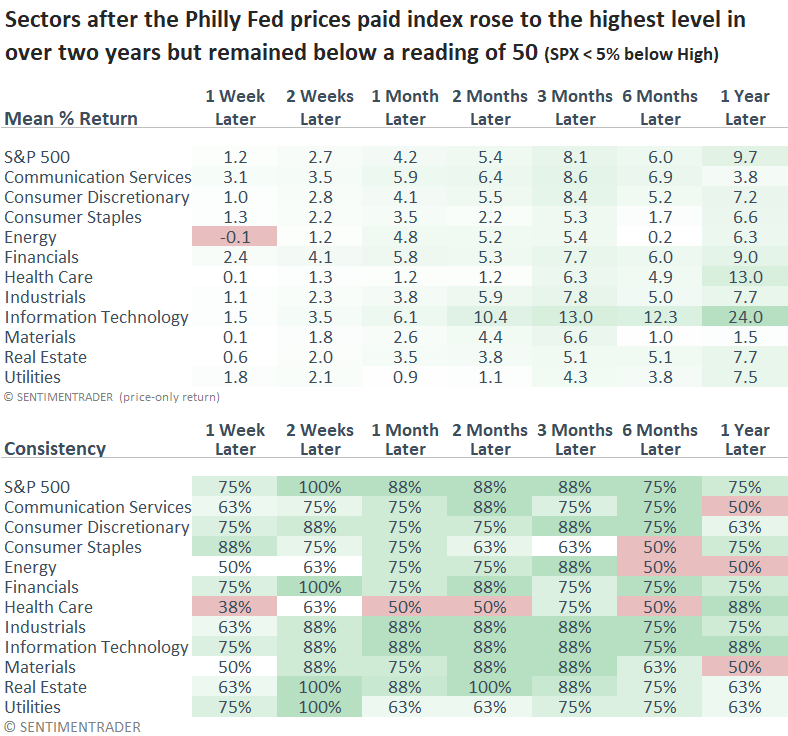

Similar breakouts in a prices-paid index preceded positive returns for stocks

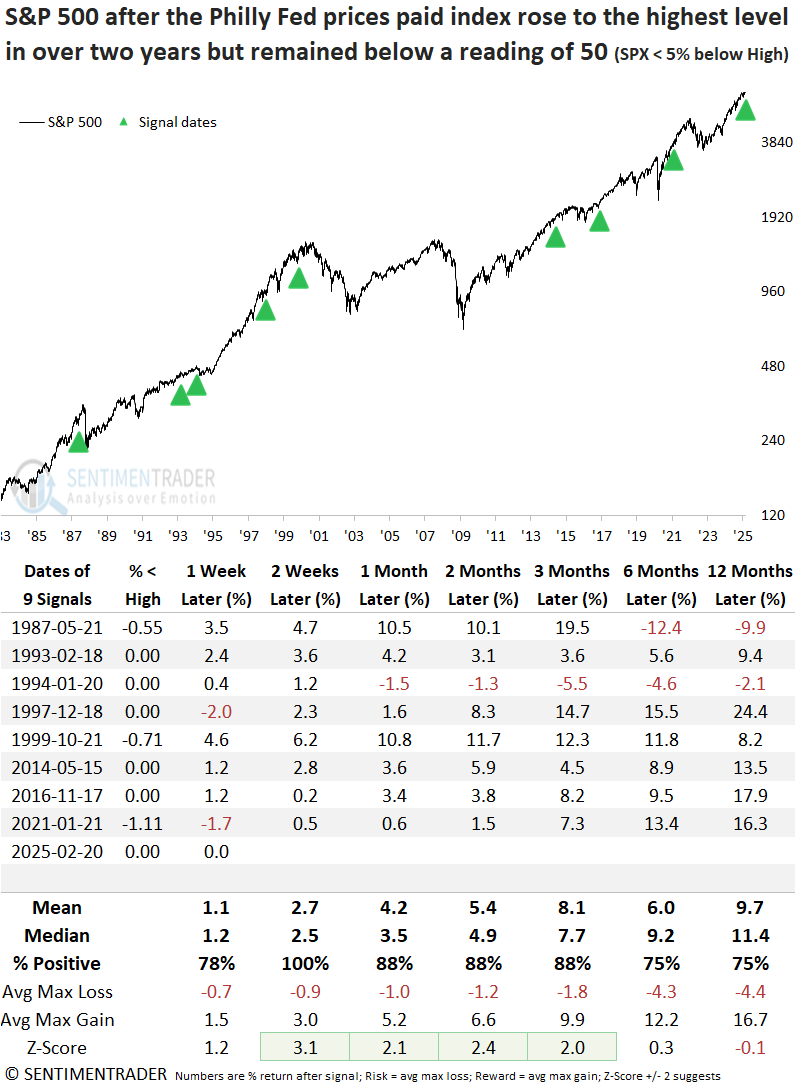

A breakout in the Philly Fed prices paid manufacturing index, coinciding with the S&P 500 trading near its all-time high, produced excellent returns and consistency for the world's most benchmarked index over the subsequent year, suggesting a reflationary tailwind that supported, rather than hindered, stocks.

Over the subsequent twelve months, the S&P 500 experienced only one maximum loss that surpassed -10%, an anomaly associated with the 1987 crash.

The Technology sector was the clear winner following a breakout in the prices paid index, gaining 88% of the time over the next year with a median return of 24%. Even excluding Dotcom-era signals from 1997 and 1999, it remained the top-performing sector.

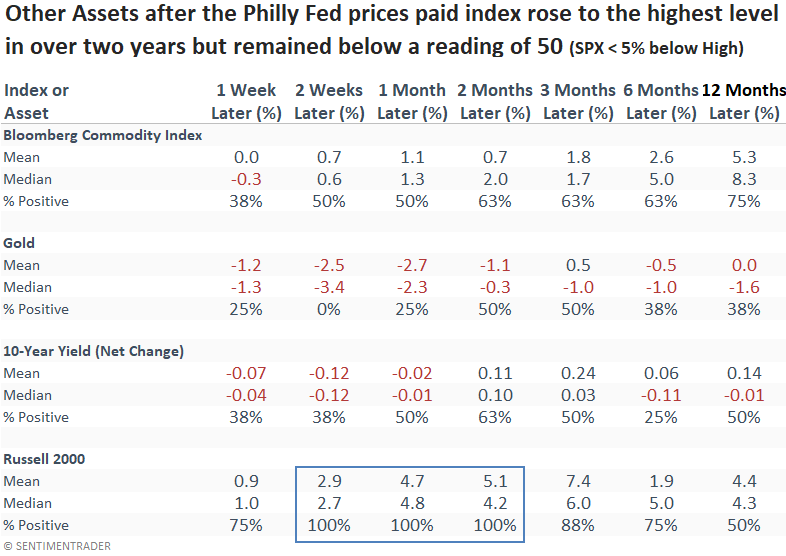

Other assets

Despite a breakout in the prices paid index signaling reflation, there was no substantial rally in commodities or gold, and the 10-year Treasury yield mostly trended lower. The small-cap Russell 2000 showed robust short- and medium-term performance, but consistency was a coin toss over the subsequent year.

What the research tells us...

The Philly Fed Prices Paid Index climbed to its highest level in over two years. Yet, it remained below the critical 50 threshold, signaling that while there are signs of rising inflationary pressures, the situation is not yet severe enough to disrupt stock prices. Historically, similar breakouts have been followed by impressive returns and consistency for the S&P 500 over the following year. Notably, the Technology sector has led the charge, outperforming all other groups.