A new high on weaker participation

Dean and I have been semi-obsessively checking for signs of internal deterioration for over a month. Following a speculative extreme like we've seen since November, internal divergences are usually an excellent heads-up that the excesses are on the cusp of being unwound.

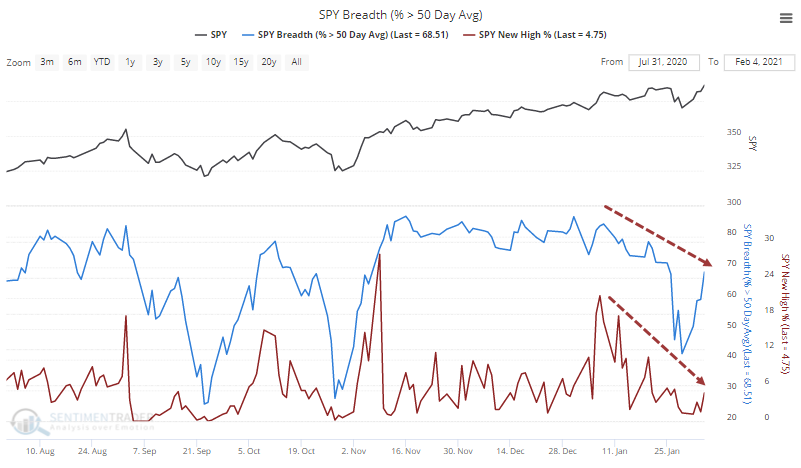

There were few to none of those warnings up until the last couple of weeks. When stocks moved to their highs in late January, some of them started to trigger. After the mini-panic last week, we were watching to see if a move back to new highs would be accompanied by more signs of internal deterioration.

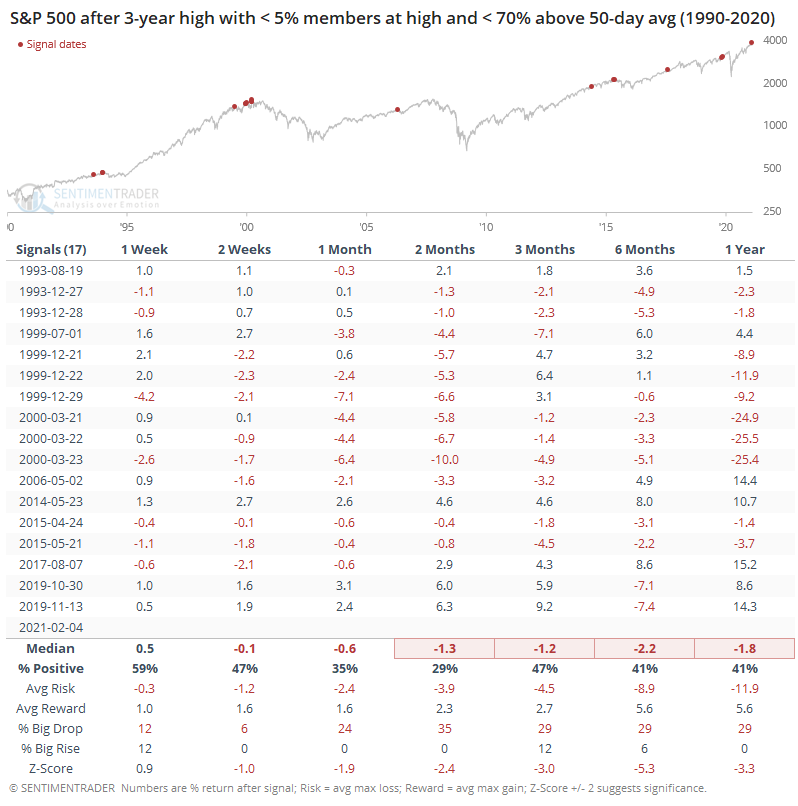

It's not to the point where it's pound-the-table obvious, but there are certainly more signs now than before. The S&P 500 moved to a record high, but fewer than 5% of its member stocks also hit a high on Thursday. And fewer than 70% of them have even made it above their 50-day moving averages.

This kind of move has been decidedly negative for forward returns.

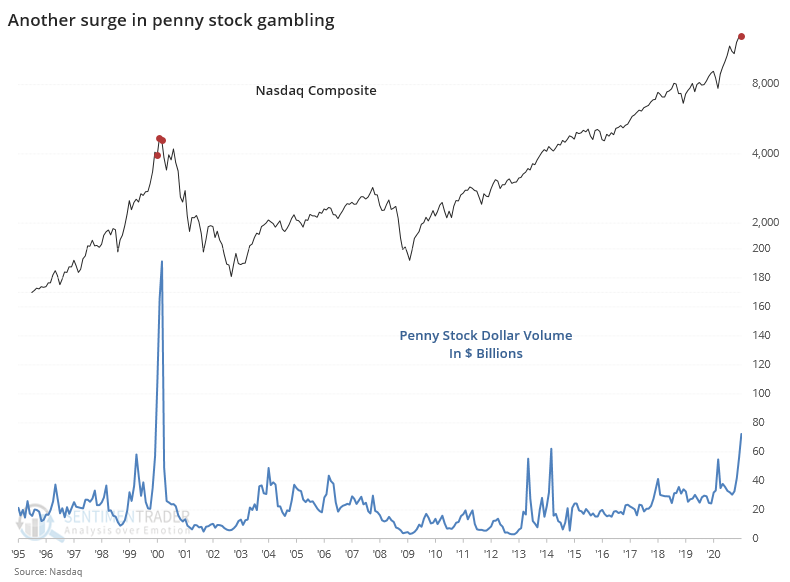

Not that we need more signs of excesses, but the latest data on penny stock trading was released for January. These stock jockeys turned over more than $72 billion in volume in these lottery tickets, exceeded by only a few months in 2000.

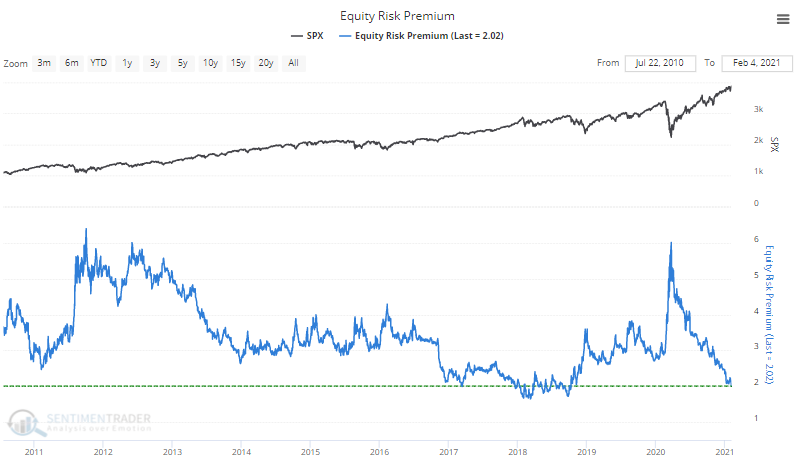

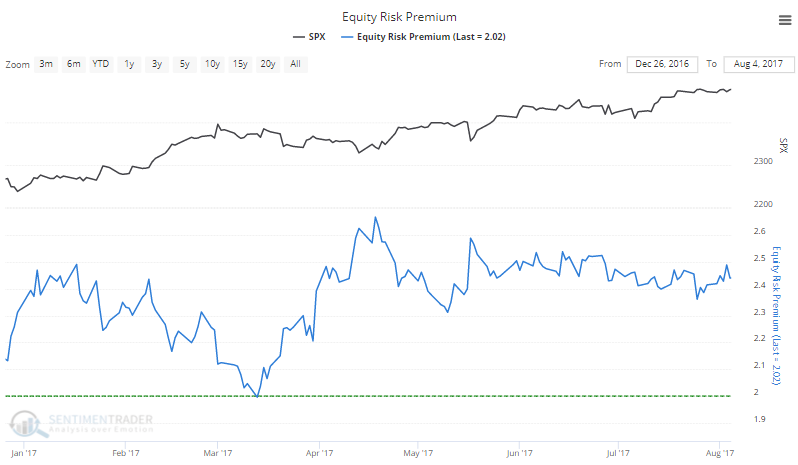

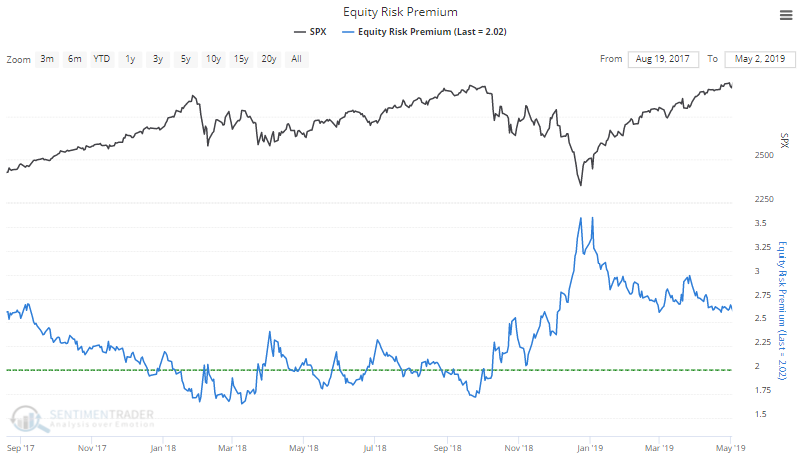

This push to new highs has been excused by the TINA crowd because interest rates are so low, there's nowhere else to invest. Even so, the combination of rising prices and still-weak earnings (like we saw yesterday) has pushed the Equity Risk Premium to nearly the lowest level in the past decade. Granted, it's still high over the long-term, so there is a lot of room for this to move still lower. We're just looking at recent history here.

When it got this low in 2017, stocks took about a month-long breather.

In 2018, it led to a much choppier market, for much longer.

Any sign of price exhaustion and false breakouts in the coming day(s) given these developments would be a major cause for concern.