A New Growth vs. Value Signal

A new relative ratio range rank signal for growth stocks triggered on the close of trading on 6/22/21. Value has been in favor since September of 2020. Could the tide be shifting in favor of growth, or does this signal represent a mean reversion trade that we should rent for the time being?

RELATIVE RATIO RANGE SIGNAL CONCEPT

The concept I use to identify relative ratio range signals is simple. I calculate the ratio for two securities and measure the range over a lookback period in percentage terms. The range rank methodology allows one to test threshold levels between 0 and 100%. I then optimized the signal to determine the most favorable lookback period, reset and buy level thresholds.

PARAMETERS AND CONDITIONS FOR GROWTH SIGNALS

Ratio = Growth Index/Value Index. The range rank for the relative ratio utilizes an 84-day lookback period.

- If the relative ratio range rank crosses below the 10th percentile, the reset condition is true.

- If the reset condition is true and the relative ratio range rank crosses above the 93rd percentile, buy the growth index.

Let's take a look at the current chart and historical signal performance.

CURRENT DAY CHART

The relative ratio range for growth vs. value reset below the 10th percentile last November, and value has been in favor for almost seven months. The range rank exploded higher this week and triggered a new signal that suggests we should favor growth stocks.

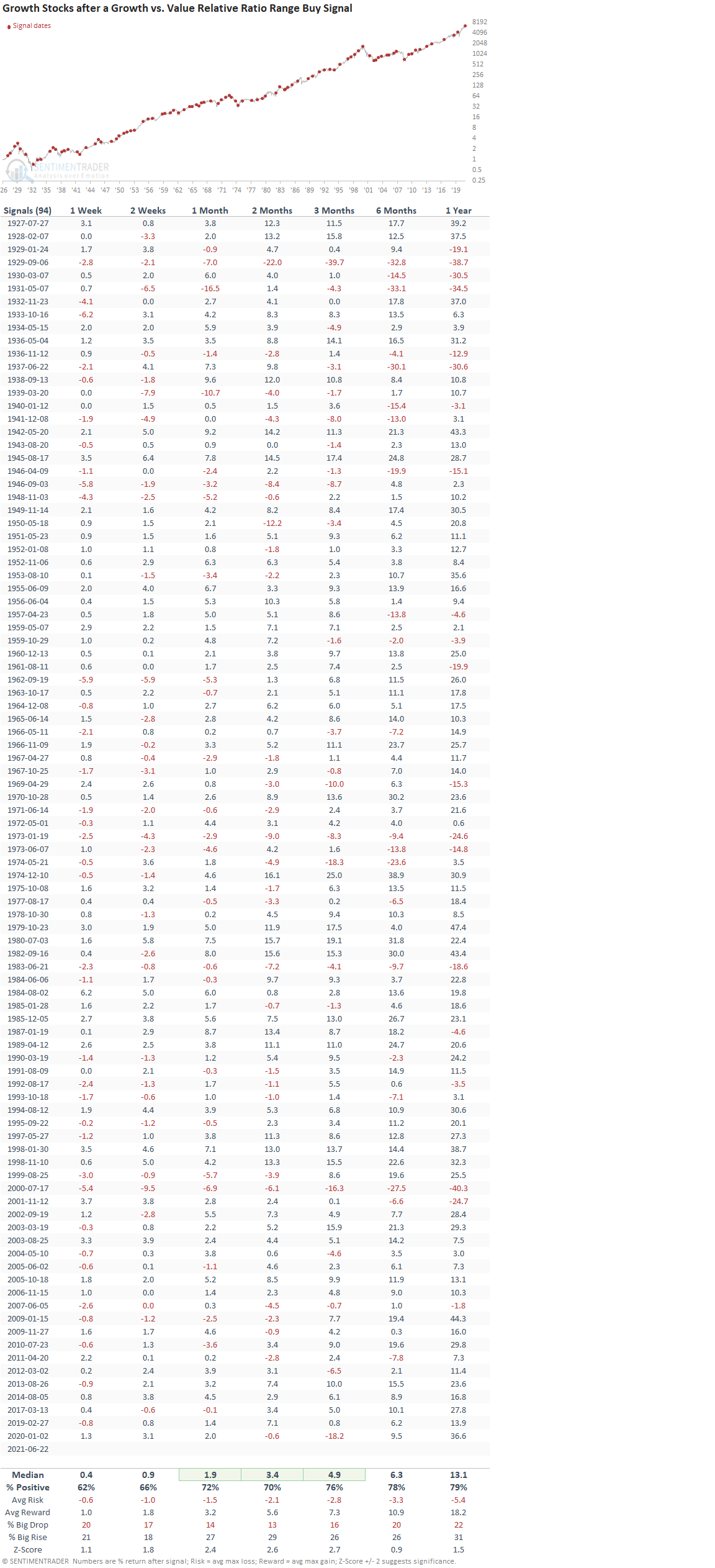

HOW THE SIGNALS PERFORMED - GROWTH

Growth performed well across all timeframes with several notable z-scores.

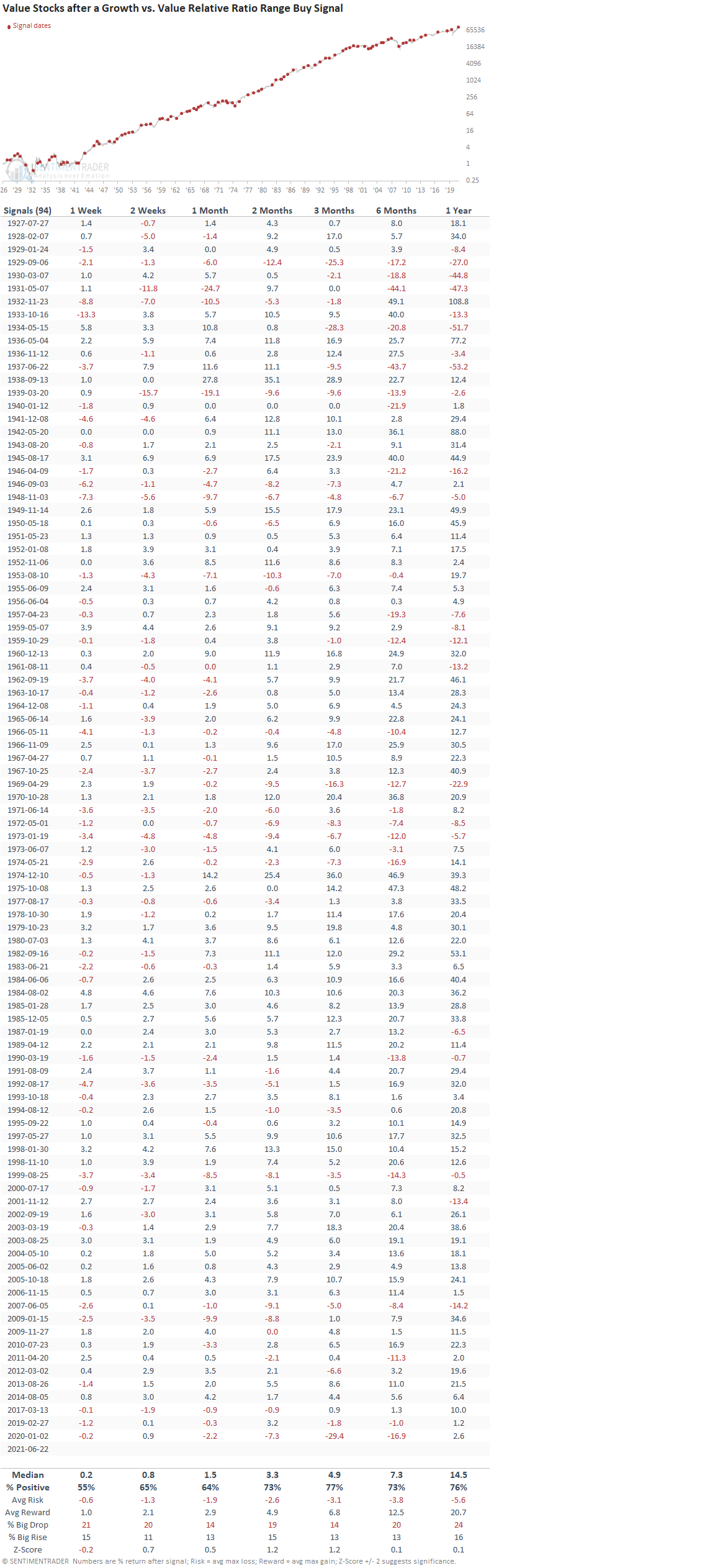

HOW THE SIGNALS PERFORMED - VALUE

If we bought the value index when growth triggered a signal, we see results that look okay.

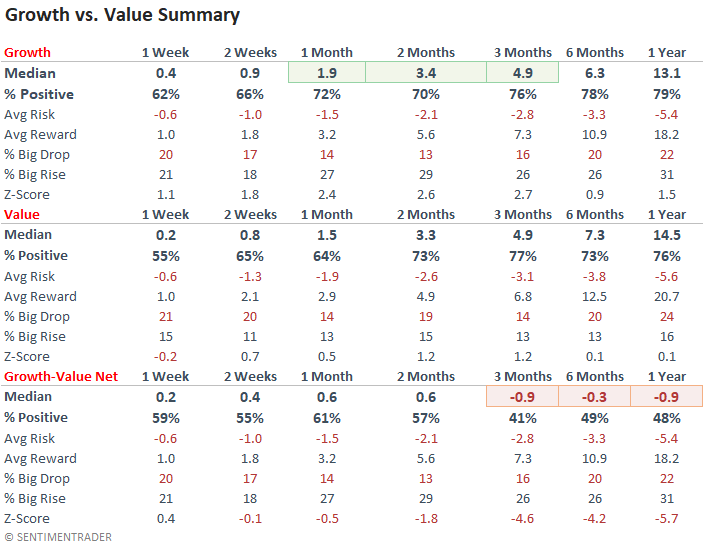

GROWTH VS. VALUE RELATIVE COMPARISON

The summary table suggests that one should favor growth for the time being as the short to intermediate-term results provide a slight edge.

RELATIVE PERFORMANCE WALK FORWARD

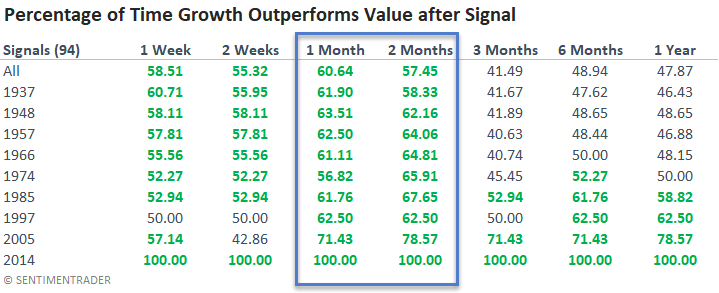

The following table provides some context around the consistency of the growth signals through time. The win rate looks good on a short to intermediate-term basis, but especially of late. The shift to more consistent results on a long-term basis is interesting. Could the growth versus value dynamic be changing?

The walk forward for the win rate is calculated every ten signals.