A new breadth thrust signal suggests higher stock prices

Key points:

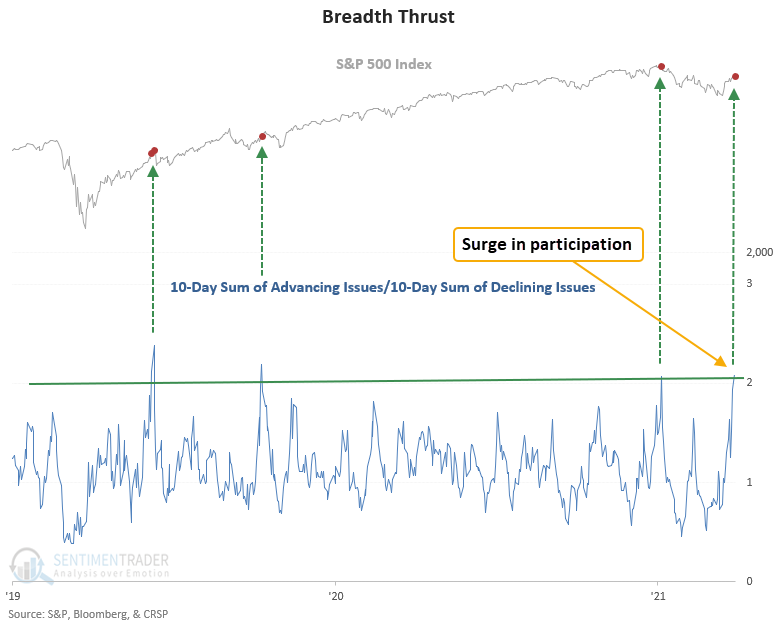

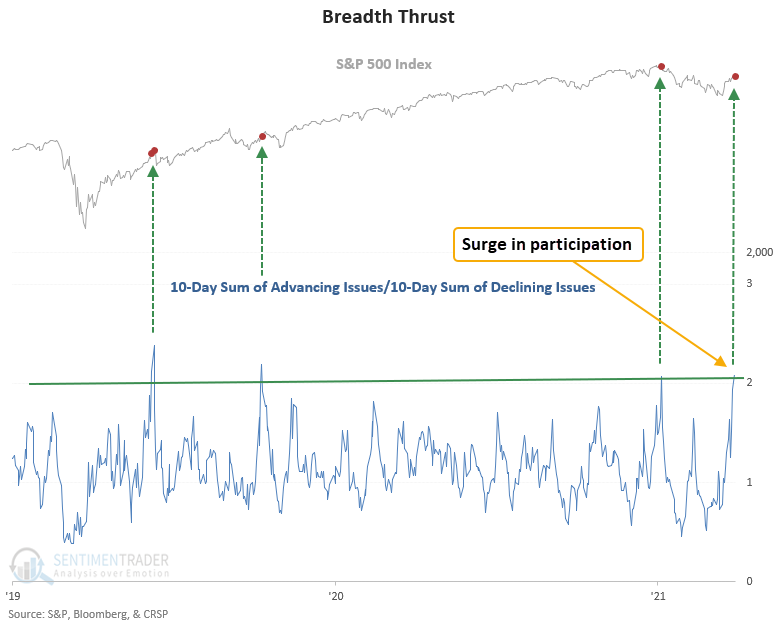

- A ratio between S&P 500 advancing and declining issues surged higher

- The burst in participation triggered a new breadth thrust buy signal on Monday

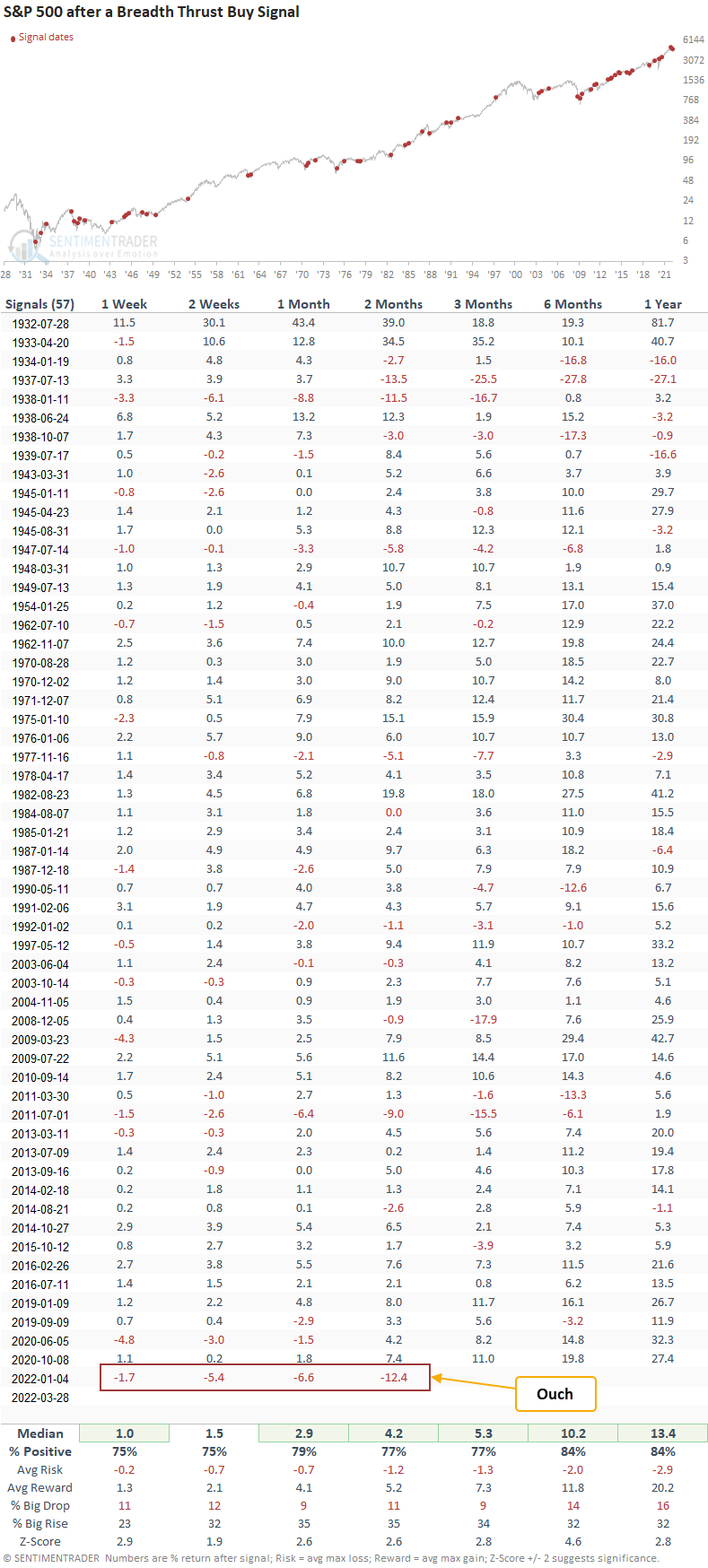

- The S&P 500 has rallied 84% of the time over the next 6 & 12 months after other signals

Advancing issues are outpacing declining issues, triggering a new composite thrust model alert

A new signal from a voting member in the composite thrust model registered an alert on Monday.

The breadth thrust system identifies when the 10-day sum of S&P 500 advancing issues exceeds the 10-day sum of S&P 500 declining issues by 2.02 to 1. I use a reset condition to screen out repeats, which requires the ratio to fall below 0.8 before a new signal can trigger again.

Please click here for the TCTM live updates page on the website.

Similar surges in participation preceded gains 84% of the time

This signal has been triggered 57 other times over the past 90 years. After the others, future returns, win rates, and risk/reward profiles were solid across all time frames. Since 1942, the win rate in the 12-month time frame has been excellent, with 44 out of 48 winners. And the max drawdown was minimal, with a decline of 6.4%. The previous signal from 1/4/22 shows a drawdown across all time frames, with the worst 2-month return since 1937. That signal occurred one day before the release of Fed minutes which highlighted the central banks' intention to pivot from an accommodate policy approach to one with less accommodation. Fed policy matters.

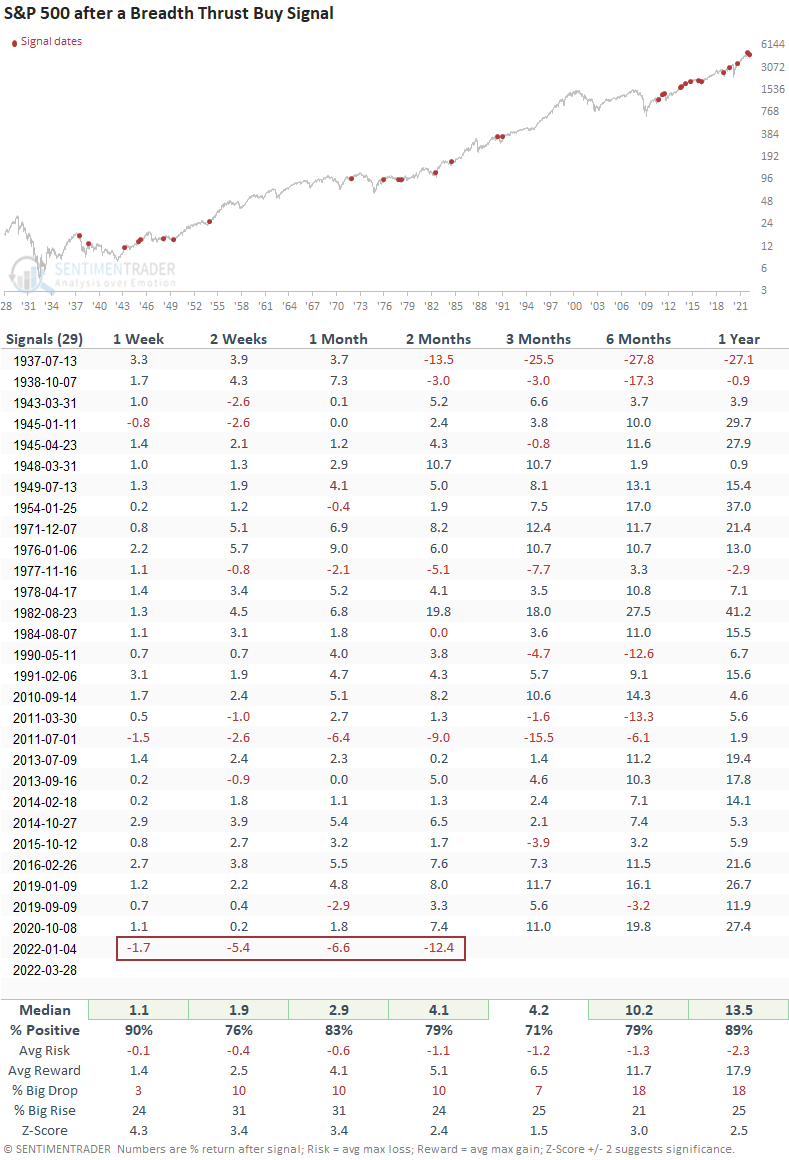

Signals associated with a market correction between 10-20%

If we strip out the bear market and new high signals, the breadth thrust triggered 29 other times over the past 85 years during a correction. After the others, future returns, win rates, and risk/reward profiles were excellent across all time frames, especially the 1-week window.

What the research tells us...

When the ratio between advancing and declining issues surges in favor of advancing issues, the burst in participation provides a new energy source for the market. Similar setups to what we're seeing now have preceded rising S&P 500 prices across every time frame, with notable long-term results. The initial drawdown from the previous signal provides a good reminder that no single indicator is infallible and Fed policy matters.