A Most Excellent Recovery

An excellent recovery

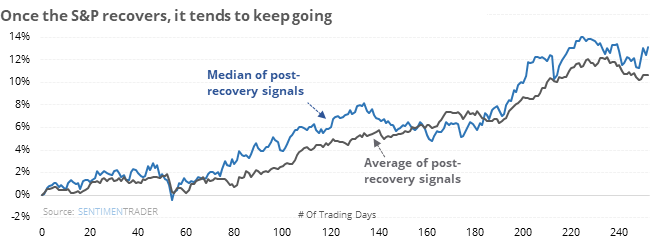

The S&P 500’s new high marks an end to the correction, one of the S&P’s most impressive recoveries from a major decline from a prior all-time high. Other times it made a somewhat similarly-sized recovery over a quick- to moderate time frame, it tended to keep going, but it wasn’t a slam-dunk.

Troops are lagging a bit

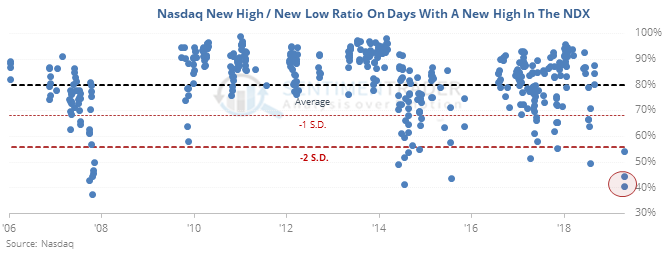

Twice in the past few sessions, the big tech stocks drove the Nasdaq 100 index to new highs, but there were more stocks on the Nasdaq exchange sliding to a 52-week low than rising to a 52-week high.

Since 1986, this has been extremely rare and had mostly negative consequences for both the Nasdaq and broader stock market.

Lacking oomph

Despite the new high in the S&P, the McClellan Oscillator is still negative. The only day this happened in the past year was September 20 of last year, which happened to mark the peak. The time prior to that was January 26, also a peak. But it wasn’t that bad. Conditions like this were typically seen at major peaks, but there were also many false signals.

Half at extremes

Nearly 50% of our core indicators are now showing optimism. None of them are showing pessimism. The spread between them is now the widest since January 2018. Since the financial crisis, it has been matched only by March 2015, early 2017, and January 2018.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.