A month when it was tough to lose money

The Capital Spectator blog noted something interesting on Tuesday - in November, everything rallied.

Looking at November returns across a broad spectrum of assets, it was impossible to find anything with a negative return. Among the indexes with the longest history, all of them even showing a gain of at least 1%. That includes stocks, bonds, commodities, and real estate.

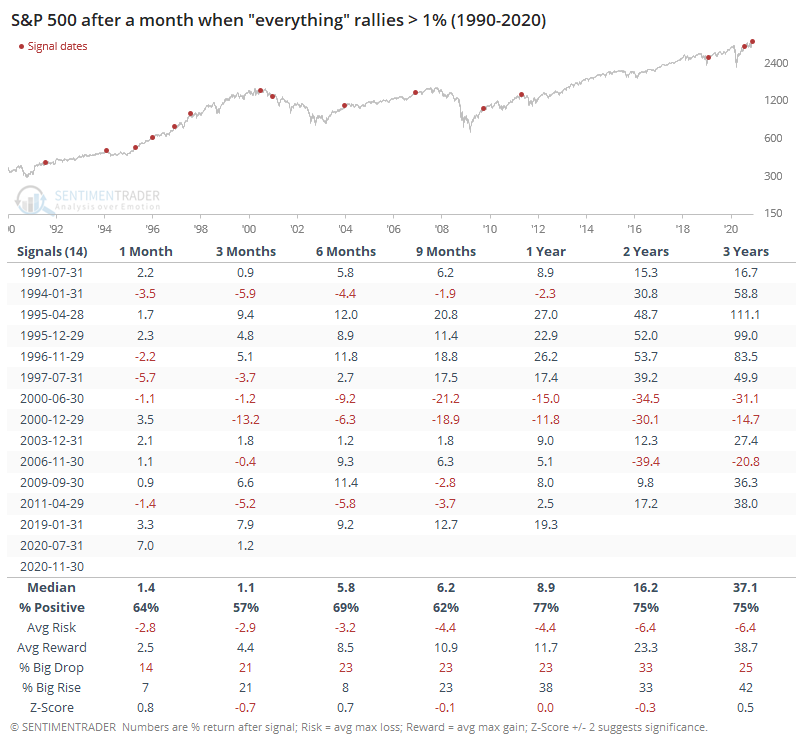

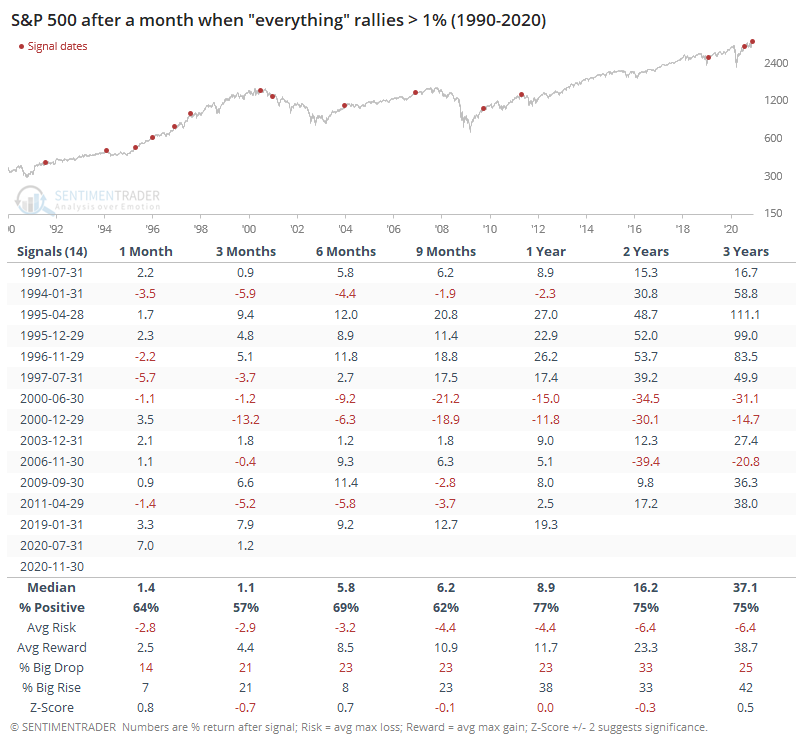

To see if that's a sign of investor nirvana that might lead to at least a temporary reality check, the table below shows returns in the S&P 500 after any month when every index showed at least a 1% gain.

It didn't prove to be a consistent warning sign, but it wasn't exactly a buy signal, either. The S&P rose consistently going forward, though its average returns were only about in line with random.

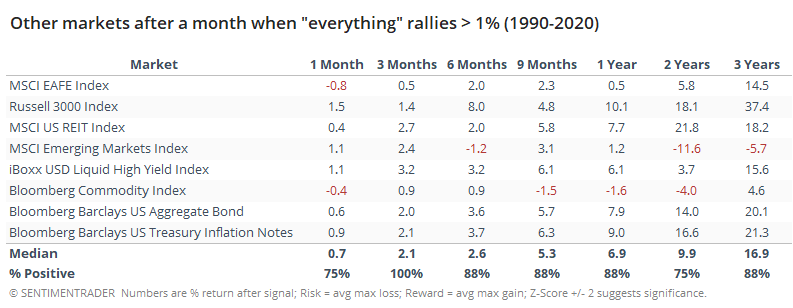

For other markets, they all showed a positive average return over the next 3 months. Stocks and high-yield bonds tended to show the best relative returns. We eliminated those markets that had only a limited history.

When it seems like everything is working, it tends to make contrarians nervous, and sometimes for good reason. After other months when it was hard to lose money, it was a good sign when coming out of a severe decline, but less so when triggering at all-time highs.

The tough part about our current situation is that we check both of those boxes right now. About the only precedents are 1991, 1995, and in July of this year. For what it's worth, those precedents showed further gains.