A momentous shift in momentum

There has been a momentous shift in momentum. Former highflyers are losing altitude while stocks that had been left behind are storming back.

We saw this in the extreme movements between Technology and Financials and Energy.

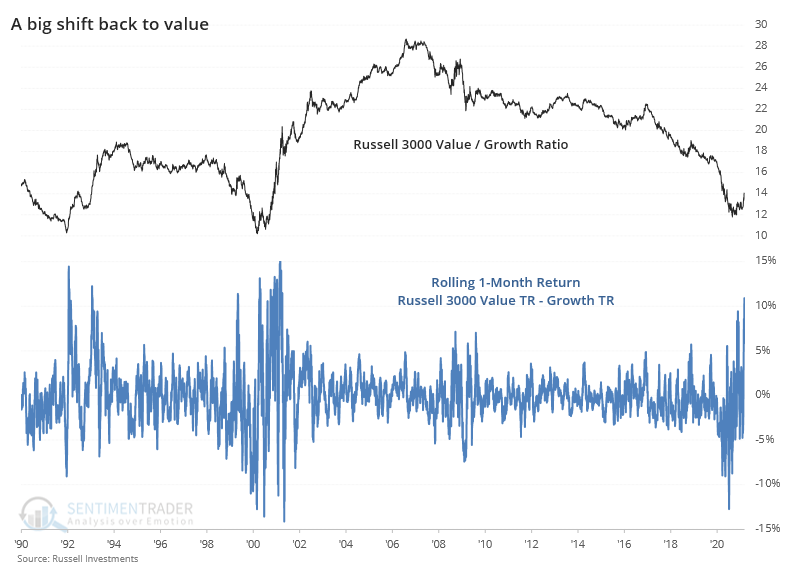

All of these shifts have triggered a massive move in Value stocks relative to Growth. Over a rolling 1-month period, the total return on value is more than 10% greater than the total return on growth, one of the largest spreads in 30 years.

The last two shifts were notable, because they marked the ends of long periods of Value stock under-performance. In the years following those thrusts, Value stocks crushed Growth stocks.

It turns out that's more the rule than the exception.

The table below shows every time since 1928 when the total return on Value stocks over a rolling 21-day period was more than +5%, while the total return on Growth stocks was less than -5%.

What else we're looking at

- Full returns in Value, Growth, Value vs Growth, and the S&P 500 after other big shits between the two factors

- Even longer-term value is showing a consistent signal versus growth

- What happens when the Nasdaq surges with most of its stocks in medium-term downtrends

- Returns after the quickest corrections in Nasdaq history

- The Shanghai Composite just entered a correction, too

Behind the Charts

Check out this interview with Dave Keller of Stockcharts as SentimenTrader founder Jason Goepfert discusses the experiences that helped shape the company's beginnings.

| Stat Box For only the 9th time since 1928, on Tuesday, the S&P 500 gained more than 1.25% and yet more stocks in the index declined on the day than advanced. |

Etcetera

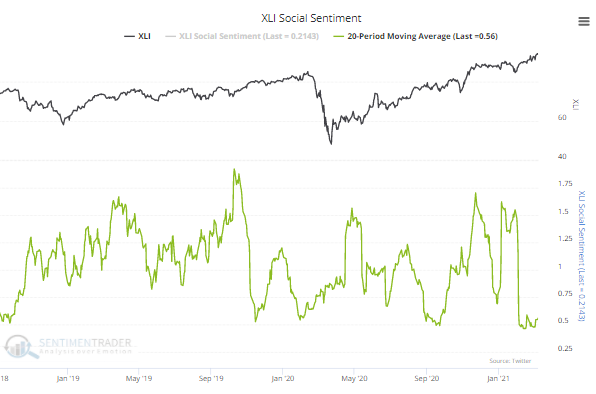

Twitter users love the relation trade. Social Sentiment on the Industrials ETF, XLI, has been skewed heavily toward positive messages on Twitter. Using AI analysis of mentions of the fund, the 20-day Social Sentiment score has dropped to one of the lowest levels in years. This functions like a put/call ratio, so low levels mean that there are fewer negative tweets than positive ones.

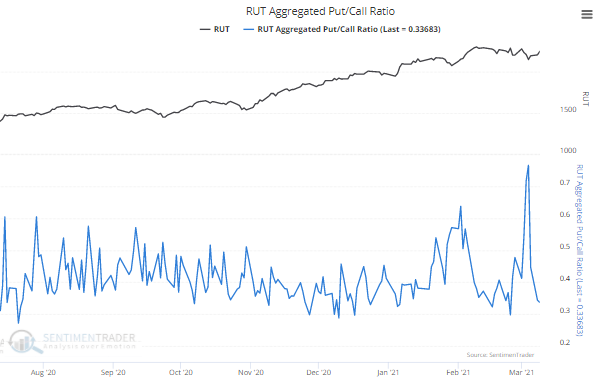

Traders love small-caps again, too. Yesterday, the put/call ratio aggregated across all stocks in the Russell 2000 dropped to an extremely low level, meaning there were relatively few put options traded relative to call options, a sign of optimism. That's a sudden change from the recent spike.

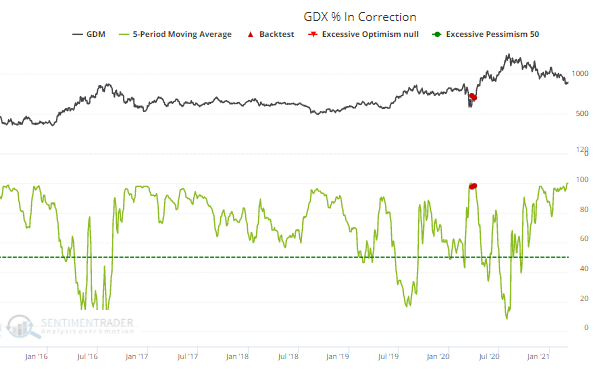

They do NOT love gold miners. Every gold mining stock we track is now in a correction, at least 10% below their highs. It's been this way for the past 5 sessions. The only other time in recent years that every miner was in a correction, and then reversed, is marked on the chart.